China Launches Its First Free-Trade Zone (FTZ) In Shanghai, Major Step For Financial Reforms

The much-talked-about free-trade zone in Shanghai, China's economic hub, was launched Sunday as the world's second-biggest economy prepares to test major financial and economic reforms. But some doubt the Chinese government’s bold move will be a game-changer.

The initiative, which is being undertaken in a 29-square-kilometer area in an eastern suburb of Shanghai, is seen as a strong testament to the new leadership's commitment to pushing ahead with reforms. State media reported that a first batch of 25 Chinese and foreign companies, including Citigroup Inc. (NYSE: C) and Bank of China Limited (SHA:601988), already have been granted licenses to register in the zone.

The Shanghai free-trade zone is the first Hong Kong-like free trade area in mainland China. Rules in the zone will be introduced over three years, and Premier Li Keqiang, who personally endorsed the plan, has signaled he may later expand the experiment more broadly if it proves a success. Other mainland cities and provinces, including Tianjin in the north and Guangdong in the south, have also lobbied Beijing for such approvals.

Li mentioned the free-trade area in a commentary earlier this month in the Financial Times. He wrote that China will stay on the path of reform and opening up. “We will explore new ways to open China to the outside world, and Shanghai’s pilot free-trade zone is a case in point,” he wrote. The premier has called for the state to increase the role of the private sector to sustain growth.

What’s in the Deal

Among the measures to be tested inside the free-trade zone are allowing China's heavily regulated currency, the yuan, to be swapped freely for other currencies, China's State Council said in a statement on Friday. This is a necessary step for Shanghai to become a global trading and business hub. The yuan was ranked the ninth most-traded currency in 2012, with a 2.2 percent share of global foreign exchange volume, according to the Bank for International Settlements. That’s the first time it's made the top 10.

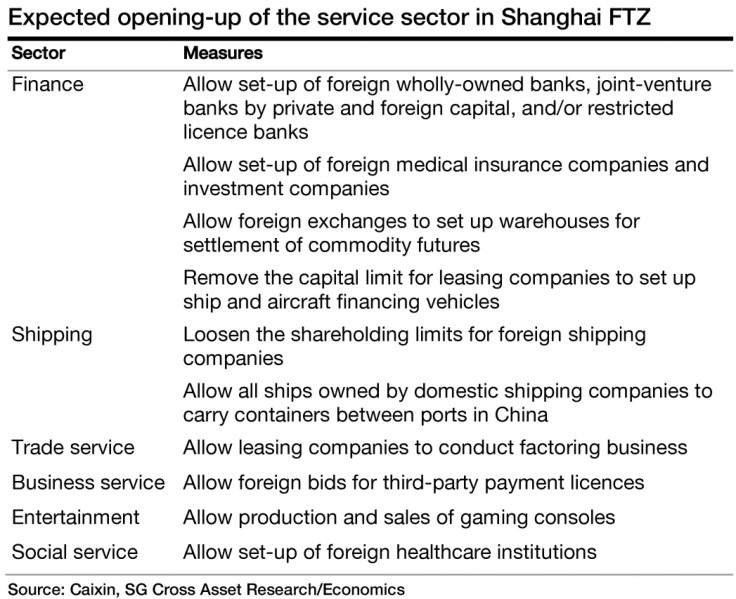

The most significant measure confirmed so far is a three-year suspension of most of the current legal restrictions on foreign investment. Essentially, foreign investors will be able to invest (nearly) as freely as their domestic peers. Restrictions on foreign ownership are going to be abolished and the entry barriers will be lowered for the service industries, including finance, shipping, trade services, business services, entertainment and social services, according to Wei Yao, China economist at Societe Generale.

Eighteen sectors, ranging from finance to shipping, will have regulations loosened in the zone.

Significance Of The FTZ

“We believe the importance of this pilot FTZ could potentially be on par with China’s special economic zones in the 1980s and its commitment to join the WTO in 2001,” said Jian Chang, China economist at Barclays.

In order to understand the significance of the FTZ project, one needs to look at the history of China’s reforms and opening-up since 1978. According to Societe Generale’s Wei Yao:

Deng Xiaoping introduced market mechanisms into a highly closed, tightly controlled and near-dead economy via several flagship regional experiments. In particular, the establishment of the Shenzhen Special Economic Zone (SEZ) in 1980 reopened the door to foreign direct investment for the first time since the revolution. This SEZ model was adopted by a number of coastal cities from the mid-1980s. However, reform momentum stalled due to the political struggles of the late 1980s.

Aiming to rekindle investor confidence, Deng made his famous southern tour in 1992, reaffirming the central government’s commitment to reform. One of the grand gestures following the tour was to grant Shanghai’s Pudong area a big package of pro-business policies, opening up to overseas investment to a greater extent. The overarching theme of all the reform in the 1980s and 1990s was, simply put, liberalization. Local experiments in strategically important cities not only served as policy signals of reform commitment but provided guidance to coming changes.

The Shanghai FTZ comes at a time when China is facing unprecedented challenges from home and abroad. Globally, against the backdrop of slowing demand, rising trade protectionism and stagnant multilateral trade negotiations, major economies are actively pursuing alternatives, according to Barclays’ Jian Chang.

For example, the US-led Trans-Pacific Partnership (TPP) includes 12 countries: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the U.S. and Vietnam. Together, they account for nearly 40 percent of global output and about a third of world trade, making it one of the largest free trade areas once concluded. The U.S. and European Union have also started talks on a Transatlantic Trade and Investment Partnership.

Domestically, China is at a critical juncture after 30 years of rapid economic growth. Favorable conditions, such as the demographic dividend, the dividend from earlier rural, financial and fiscal reforms, and the WTO dividend are diminishing. But new growth drivers have yet to be developed. In March, Premier Li said, “Thirty years ago, China’s reforms were led by the Special Economic Zones. It is time to find a new pilot zone to fuel a new round of reforms through opening up. There is still great room and potential, and Shanghai has all the conditions to realize this.”

“The new leadership is forcefully pushing for another big package of corporate sector reform in Shanghai at a time when the Chinese economy is clearly at a critical juncture. It is hard not to see the historical resemblance and infer the significance of this move,” Yao said.

Doubts

“This is an experiment worth watching, but not the game-changer that some believe,” said Capital Economics analyst Jessica Hinds.

Skeptics point to a similar scheme launched near Shenzhen, in Qianhai, last year, but that has so far failed to live up to expectations. Qianhai was presented as place for radical experimentation with China's capital account.

In addition, Barclays’ Jiang Chang notes that consolidating Shanghai’s position as a global financial and services center has its risks and probably will require strong execution of a gradual process taking into account interest rate and yuan arbitrage, limitations on foreign bank operating licenses, the likely effect on land prices, and yet at the same time establish confidence in the future light-touch legal framework.

There are also concerns that the Shanghai FTZ will attract services and trade revenue from Hong Kong, such as yuan settlement, luxury goods sales and port revenues, potentially damaging Hong Kong’s position as the world’s business gateway to China, according to Chang.

First, the trade and logistics industry is likely to be affected – nearly 55 percent of Hong Kong’s re-exports go to China. As custom procedures are simplified and costs lowered in Shanghai’s FTZ, some firms may choose to bypass Hong Kong and ship their goods directly into the mainland. Second, Hong Kong’s offshore yuan business is likely to see more intense competition. Furthermore, Hong Kong’s value proposition as a duty-free shopping hub for mainlanders may become less appealing. With possible lower import tariffs, luxury goods may soon be available in the mainland at more competitive prices.

“That said, in the short-term, we think Hong Kong will be able to withstand competition from the FTZ,” Chang said. “It has a first-mover advantage, a huge lead in fact, as it will take time for the Shanghai trade zone to be developed.”

© Copyright IBTimes 2024. All rights reserved.