Alibaba's Online Money Market Fund Yu’E Bao: 8 Things You Need To Know

A big money migration is under way in China, as depositors loosen their long-held ties to traditional banks and start parking their hard-earned money in Yu’e Bao, an Internet money market fund that looks and smells pretty much like bank deposits but offers consumers higher returns than Chinese banks will.

Here are eight things you need to know.

1. What is Yu’e Bao?

Yu’e Bao (余额宝) is an investment product offered through the Chinese e-commerce giant Alibaba Group Holding Ltd.'s third-party payment affiliate, Alipay.com Co.

Alipay began offering Yu’e Bao, which means “leftover treasure,” last June. Alipay users can put their money into the product, which invests in funds. There is no minimum amount, and customers can withdraw their cash anytime. Yu’e Bao funds are managed by Tianhong Asset Management Co.

2. Why is everyone talking about it?

Launched just nine months ago, Yu’e Bao now has more investors than China’s equity markets.

The mainland's biggest online money market fund had attracted more than 81 million investors by the end of February, a figure that represents an increase of nearly 20 million users within half a month, according to Tianhong data. By comparison, China's A-share market boasts about 67 million investors after 23 years of development.

Senior Chinese financial officials told the Financial Times that Yu’e Bao had accumulated at least 500 billion yuan ($81 billion) in deposits by the second week of March.

3. Why is investing in Yu’e Bao better than putting my money in a shoebox (or in the bank)?

When an ordinary demand deposit in savings accounts at major banks offers an interest rate of just 0.35 percent a year, and Yu’e Bao offers an annual interest of about 6 percent and still allows depositors to withdraw their money at any time, the answer is pretty simple.

Even if investors are willing to give up the right to withdraw on demand for a year, traditional banks are subject to the government-imposed upper limit of 3.3 percent interest that banks can offer on one-year deposits.

4. What does Yu’e Bao do with the deposits, and is this high yield sustainable?

Up to 90 percent of Yu’e Bao funds are invested in interbank deposits at 29 large banks, including the big state-owned ones. Interbank deposits are banks' wholesale businesses with each other.

Unless those banks default on a loan they took out from Tianhong, the investment is safe. But there is a liquidity concern.

Wang Dengfeng, a Tianhong fund manager who oversees the money market fund connected with Yu’e Bao, explained in a recent interview with China's major business paper Caixin how Tianhong allocates Yu’e Bao funds.

We allocate investments and match maturities based on data analysis. At different stages a bank's ability to take deposits varies. On one hand, there are banks that can only take, say, 10 billion yuan, but we have 11 billion yuan that needs to be taken care of. That is when we hit the limit of their deposit-taking ability. We can deal with other banks or lower the interest rates we charge. On the other hand, a larger size brings greater negotiating power. We can ask for higher interest rates.

We pay the most attention to liquidity management. So far, we have seen a net increase in Yu'e Bao investment. That means we face the pressure of finding investment opportunities for new funds every day.

Aside from the seemingly ever-increasing fund size, traditional banks are also lobbying to have the terms of the loan agreements changed, which could force Tianhong to either cut yields or make withdrawals more difficult. In the worst-case scenario, this could trigger a run on Yu’e Bao accounts.

A similar fund offered in the U.S. by payments processor PayPal grew quickly when it offered a high yield but eventually closed in 2011 as investors fled when the returns dropped.

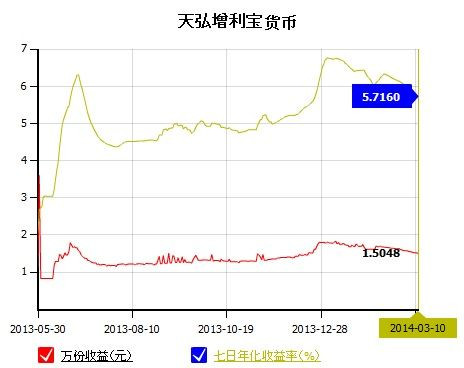

Prior to March 1, Yu’e Bao’s 7-day annualized return held above 6 percent. It dipped below 6 percent on the next day, and had slipped to 5.7160 percent Monday.

Tianhong was quoted in the Chinese media as saying that they have “made it clear to investors that a 6 percent yield is not the norm; it could drop further.”

5. Is Yu’e Bao a threat to traditional banks?

China's financial sector has long been dominated by state-owned banks that have enjoyed high government-guaranteed profits for years, thanks to strict controls on lending and deposit rates that have helped fund China’s booming investment-led growth at a high cost to savers.

Now, technology companies have begun to enter their turf by using online platforms to push innovations in the sector. Upon seeing Alibaba’s success with Yu’e Bao, China's Tencent Holdings Ltd (HKG:0700) and Baidu Inc. (NASDAQ:BIDU) have since launched similar products.

For now, funds invested into these new online financing platforms are equivalent to a little more than 1 percent of the state-controlled banking sector's roughly 74.2 trillion yuan in consumer deposits. But the platforms are growing rapidly, and the story could be vastly different a mere three years from now.

A report issued in February by Chinese International Capital Corp., a domestic brokerage, said that in three years the online money-market funds could manage funds comparable to 8 percent of all bank deposits and shave 0.15 percentage point from banks' net interest-rate margin, which is the difference between the interest paid on deposits and the interest received on loans. Banks’ average net interest margin stood at 2.68 percent at the end of 2013.

The report pointed out that at their peak, money market funds in the U.S. were comparable in size to 60 percent of bank deposits as the country liberalized interest rates.

Li Lihui, the former president of Bank of China (HKG:3988), told reporters at a briefing on Monday that online finance products are speeding interest-rate liberalization. He predicted that interest rates could be fully liberalized in one or two years, and that a deposit-insurance program would likely be in place within one year to ensure protection in case of a bank failure as competition intensifies.

“The online funds have become a significant challenge to traditional banks,” Li said. “They will certainly cut into the banks' interest income,” he added, that noting this is the key source of profit for most domestic banks.

Traditional banks now face the prospect of real competition from sophisticated investment platforms that are operated by some of China's most competitive private conglomerates.

6. Are the banks doing anything to fight back?

Yes, they are urging tougher supervision, launching similar products and raising their deposit interest rates, but with little success so far.

Yu’e Bao and its rivals remain effectively unregulated as of now. The real constraint on their growth is the limits imposed by banks on the amount of assets that can be digitally transferred from bank accounts in a single day and a single month.

The Industrial and Commercial Bank of China (HKG:1398) is limiting its depositors monthly transfers to Alipay to 50,000 yuan per month. Last month, 12 Chinese banks imposed transfer limits on Tencent's Licaitong wealth management.

7. Who regulates Yu’e Bao?

It is not clear. The People’s Bank of China and the regulators of the securities and banking industries should all be concerned, according to Caixin. The central bank oversees Alipay. The securities regulator supervises Tianhong and the funds it manages. The banking regulator must pay attention as well because banks play a key role in Yu’e Bao investment.

8. Is the Chinese government supportive of the new phenomenon?

So far, yes. Beijing appears eager to continue with rapid financial reforms, unveiled at the Third Plenum of the Communist Party last November.

In his annual “state of the union” address to China’s ersatz parliament last week, Premier Li Keqiang pledged his government would “promote the healthy development of Internet banking.”

Zhou Xiaochuan, governor of the People’s Bank of China, told journalists last week that the regulators would not close down funds like Yu’e Bao but changes in their supervision were in preparation.

“Financial business on the Internet is a new thing, so the current policy, supervision and coordination could not adapt to and need to be completed,” he said. “But in general, financial policy supports the application of technology, so it needs to follow the footsteps of time and technology.”

© Copyright IBTimes 2024. All rights reserved.