Facebook IPO: 5 Danger Signs for Investors

Assuming the $100 billion initial public offering by Facebook proceeds as planned, investors will likely clamor for shares and snap them up, just as in earlier Web frenzies for Netscape Communications, Yahoo and Google.

But there are some marked differences among those IPOs -- in 1995, 1996 and 2004, respectively -- and Menlo Park, Calif.-based Facebook's despite all the companies' reliance on the Internet, computing, search and media.

They also share some of the same underwriters, including Morgan Stanley, which will lead the Facebook IPO.

Still, after combing through the details in the Facebook filing, for which It paid the U.S. Securities and Exchange Commission a $573,000 fee, here are some points to bear in mind:

Facebook will be CEO Mark Zuckerberg's kingdom: For better and worse, the 27-year-old CEO will rule the company because public Facebook will have two classes of shares. Zuckerberg will end up in control of nearly 57 percent of the company, including both his Class A and B shares.

That is not necessarily a bad thing. Companies including Washington Post, whose chairman, Donald Graham, is a Facebook director, and Google have them; so does Berkshire Hathaway, the investment vehicle of Warren E. Buffett, whose directors include Bill Gates.

Still, the future company doesn't have a chairman nor anyone designated as a lead director, reforms all recommended after the options scandal ensnared so many technology companies, including Apple, and helped inspire the Sarbanes-Oxley Act of 2002.

Who's going to challenge Zuck in the boardroom? If not Graham, could it be Netscape founder Marc Andreesen, 40, now also a director of Hewlett-Packard? Or Erskine Bowles, 66, former White House chief of staff for President Bill Clinton and co-chairman of a deficit-reduction commission?

The other directors are all Facebook investors and backers: PayPal founder Peter Thiel, Accel Partners venture capitalist Jim Breyer and Netflix CEO Reed Hastings.

Given their prestige and wealth in their own right, perhaps the dangers are mitigated.

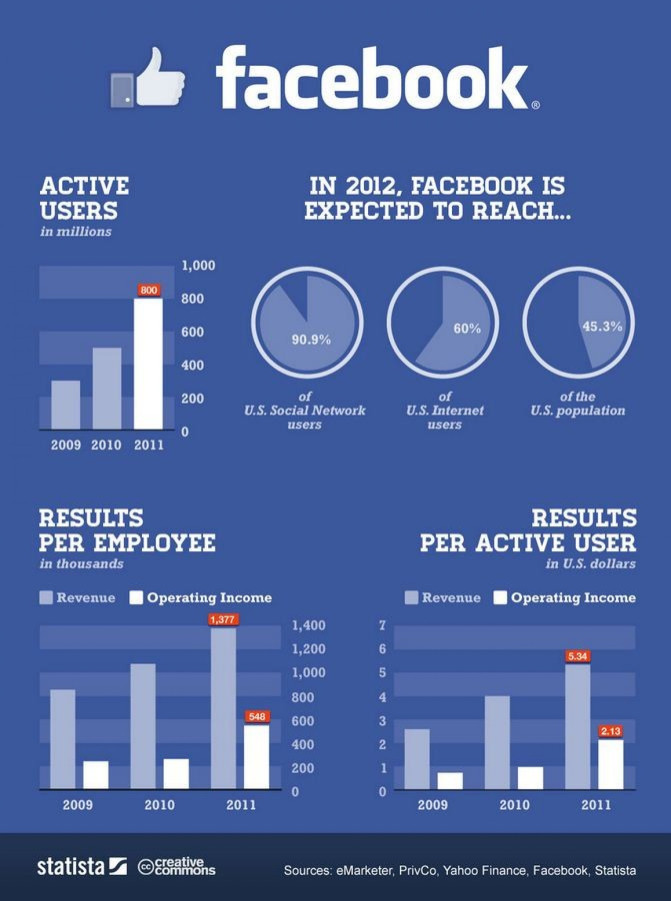

How to spur more revenue and traffic? Facebook's 2011 revenue was only $3.71 billion, about $2 billion below many estimates, although that was nearly double 2010's performance.

Given that Facebook already has 845 million members, about 12 percent of the world population, how can it attract more and generate more clicks that will generate ad and game revenue?

The prospectus doesn't address that issue, although it points out that the company's reach in many places outside the U.S. is far greater than at home. One obvious place will be to generate more daily clicks. There are only about 483 million now, Facebook disclosed, which means there's a lot of deadwood.

Higher costs to sustain uptime traffic. Facebook is only seven years old, and until last year, it didn't even operate its own data center to handle the enormous traffic demands.

The company spent $388 million on research and development last year, more than double the 2010 amount. Now it has millions of pages generated by users, billions of pictures and terabytes of data that members want to access NOW!

For sure, some of the $5 billion Facebook wants to raise will go to better infrastructure or to hire a service provider, like an HP, IBM or Cisco Systems, to manage service.

Patents and intellectual property. For the first time, Facebook disclosed holding 56 patents and applications for 503 more in the U.S. alone, as well as 33 foreign patents in hand and another 149 pending.

How valuable are they? And how can Facebook ensure they are safeguarded? Silicon Valley is embroiled in current patent litigation between Apple and the universe; Google and Oracle; Rambus and most of the chipmakers.

Intellectual property is very hot right now, bankers such as Acacia Research CEO Paul Ryan said in a recent interview. Surely anything Facebook has is being zealously guarded. That might be one reason why Zuckerberg chose Fenwick & West, well-known for patent law, as the company's outside law firm.

Where will Facebook be in 10 years? That's hard to tell. Zuckerberg, despite his letter to prospective shareholders advocating social media and global change, probably doesn't know, either.

But going public and hiring Wall Street investment banks who are not held in high public esteem means a lot of big investors such as state pension funds and mutual funds will be invited to buy Facebook shares.

Those investors will want a roadmap and specificity, although technology investors know that even for the most solid company, such as HP or IBM, there is no such thing as a perfect course.

If it's any barometer, shares of Google rose Thursday about $2.16 to $582.96, while those of Yahoo fell a penny to $15.72.

© Copyright IBTimes 2024. All rights reserved.