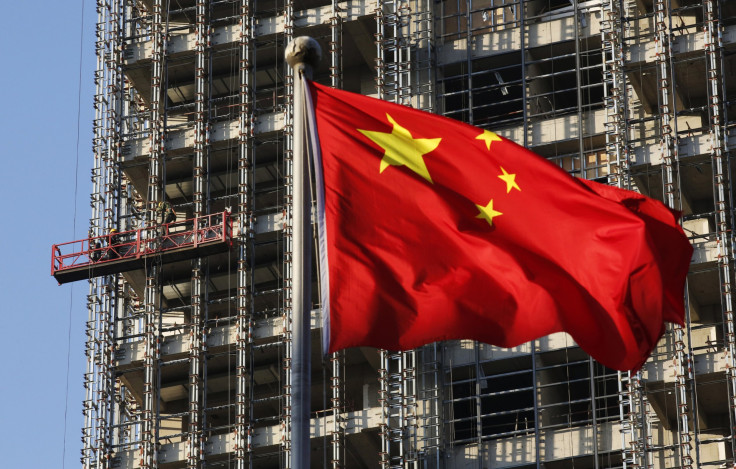

China's Real Estate Accounted For A Dangerously High Proportion Of Its Household Wealth In 2013

It’s no secret that the Chinese like to own homes and other properties – but their penchant for real estate may foretell a property bust for the world’s second-largest economy.

Some 66.1 percent of China’s family assets were in housing in 2013, a national survey of 28,000 households found, and mortgage debt as a share of disposable income rose from 18 in 2008 to 30 percent, according to estimates by Nicholas Lardy at the Peterson Institute for International Economics in Washington, Bloomberg reported on Tuesday.

But with so many assets tied up in real estate, a slide in property prices could have widespread ripple effects – a hit to household wealth would impair consumer spending, which could derail the government’s plan to steer the nation toward a more consumption-driven economy.

“A fall in housing prices could have significant knock-on effects on private consumption,” said Eswar Prasad, a former chief of the International Monetary Fund’s China division, according to Bloomberg. “Such a hit to private consumption could pose significant macroeconomic risks, both to headline growth and the process of rebalancing growth.”

For now, it seems real estate prices will keep going up. Home prices in December showed the biggest year-on-year increase in 2013 – 12 percent, according to Soufun Holdings Ltd., which operates China’s biggest real estate website. But already, there may be signs of oversupply outside the nation’s four biggest cities, according to Centaline Property Agency Ltd., China’s biggest real estate brokerage.

And in real estate, higher prices are not always good. Property holders are becoming uneasy, as prices may be rising to unsustainable levels. Liu Li Gang, the chief Greater China economist at Australia & New Zealand Banking Group Ltd., said that when China opens its capital account, property owners may rush to the exit and shift their money overseas, Bloomberg reported.

© Copyright IBTimes 2024. All rights reserved.