China Extends Lead As World’s Largest Car Market By Sales; GM, Ford China Deliveries Up By Double Digits

Four years after China became the world’s largest auto market, the pace of growth has been relentless. Last year, Chinese consumers bought about 2.7 million more new domestic and foreign brand vehicles than American buyers. In the first six months of this year, the Chinese market leads by almost 3.7 million.

Total U.S. new-auto sales grew by 1.1 percent to 8.15 million vehicles, according to the latest figures from automotive data provider Kelley Blue Book. The U.S. auto market is on track finally to recoup to pre-recession sales levels this year.

At the same time, new-car sales in China so far this year are expected to come in at about 11.81 million, about 9 percent growth, based on an IBTimes estimate using data from the China Association of Automobile Manufacturers for the first five months of the year. (June figures are due out later this month.)

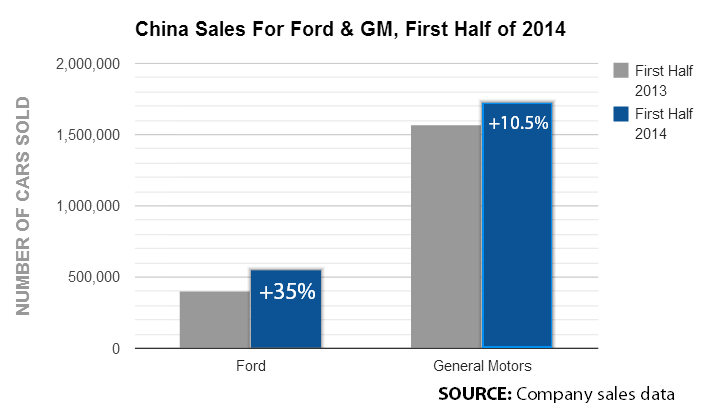

This is welcome news for General Motors Co. (NYSE:GM), the second-largest foreign automaker in China, which has been suffering a public relations crisis over a slew of recalls and the fatal ignition switch flaw in some older mid-sized sedans. Chevrolet sales are starting to feel a consumer backlash in the U.S., but GM said Monday that sales in China have increased 10.5 percent in the first half of 2014, to 1.73 million vehicles.

“We anticipate sales remaining strong through the end of 2014, as more people – particularly outside China’s major cities – become first-time vehicle buyers,” GM China President Matt Tsien said in a statement.

Ford Motor Co. (NYSE:F), a relative newcomer to the Chinese auto market, reported a 35-percent jump in deliveries, to just under 550,000 units. Ford is leagues behind GM and the largest foreign automaker in the country, Germany's Volkswagen AG (FRA:VOW), but is investing to expand its factory floor space and catch up to its competitors.

“We continue to grow our sales network, increase capacity and hire great employees,” said John Lawler, chairman and CEO of Ford China, in a statement.

Foreign automakers are required to form partnerships with domestic producers in China.

GM’s largest joint venture, called Shanghai GM, sold 819,667 vehicles in the first half of the year. SAIC-GM-Wuling sold 883,724 vehicles, while FAW-GM delivered 27,579 units. GM's top three joint ventures (it has 12 in China) boosted sales between 7 percent and 11.5 percent so far this year.

Ford makes passengers cars as Changan Ford. The joint venture reported a 39 percent rise in sales in the first six months, to 286,433 cars, led by strong demand for the Ford Focus. Ford’s commercial vehicle partnership, Jiangling Motors Corp., registered a 21 percent increase to 132,938 vehicles in the first six months of the year.

Car sales in China don’t give up the same profit margins, since many of the vehicles made under these joint ventures are targeting middle and lower-middle class buyers. But high volume can make up for at least part of what’s lost in profit and automakers are banking that China’s growing middle class will continue to strengthen the appetite for high-margin luxury cars and SUVs.

© Copyright IBTimes 2024. All rights reserved.