Fed's Operation Twist: Richard Fisher's Six Objections

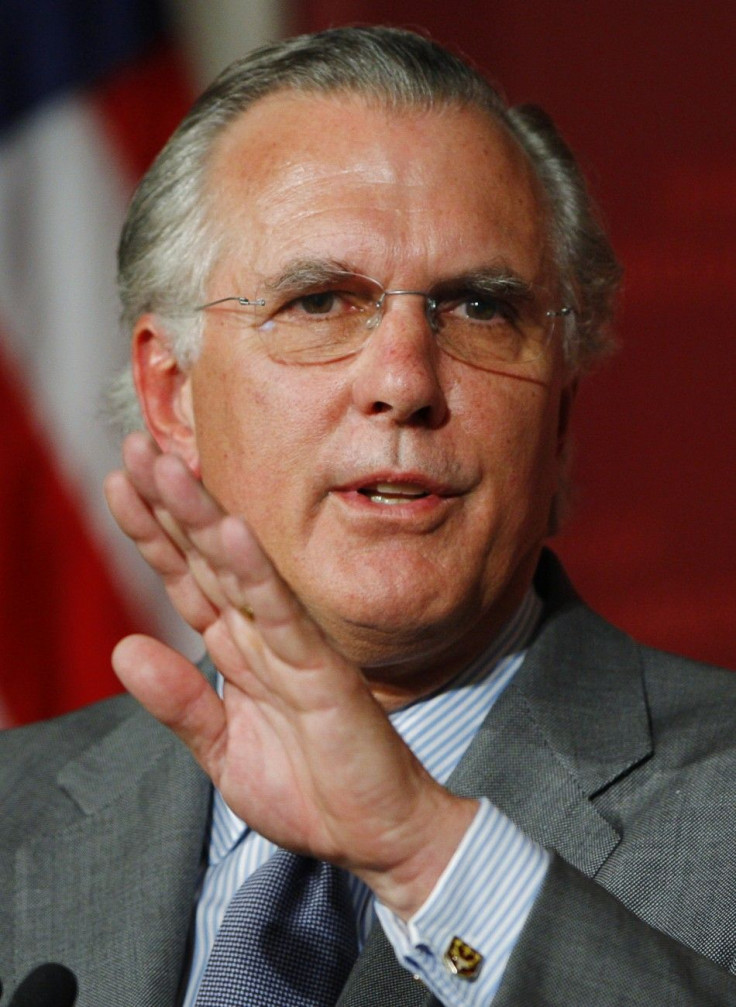

The Federal Reserve's new Operation Twist drew a number of objections from Richard W. Fisher, president of the Federal Reserve Bank of Dallas, who explained his opposition to the move in a speech Tuesday.

Speaking in Dallas, Fisher cited four main reasons for objecting to the plan, which seeks to flatten the U.S. treasury yield curve by, in effect, swapping $400 billion in shorter-term securities for longer-term securities on the central bank's balance sheet.

- It will spur increased savings, not spending, which is exactly the opposite of what it is supposed to achieve. [Savers] might view an Operation Twist as setting the stage for a new round of monetary accommodation -- a QE3, if you will, he said.

- It will damage bank earnings because it will shrink the spread between long- and short-term rates that fuels the profitability of their lending operations.

- It will force pension funds to recalculate their returns on existing investments and oblige their contributors to pay more to achieve goals settled upon in a more favorable environment.

- Should the the program be successful, it would undermine the perception of the Fed's independence. Perversely, the stronger the economy, the greater the losses the Fed would incur as interest rates rise in response and the prices of those longer-term holdings depreciate, Fisher said. The political incentive to hold rates down might then become stronger precisely when we want to initiate tighter monetary policy. The good news is that it would stem from a stronger economy; the bad is that might hurt our maneuverability and, in doing so, might undermine confidence in the Fed to conduct policy independently.

Fisher also made mention of the moral hazard of using monetary policy to achieve fiscal goals. Until our fiscal authorities get their act together, further monetary accommodation -- be it in the form of quantitative easing or performing 'jujitsu' on the yield curve through efforts such as Operation Twist -- will represent nothing more than pushing on a string.

Finally, Fisher sounded an alarm about potential problems with inflation, saying that once unleashed it tends to morph into stagflation, a phenomenon whose chief victims are the poor and the unemployed.

© Copyright IBTimes 2024. All rights reserved.