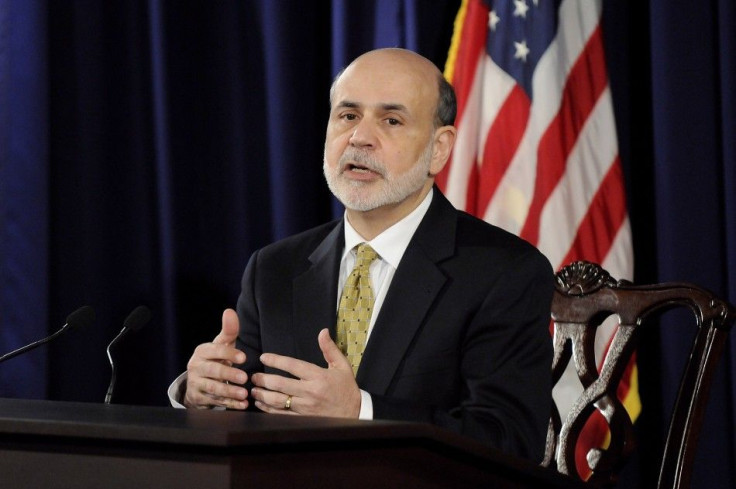

Fed Announces QE3, Bigger Than Expected

Dollar slumps but stocks and gold soar

The Federal Reserve's powerful rate-setting committee announced Thursday that it would engage in a third-round of unsterilized asset purchases to stimulate the U.S. economy, a monetary policy known colloquially as QE3 that the vast majority of market watchers expected would be undertaken by the Fed this week.

In a statement at the conclusion of a two-day meeting, the committee said it would be expanding the size of its long-term asset balance sheet by close to $85 billion per month through the end of 2012, buying about $40 billion in mortgage-backed bonds. The balance of the balance sheet expansion will occur as the Fed continues its so-called Operation Twist, which has seen the central bank buy long-term Treasuries while sterilizing its purchases by selling short-term ones.

All in all, the actions by the Fed exceeded the expectations of market analysts, the most optimistic of whom had estimated a new round of asset purchases would probably see the central bank inject $500 billion into the economy.

In addition to announcing the purchases, the Fed noted it foresaw an environment of highly accommodative rates at least through mid-2015. Previous statements had seen the bank commit to keeping low rates only until late 2014.

The Fed noted it was taking the actions, because without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions.

Only one member of the committee, Federal Reserve Bank of Richmond President Jeffrey Lacker, objected to the decision.

Financial markets rallied hard on the news, with the benchmark S&P 500 Index of U.S. stocks up more than half a percentage point in a matter of minutes to levels around 1450.

Gold futures, which had seen a sell-off 15 minutes before the Fed's announcement as traders unsuccessfully attempted to front-run the central bank, skyrocketed to recently trade at $1,752.10 per ounce.

© Copyright IBTimes 2024. All rights reserved.