Suze Orman for President

Opinion

When it comes to our national debt, the economic crisis has recalibrated the nation's sense of the normal. We have grown remarkably comfortable with being in the red. We gaze upon the ever-escalating national debt with a sense of boredom. $15 trillion? Yawn. Adding a few trillion to the debt ledger every so often has become a national pastime.

Whereas we once prided ourselves on our free-market system, Americans have lately grown used to the government intervening in the economy in extraordinary ways. Take over a doomed General Motors? Sure! Pump hundreds of billions into a corrupt banking system? Gladly! Deficit spending is the currency of the new interventionist economy.

Some economists say the only way out of a recession is for the government to spend its way out. We've thoroughly tested that remedy over the last three years, with something less than perfect success. These same economists console us with the claim that the recession might now be worse if we owed less.

Borrowing Our Way to Prosperity?

The strategy of borrowing one's way back into prosperity is not only being used to try to fix our national economy; it's also being used by millions of Americans who are trying to fix their own private economies.

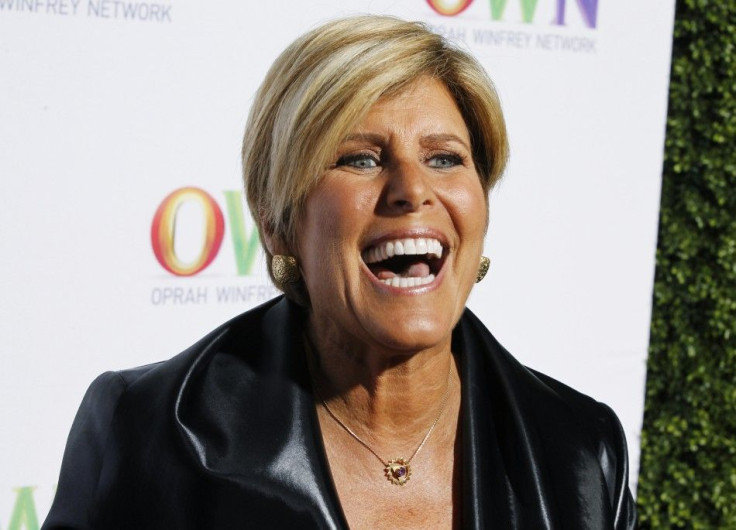

I was flipping through the channels recently and happened upon a PBS special, featuring personal finance guru Suze Orman. She's the blonde prophet of profit-a televangelist with sparkling white teeth, offering financial salvation. Her moral maxims consist of maxing out one's 401k, signing a valid Will & Trust, and, above all, living within one's means.

Living within one's means? That strikes me as countercultural, even subversive, in the face of the present Let's spend our way out of this hole national ethos.

At one point in the program, a middle-aged man in the audience got up to tell his story, and it was a familiar tale. Struggling with a low-paying job and high levels of credit card and educational debt, he had enacted his own personal version of a stimulus bill.

He decided to get a Master's degree in hopes of enhancing his employment prospects. A year or two later, his educational loans had ballooned from around $20,000 to more than $100,000. Meanwhile, his employment prospects did not improve. He ended up with the same subsistence-level income, only with five times more debt weighing him down.

The man asked whether he should consider filing for bankruptcy. Orman had the dubious privilege of being the one to inform him that, unlike most kinds of debt, student loans cannot be eliminated through bankruptcy. Those loans will be around forever, she informed him. Lenders can garnish your wages. And decades from now, if those loans are still hanging around, they can even garnish your social security checks. The poor fellow was near tears by the time the blonde finance queen had finished pronouncing her decree.

There may be limits to the application of personal finance principles to the management of the national budget. But it was at that moment that I began to wish that some of our politicians in Washington could be subjected to a Suze Orman-style sobering up on the issue of debt.

Perhaps we should make her temporary President for a few weeks-just long enough to apply one of her twelve-step programs to the budget making process.

The Clock is Ticking

In 1989, real estate developer Seymour Durst installed the famous national debt clock in Manhattan. At the time, the national debt stood at $2.7 trillion. By 2008, that number had grown so large that the clock ran out of digits. And in the three years since, it has increased another fifty percent.

We can put off the pain of trying to live within our national means -- for a while. But like the fellow with the massive educational loans, we will have to reckon with our debt eventually. By then, we may realize that borrowing our way back to prosperity was a doomed strategy to begin with.

Nathan Harden is editor of The College Fix. He writes about culture and politics every Wednesday for the International Business Times. Follow him on Twitter @nathanharden

© Copyright IBTimes 2024. All rights reserved.