American Agriculture Could Slump In 2014, Confronting Farmland Bubble

U.S. farms and related agricultural industries could be entering a harsh years-long winter in 2014, if analysts are right about declining capital spending and potential asset bubbles in U.S. farmland.

William Blair & Co. analyst Larry de Maria warned in August of an impending cyclical downturn, amid lower commodity prices, international competition and lower exports. Companies like farm equipment giant Deere & Company (NYSE:DE) will suffer, he said then.

Larger harvests in the U.S. could depress prices, narrowing profit margins for farmers next year, said De Maria in a November interview with IBTimes.

“Weak used equipment prices and some weakness in land values are starting to show. These are some of the signs,” he said. “We’re starting to see signs of cracking, but it’s more about the next couple of years.”

Deere beat analyst expectations with its latest quarterly report in November, despite lower corn prices. Still, the company forecast a decline in sales of farm equipment for 2014.

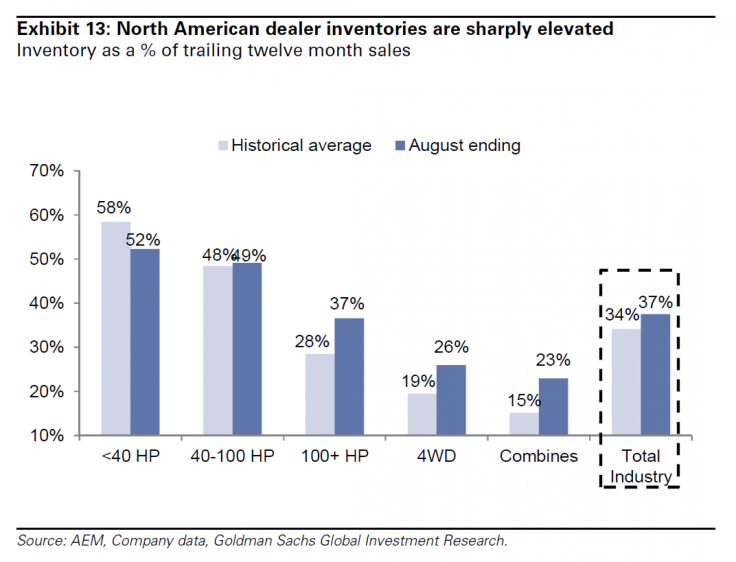

In the last five years, sales of high-powered combine harvesters boomed as ethanol demand soared, but farmers may now sit tight on equipment they already own. Deere could compete fiercely with rivals like Titan Machinery Inc. (NASDAQ:TITN), which sells popular CNH Global NV (NYSE:CNH) farm equipment through more than 100 dealers in North America, on cheaper farm equipment prices.

U.S. agriculture has followed a familiar boom-and-bust cycle for decades, driven by commodity prices and broader economic factors.

“Farmer sentiment is likely to drift lower as the reality of $4 [per bushel] corn sinks in,” wrote De Maria in August. Corn opened at $4.24 per bushel for March 2014 delivery on Tuesday, and is set for its largest annual drop since 1960, performing the worst relative to other commodities.

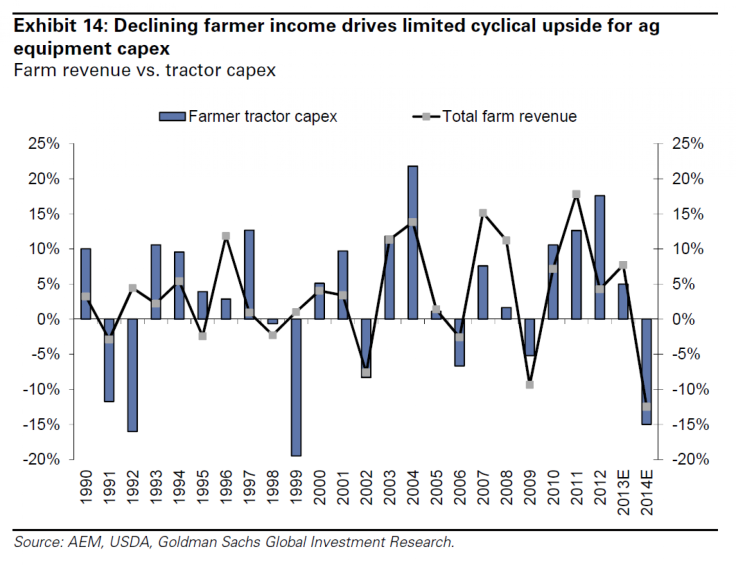

Less cash from farm crops will likely stem equipment buying. U.S. cash crop income could fall 11 percent in 2014 and a further 2 percent in 2015, according to William Blair estimates.

Others are similarly cautious on the timing of this slump, though they’re still bearish on North American agriculture.

“I don’t know whether you are seeing it already or not,” Vertical Research analyst Rob Wertheimer said of the slump he believes will play out in coming years. Negative signs from CNH dealers and cautious signals from equipment maker AGCO Corporation (NYSE:AGCO) in its mid-December investor day conflict with strong Deere sales from early 2013.

Still, Wertheimer expects spending by U.S. farmers on tractors to decline 15 percent in 2014 and 35 percent in 2015, with further drops in 2016.

“We basically are expecting the market to get cut in half,” Wertheimer told IBTimes. Part of the peak in farm equipment sales is due to historically high production capacity, led by increasingly powerful tractors, according to Wertheimer. Horsepower has climbed higher.

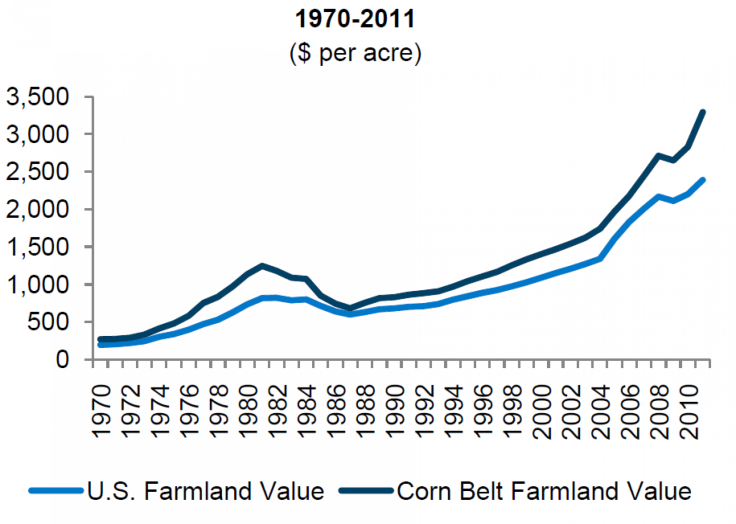

Complicating the picture is a potential bubble in U.S. farmland prices. Weakness in farmland trades emerged in late 2013, according to De Maria. He earlier said in a separate report in August that there is a “potential asset bubble” in farmland, which could cause sharper spending declines.

“This could be the big wild card. Since 85 percent of farmer assets are tied to land holdings, if they weaken that could severely affect farmer balance sheets and their ‘wealth effect’,” wrote De Maria in an email on Friday. “We are starting to see signs of stress in transactions since the outlook for prices and cash flow is worsening.”

Investors could earn $1.4 million after 10 years if they bought and held U.S. farmland worth $2.5 million, with annualized returns exceeding 10 percent, according to a Bank of America Corp (NYSE:BAC) October 2013 report on U.S. farmland investment.

That includes asset appreciation if U.S. farmland values rise, as they have done consistently over the past decade.

U.S. farmland prices rose more than 10 percent annually since 2000, and surged more than 25 percent yearly from 2008, on William Blair’s estimates, to reach up to $3,500 per acre in 2010, in the fertile Midwestern U.S. corn belt. That region encompasses Iowa, Indiana and Illinois, among other states.

That’s up from under $500 per acre in 1970. The U.S. contains about 12 percent of the world’s farmland.

“Certainly, they’re extremely high – no question about that,” said Wertheimer of U.S. farmland prices. Higher corn prices in recent years probably boosted farm values, he said.

But he added: “Even if land prices are bubbly, debt is low at farms. … Farm balance sheets are healthier.”

Michael McGlone, who used to cover agricultural commodities for Standards & Poor’s Financial Services LLC, visited relatives in Princeton, Ill., this Christmas, in the heart of America’s grain belt.

Serious droughts in 2012 recently pushed grain prices, land prices and equipment sales to peaks, McGlone told IBTimes. That means declines could be on their way. He sold his Indiana farm, which produced corns and soybeans, in April of this year.

“When I was a kid, there weren’t pivots anywhere, near where my farmland was,” said McGlone earlier in December, referring to irrigation systems designed to improve crop yields. Investment in such farm infrastructure has helped boost corn supply in the long run, with U.S. production at 10.8 billion bushels last year, and up to about 14 billion bushels this year.

That in turn has bearish implications for corn prices, according to McGlone. Only freakish one-off weather events can disrupt basic supply-demand dynamics and lift prices significantly, in McGlone’s view.

There could be weakness in agriculture elsewhere in the world, too. Weak orders at Europe’s premier November Agritechnica trade show don’t bode well. Bumper soybean crops in Brazil next year will also narrow margins and pressure prices for farmers, according to De Maria.

© Copyright IBTimes 2024. All rights reserved.