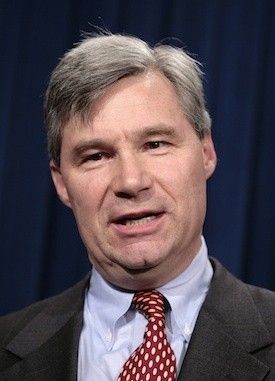

Sen. Sheldon Whitehouse to Introduce 'Buffett Rule' Tax Bill This Week

Building off President Barack Obama's call for tax fairness in his State of the Union address last week, Sen. Sheldon Whitehouse (D-R.I), confirmed Monday that he intends to introduce legislation this week that would require millionaires to pay a 30 percent tax rate on their income.

Whitehouse said he would introduce the proposal, the first concrete legislative vehicle to implement the so-called Buffett Rule, during a conference call with reporters, multiple reports said. Under the measure, individuals making more than $1 million a year would be required to calculate their overall tax rate as they do now, leaving all of the deductions, credits and loopholes intact. They would also calculate what 30 percent of their adjusted gross income amounts to, and then pay whichever amount is larger.

In theory, we have a progressive tax code in which the more successful you are, the more money you make, the greater rate you pay in taxation, Whitehouse said, The New York Times reported. Unfortunately what turns out to be the fact in practice is that you have these huge exceptions.

As an example, Whitehouse cited billionaire investor Warren Buffett, an outspoken advocate of a progressive tax who made tax fairness a national issue by publicly asserting that various deductions and loopholes allow him to pay a lower tax rate than his secretary. Buffett is chairman of Omaha-based Berkshire Hathaway, a holding company valued at $195.8 billion.

The issue also came to a head in the days before the State of the Union after GOP presidential hopeful Mitt Romney released his tax returns, revealing he paid less than a 14 percent tax rate on his reported income of $21.7 million in 2010.

If your income is over $1 million, multiply it by 0.3, and if that number is bigger than you'd otherwise be paying, pay that, Whitehouse said, boiling down his proposal to a single sentence.

Whitehouse told sources that he had already attracted two Democratic co-sponsors for the bill by Monday morning. Moreover, the senator confirmed the White House has been notified about his legislation, suggesting the Obama administration may have a hand in bringing the proposal to light.

People believe that the American tax system is not fair, and that the more lobbyists and the more wealth you have, the more goodies you get out of the tax system, Whitehouse said, The Washington Post reported. This is a welcome proposal and I hope this will be supported across the board.

The measure will likely face fierce opposition from Senate Republicans, who opposed -- and eventually forced Democrats to drop -- a provision in December's payroll tax legislation that would have imposed a 1.9 percent surtax on people earning more than $1 million per year.

However, multiple polls have confirmed that a majority of Americans, including both Democrats and Republicans, are in favor of a millionaire's surtax. A September Gallup poll found that two-thirds of Americans favored raising taxes on individuals who make at least $200,000 per year, paralleling the results of similar Daily Kos poll that concluded 73 percent of Americans -- including 66 percent of Republican respondents -- supported the Buffett Rule.

© Copyright IBTimes 2024. All rights reserved.