Bitcoin Rules Divide Wall Street's Digital Currency Community

Bitcoin is facing a coming-of-age moment. The cybercurrency, beloved by techno-libertarians and notorious for financing the Web’s largest black market, will soon come under the formal purview of New York state financial regulators.

That’s anathema to bitcoin diehards.

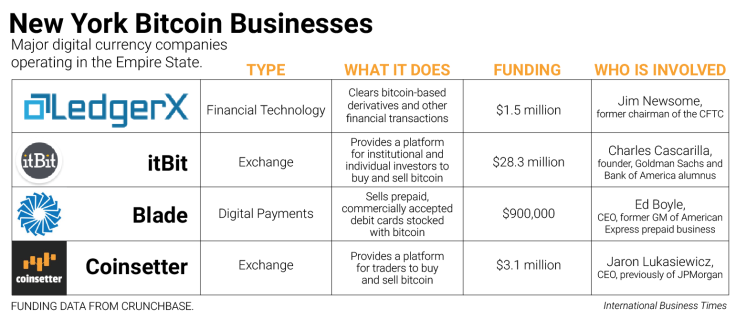

“The reaction has been overwhelmingly negative,” says Steve Wager, head of global operations at digital currency startup itBit, which is headquartered in New York.

But itBit isn’t your typical bitcoin outfit. “We take somewhat a contrarian stance,” says Wager, a former manager at Citibank. “We see this as a positive.”

Not only does itBit support the coming rules but the company took the trouble to obtain a traditional banking license earlier this year -- the first bitcoin exchange in the U.S. to do so. (Indeed, it’s the first institution of any kind to secure a New York banking charter since the financial crisis.)

That leaves Wager blasé about the BitLicense, New York’s coming regulatory regime for bitcoin-based financial services. The final act of Benjamin Lawsky, New York’s outgoing chief financial regulator, the BitLicense is meant to safeguard consumers and root out money laundering in the burgeoning industry.

The rules, expected to be announced in the coming week, will likely mandate capital cushions at bitcoin depositories and address risks around money laundering and cybersecurity.

Depending on who’s talking, the regulations could lend legitimacy to an industry on the up-and-up -- or impose roadblocks that will send digital entrepreneurs packing for Silicon Valley and other locales with looser requirements.

“A clear set of rules and certainty in how they’re going to be enforced would give New York an advantage,” says Gil Luria, a digital currency analyst at Wedbush Securities. “Even if the regulations are more restrictive, the clarity would allow businesses to move forward.”

Though many bitcoin companies are bracing for the costs the new regulations may bring, the industry as a whole will breathe a sigh of relief when the rules are unveiled, Luria says. “The uncertainty is paralyzing.”

From Wild West To Wall Street

Two years ago, the world of bitcoin was considered a monetary Wild West. Exchange rates swung violently, with the currency topping $1,000 in late 2013, before a spectacular plunge cut prices in half. High-profile trading venues like Mt. Gox imploded amid allegations of fraud and incompetence. Customers lost hundreds of millions of dollars from their accounts.

But in the past year, the currency has tamed its price gyrations, shaken its outlaw image and found a new home on Wall Street, where legacy institutions have acquired a taste for the technology.

This month, the New York Stock Exchange debuted a bitcoin index, while Nasdaq announced a pilot program that would use bitcoin’s technological infrastructure -- known as the blockchain -- to trade shares in private companies.

Wall Street titans have dabbled in the cryptocurrency as well. Goldman Sachs joined a recent $50 million funding round for Circle, which uses bitcoin technology to aid money transfers. And Blythe Masters, a former JPMorgan executive and storied pioneer of derivatives, now leads Digital Asset Holdings, which aims to settle bitcoin transactions for large financial institutions.

Others have loftier visions. Some see bitcoin slashing the cost of remittances that immigrants send home. Its underlying technology, others hope, could be a bulwark against identity theft and other frauds.

Luria compares bitcoin’s move into legitimacy to the Web’s adolescence. “In its early days, the Internet was a cesspool of pornography and hate speech,” Luria says. “Bad people realize when regulation hasn’t caught up, and they exploit it. But some people saw through that and realized the Web was a powerful technology.”

Bitcoin has followed a similar route. And as cryptocurrencies have marched into the financial mainstream, New York’s Department of Financial Services has extended a regulatory embrace.

By August 2013, the DFS was devising the BitLicense to address bitcoin’s unique risks. “The more we learned during the course of our inquiry,” DFS Superintendent Lawsky said in a speech last year, “the more we saw that virtual currencies -- and the very powerful technologies behind them -- could hold a number of very interesting potential benefits.”

But unsurprisingly, draft proposals of the rules released last year raised the hackles of the bitcoin community. Thousands of comments flooded into the agency, asking which types of firms would be affected and how rigorous the anti-money-laundering controls would be.

Lawsky’s office clarified that only financial intermediaries -- companies that safeguard customer bitcoins -- would need a BitLicense. Software developers and individuals would be exempt. Moreover, some firms could seek a provisional two-year BitLicense with lighter requirements, to “provide startups an on-ramp as they build up their operations,” as Lawsky said in December.

Stifling Innovation

Still, some say that the new requirements could be a drag.

“Can regulators do a sufficient job in maintaining consumer safety? Do regulators even know enough about bitcoin?” asks Jaron Lukasiewicz, CEO of Coinsetter, a New York bitcoin exchange. “That’s probably not the case today.”

Lawsky, who has cemented a tough-guy reputation on Wall Street, has said the rules are tailored to allow for innovation in the bitcoin business.

But Peter Van Valkenburgh, research director of the bitcoin think tank Coin Center, isn’t convinced. “When the burdens placed on a company are above those of normal money transfer companies, I think it’s a facetious claim.”

To Van Valkenburgh, state regulations for existing money transfer companies like Western Union suffice to keep bitcoin dealers in line. The added requirements in Lawsky’s proposals for digital currencies, he says, could push bitcoin-dealing firms out of the New York market -- though most see this as a faint possibility.

Despite protests from bitcoin proponents, though, the currency remains a favorite means of hiding ill-gotten money. Money laundering has emerged as one of Lawsky’s chief concerns.

Generally the province of federal regulators, money-laundering oversight brings with it considerable costs. New York’s rules could require firms to keep tabs not just on their own customers -- which Coinsetter's Lukasiewicz says companies like his already do -- but also on transfer recipients.

Lukasiewicz says his company has spent upwards of $30,000 preparing for the new rules. The DFS’ proposed money-laundering requirements, he worries, could present a steeper challenge than those already on the books.

If the measures remain, Lukasiewicz says, “you’ll see a stifling of innovation.”

What's more, bitcoin’s blockchain technology could make these controls unnecessary. Bitcoin operates by keeping a public ledger maintained independently in countless digital wallets. Law enforcement agents have successfully used that ledger to ferret out lawbreakers.

Indeed, bitcoin devotees were even able to locate the FBI’s own bitcoin hoard after the agency seized the digital assets of Silk Road, the now-shuttered online black market.

Analysts warn that the novelty and intrigue of bitcoin will cause regulators to impose rules that are at best redundant and at worst suffocating. Some fear a dizzying patchwork of independent state regimes. “There’s already a robust set of regulations around money transfer companies,” Luria says. “Going above and beyond regulations for other money services businesses would be unusual.”

Rules Of The Road

But itBit’s Wager isn’t stressed about the rules coming down the pike. He harks back to his years at Citibank, which is now reportedly under investigation for letting dirty money come through its Mexican branch.

“It’s onerous, there’s no arguing with that,” Wager says of money-laundering oversight. “But it gets you out of trouble.”

What worries Wager more is the reputation of bitcoin, which is still dogged by memories of wild speculation and outright theft. “We’re still fighting the issues of legitimacy,” he says. A solid regulatory regime could help buffer bitcoin’s public image, even if it comes with costs.

“We don’t want there to be a backlash against New York state,” he says. But he hopes that the new rules will bring transparency to the world of bitcoin operators and spur wider adoption of the technology.

“When there are rules of the road, businesses won’t have to operate in a gray zone.”

© Copyright IBTimes 2024. All rights reserved.