China Slowdown, Low Oil Prices: A Challenge And An Opportunity For India To Push Through Reforms

BANGALORE -- Every morning P Chinnasamy, like his father before him, makes the short journey to his family-owned textile mill, KKP Textiles, in the southern Indian town of Namakkal, on the periphery of Coimbatore, one of India’s largest textile hubs.

Chinnasamy's mill churns out yarn, fabric and bed sheets, of which half are exported. The fabric and bed sheets are exported to the U.S. and Europe but much of his yarn export is to China. And that's a problem -- an economic slowdown in China is significantly lowering demand. In the first six months this year, Chinnasamy exported only 60 percent as much yarn as he did in the same period last year.

“Compared to last year, this year will be bad,” Chinnasamy said.

Chinnasamy is, relatively, one of the lucky ones. Not being dependent only on yarn, and exporting fabric to the U.S. and Europe, where demand is stable, helps Chinnasamy run his mill at full capacity 24/7, but others in the sector have been hit hard by the Chinese slowdown.

“If the bloodbath in China, commodity, equity, everything, if that leads to demand destruction, globally, then India can’t be isolated from that and exports would suffer, across the board,” said Bhavin Shah, former managing director and head of technology equity research in Asia Pacific at JPMorgan Chase & Co., who now runs Sameeksha, his own investment firm in the western Indian city of Ahmedabad.

China, which was a major importer of Indian yarns for the past few years, has cut down imports in the past few months, thus worsening the situation (of excess capacity), leading to accumulation of yarn stocks in Indian spinning mills, the Northern Indian Textile Mills Association, a lobby, said in a press release earlier this month.

Spinning mills that are part of this association were considering closing their plants once a week to reduce production, according to the press release. In Bhiwandi, in the western Indian state of Maharashtra, some 900,000 powerloom units are on strike against a local hike in electricity tariff, but also demanding the right to export the cloth they produce.

China devaluing its currency could exacerbate their worries that cheaper imports into India, including from China, will hurt their prospects. The striking workers have said they will send 100,000 postcards to India’s Prime Minister Narendra Modi, seeking relief.

Chinnasamy remains convinced that China’s turmoil will settle and even the yarn demand will pick up. “Labor is becoming very expensive in China and a lot of mills are closing down, so demand for yarn will be there ... this is a temporary situation. From March-April, a lot of business should come back,” he said.

Many analysts agree. "India does have a lot of positive domestic drivers that could be further exploited by kind of taking advantage of this crisis,” Shah said.

The South Asian giant, which only has about 4.2 percent of the global textile market share, is growing its exports to the U.S. faster than China, which produces more than a third of the world’s textiles.

U.S. government data, from the Department of Commerce's textiles and apparel division, show Indian textile exports to America grew by 12.4 percent to 2.3 billion sq.mt. equivalent (SME) in the six months through June against the same period last year. China’s rose 10.6 percent to 14 billion SME. In terms of value, Indian textile exports rose about 11.5 percent to $3.8 billion and China’s rose by close to 4 percent, to $18.8 billion.

“Although India has a small share in the global textile trade, it is well positioned to gain from weak input prices and growing demand for apparels and made-ups,” analysts Tanu Sharma and Salil Garg at India Ratings & Research, a rating agency, wrote in a July report, with a “Stable” outlook for the sector in the current fiscal year that ends March 31, 2016.

At home, India could do more to boost its own economy by pushing through hard reforms, Shah and others say. Falling oil prices, which were sold down further, triggered by the Chinese rout, will help in this process. In this environment, India’s federal government should be able to push through much needed reforms, because it is going to be seen as having less of an impact to do so.

Two such important reforms are a new goods and services tax regime and new land acquisition rules. However, that both these long-awaited reforms are still hanging fire demonstrates the need for real action on the ground.

“While one could argue that a China scare may be an opportunity in India, if you look at the macros, there hasn’t been a significant change,” Mridul Arora, vice president at early-stage venture fund SAIF Partners, said. “Directionally, a lot of right noises are being made, but we are still far from seeing real significant improvement in India right now.”

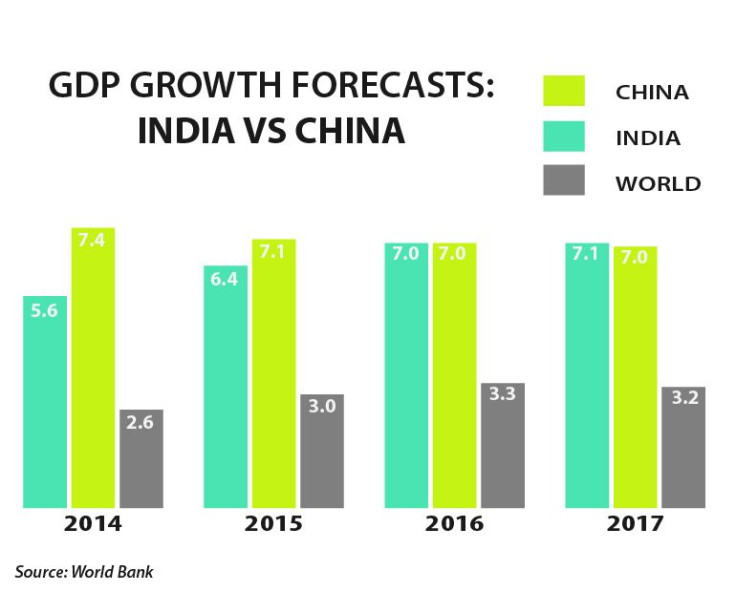

India’s growth in the last two years hasn’t exactly been stellar, Arora pointed out. SAIF Partners has been an early investor in several startups with a strong domestic consumption play in the country.

India could still be looking at short-term pain, as “the real economy does not seem to be investing massively given it is burdened under significant amount of debt.” For instance, the banking sector is saddled with a lot of bad loans, and interest rates don’t seem to be coming down significantly anytime soon.

“While in theory it’s fine to say we will benefit as a net commodity importer, it’s based on the false assumption that you will cut your import bill while maintaining your exports. That doesn’t happen,” said Phani Sekhar, a fund manager at Mumbai’s Karvy Stock Broking.

Among India’s trading partners are commodity exporters and “if the health of those countries is impacted then it’s common sense that your exports will get hurt,” Sekhar said. “That’s a hit on your economic growth, a hit on your employment.”

The effect of the Chinese crisis over the next six months could be negative for India, especially from an overseas financial investor’s perspective, but in two years and beyond, not only is India insulated, it has a “wonderful opportunity” to push growth-oriented reforms, he said.

Arora added: “India as a market opportunity driven by factors such as strong demographics, robust domestic consumption and increasing technology adoption remains an attractive destination for risk capital.”

Lower commodity prices and cheaper oil are a huge advantage to India, “so whether India does extremely well or relatively well is the only thing” to watch out for, depending on how the government acts, Shah said.

“If they show the resolve, then India can isolate itself,” he said. Taking advantage of cheaper commodities, interest rates can come down, and the world-class infrastructure that China already has, but India needs to build, can come up at a much lower cost of material, labor and finance.

According to Chinnasamy, Indian textile makers -- and Indian exporters - can do much better if the government helped more. For instance, Chinese importers of Indian yarn have to pay a 3.5 percent duty, whereas buying yarn from Vietnam costs them no import duty. “The Indian government must convince the Chinese government to drop that 3.5 percent,” he said.

© Copyright IBTimes 2024. All rights reserved.