Dodd-Frank Rules Nearly 9,000 Pages, But It's Less Than One-Third Finished

And they've been at it for two years (welcome to Byzantium)

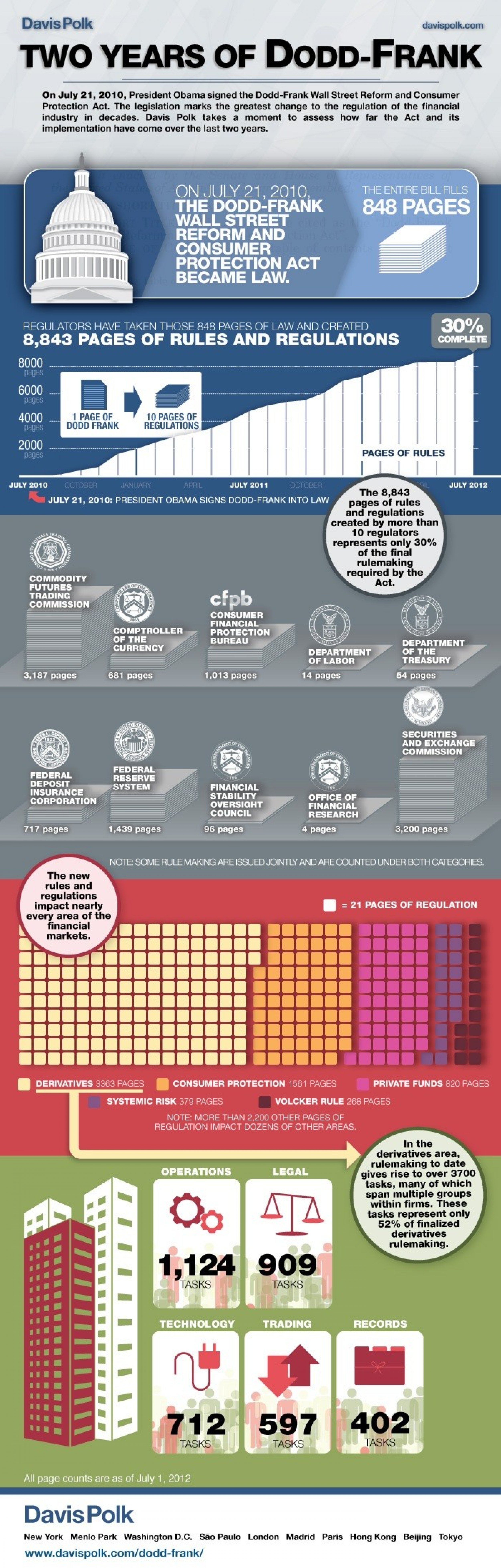

The Dodd-Frank financial regulation law, a signature achievement of President Barack Obama's administration crafted as a response to the global financial crisis of 2008 was signed exactly two years ago. Since then, only about 30 percent of the law's provisions have come into effect, even as the statute itself has metastasized into 8,843 pages of complex, loop-hole ridden rules.

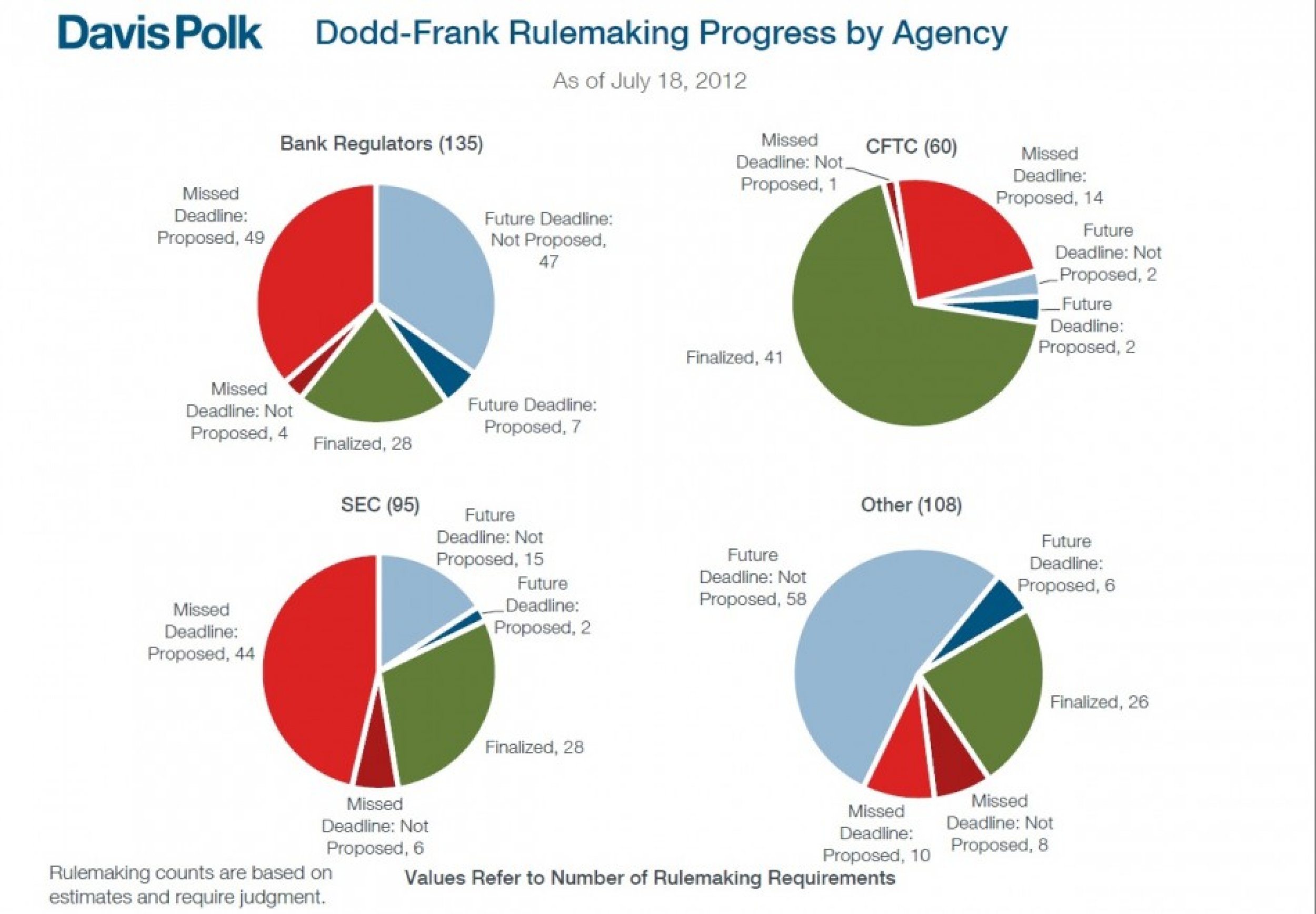

Those findings, among other key facts, come from a summary report released Thursday by the law firm David Polk & Wardell LLP, which graphically illustrates the mind-boggling complexity -- and high level of delay -- regulators have faced attempting to implement Dodd-Frank.

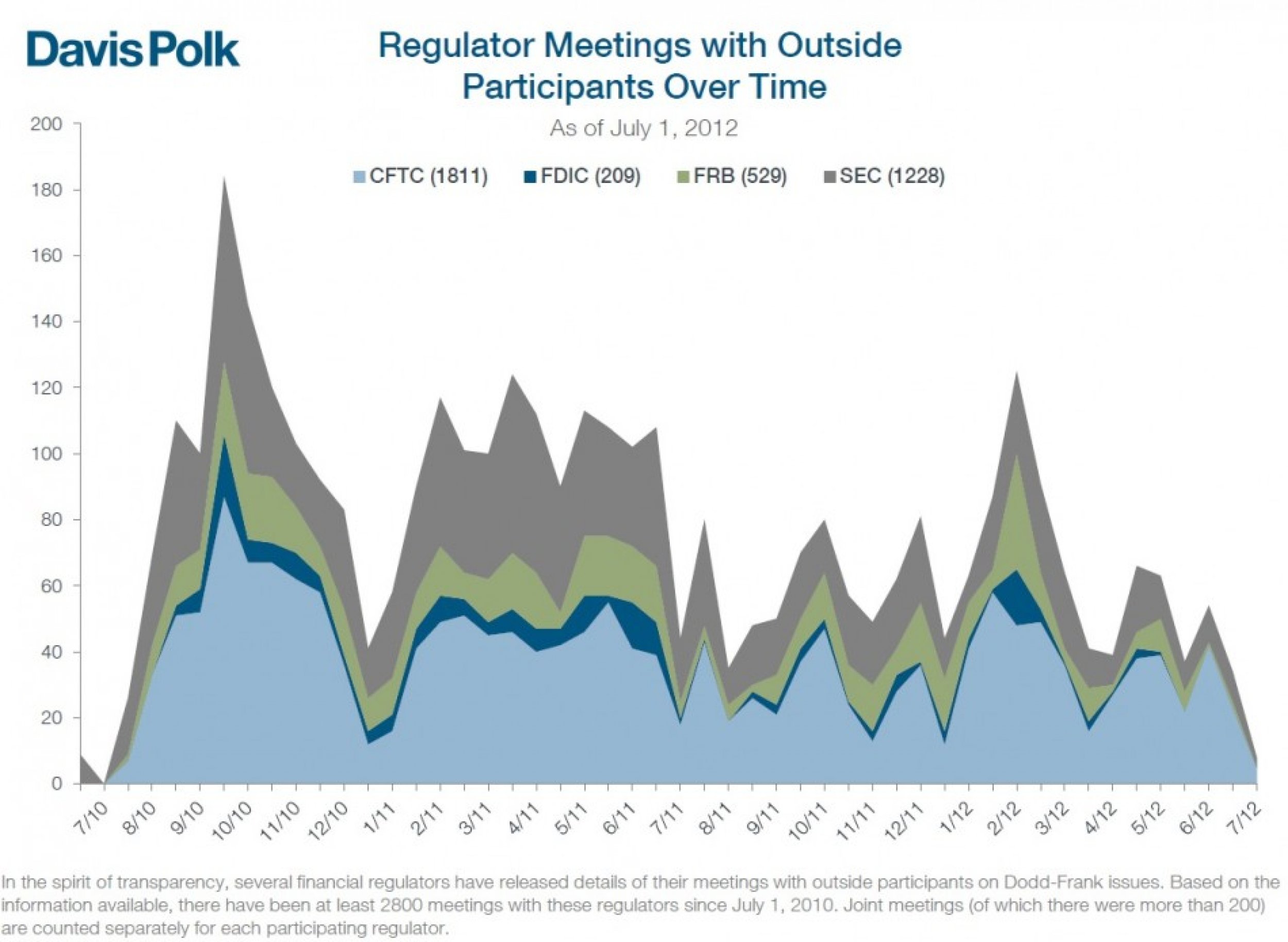

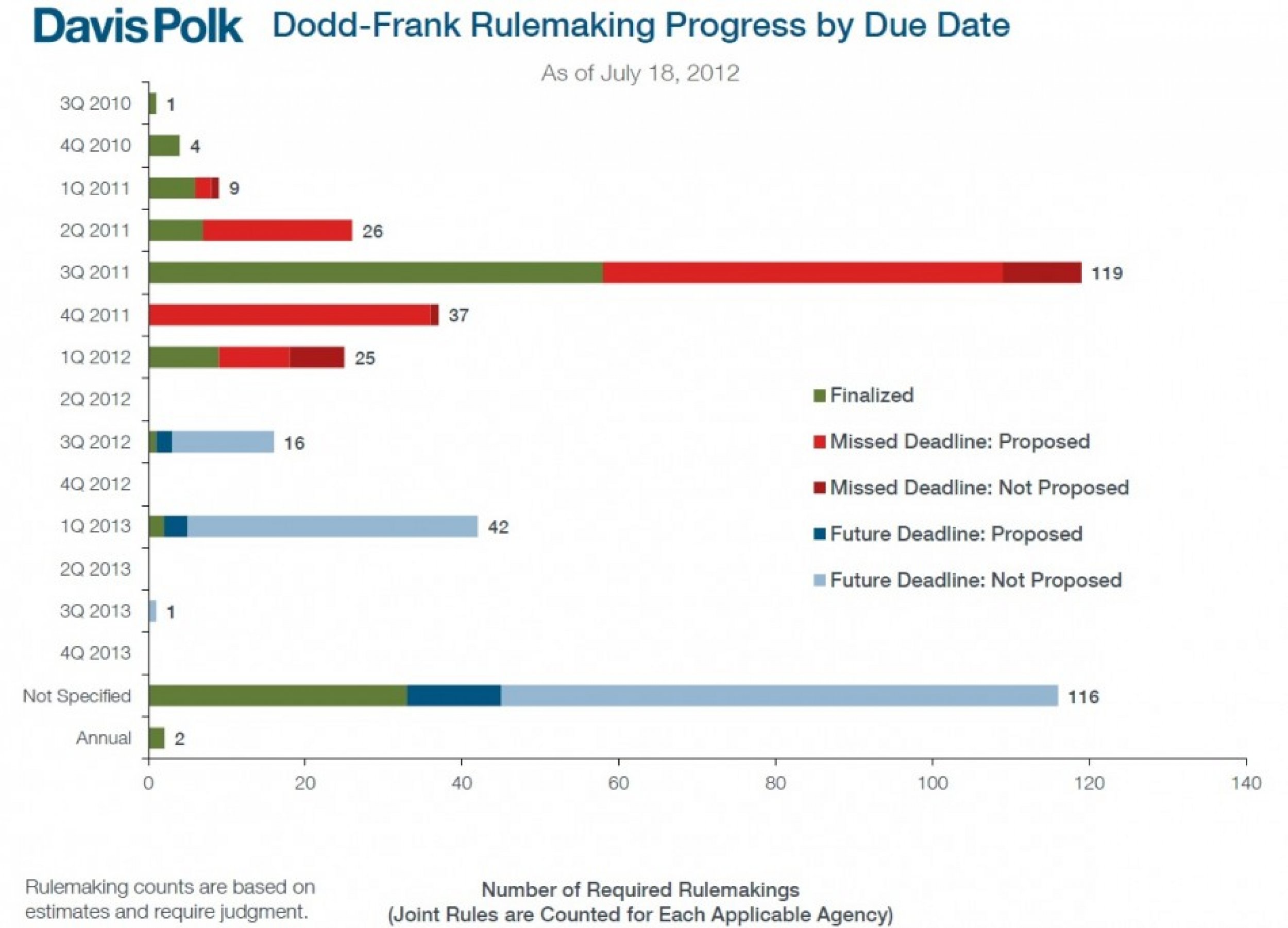

While the report on the financial regulation law's roll-out has many interesting factoids, among the most interesting are its breakdowns on what deadlines have been missed, and which regulators have been responsible for dragging their feet. The Commodities and Futures Trading Commission appears to be on top of things in this regard. The SEC, not so much.

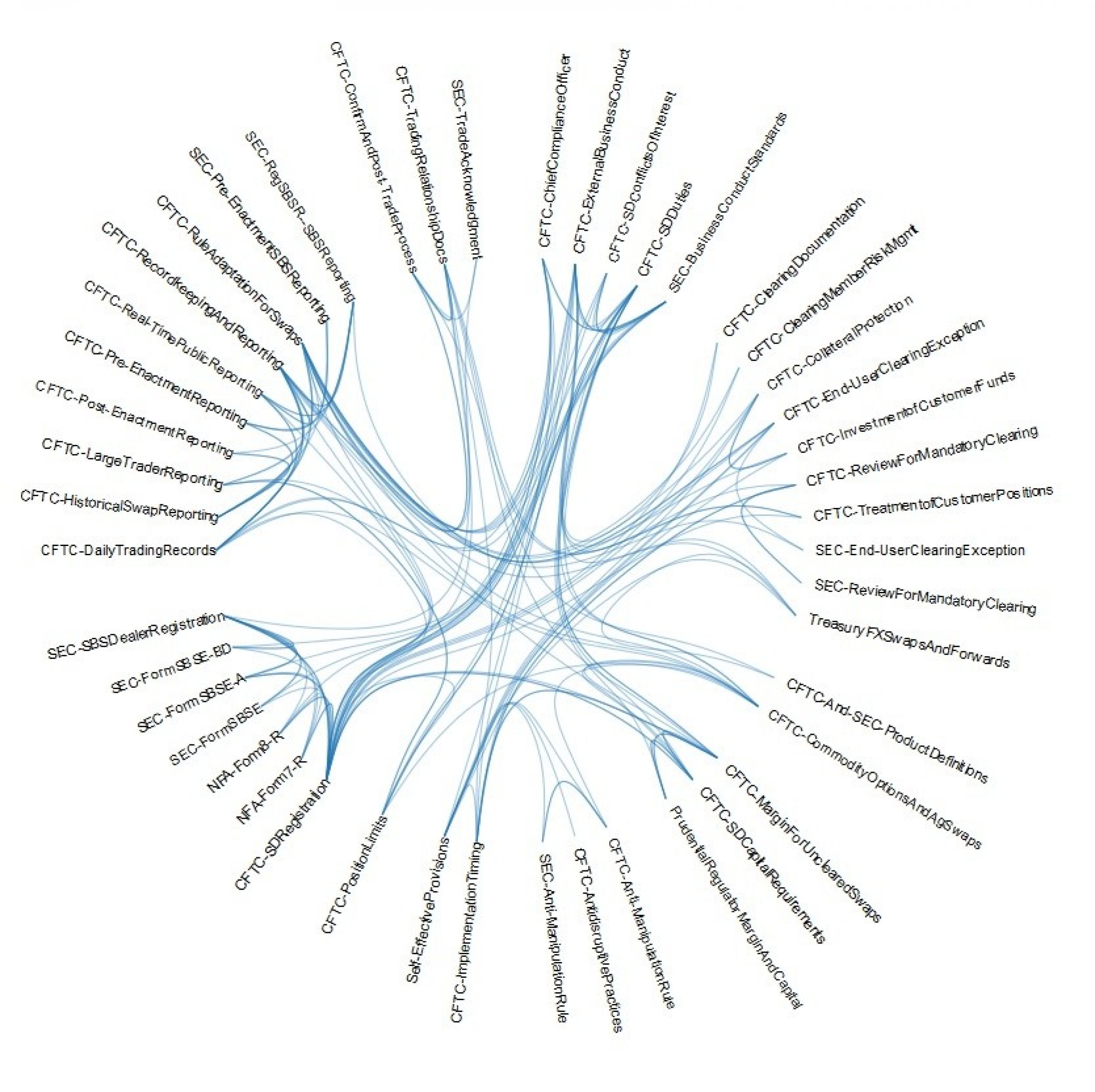

A particularly striking graphic included in the report also focuses on the complexity of interlinked rules, showing how 46 rules written by four different regulators that cover just one aspect of the financial markets -- interest-rate swaps -- have literally thousands of references to other rules.

Below, some choice selections from the report.

© Copyright IBTimes 2024. All rights reserved.