Dow Jones Industrial Average Drops Nearly 100 Points On Apple Inc (AAPL), Microsoft Corporation (MSFT) Earnings

U.S. stocks traded lower Wednesday after disappointing earnings from major technology bellwethers weighed on investor sentiment, including the world’s most valuable company, Apple Inc., and the world's largest computer software company, Microsoft Corporation. Five of the 10 Standard & Poor's 500 sectors traded lower, led by declines information technology.

The Dow (INDEXDJX:.DJI) dropped 92.37 points, or 0.52 percent, to 17,826.92. The S&P 500 (INDEXSP:.INX) dipped 6.57 points, or 0.31 percent, to 2,112.73. The Nasdaq composite (INDEXNASDAQ:.IXIC) lost 40.95 points, or 0.78 percent, to 5,167.36.

Apple Inc. (NASDAQ:AAPL) led the Dow lower Wednesday, dropping more than 5 percent after the tech giant posted quarterly earnings and revenue that slightly beat Wall Street expectations. Shipments for its flagship iPhone, Apple's biggest product category by unit sales and revenue, came in at 47.5 million, below analysts’ forecasts for 50 million. The miss sent shares down more than 8 percent in after-hours trading Tuesday.

Meanwhile, Apple’s “other product revenues” came in at $2.6 billion last quarter, compared to $1.7 billion during the prior quarter. Apple Watch sales are included in the "other" figure, along with products like the iPod and Beats accessories.

Apple likely sold roughly 1.2 million units of the wearable device, Piper Jaffray analyst Gene Munster wrote in a research note Tuesday. That’s down from Street forecasts for the Apple Watch to sell around 4 million units.

However, growth in China remained robust, with sales more than doubling and comprising 27 percent of total revenue.

FBR Capital Markets maintained its Outperform rating on Apple, but lowered its 12-month price target from $185 to $175.

In the last 12 months, shares of Apple have rallied more than 30 percent.

Dow component Microsoft Corporation (NASDAQ:MSFT) sank 3 percent, despite the software company turning in quarterly earnings and revenue that beat Wall Street estimates. Microsoft was dragged down by a $7.6 billion write-down and restructuring in the company’s Nokia mobile-phone operation.

However, revenue for the company's commercial cloud computing, a crucial segment that includes Office 365 and Azure, grew 88 percent from a year ago. The world's largest computer software company is unexpectedly on a new phase of growth, thanks in part to solid revenue in its cloud business, despite global personal computer sales suffering their steepest declines in two years during last quarter.

“While we characterize the June performance as ‘good enough’ in the face of a challenging PC environment, ultimately all investor eyes will be on the July 29 launch of Windows 10 as Mr. Nadella [Microsoft CEO Satya Nadella] and company look to make the transformational cloud transition with Windows in the hopes of reinvigorating growth in the core business and achieving similar success to the Office franchise transition,” said Daniel Ives, an analyst at FBR Capital Markets.

FBR Capital Markets maintained its Outperform rating on Microsoft with a 12-month price target of $53.

Shares of Microsoft have gained 5 percent in the last 12 months.

Meanwhile, the world’s largest retailer, Wal-Mart Stores Inc. (NYSE:WMT) was among the largest gainers in the Dow, up 1 percent.

Shares of Boeing Co. (NYSE:BA) jumped more than 2 percent in morning trading after the aerospace company turned in earnings that topped analysts’ forecasts. However, the company was hurt by a $536 million after-tax charge in the second-quarter related to its KC-46A aerial refueling tanker program for the U.S. Air Force.

Shares of Boeing have gained nearly 12 percent in the last year.

U.S. home resales rose leaped to an eight-year high in June as existing home sales last month increased 3.2 percent to annual rate of 5.49 million units, the highest level since February 2007, the National Association of Realtors said Wednesday. That’s up from May, which was revised slightly lower to 5.32 million homes added in the previous month from the previously reported 5.35 million units.

The rise in existing home sales to their highest level since before the financial crisis provides further evidence that the housing recovery has shifted into a higher gear, says Andrew Hunter, assistant economist at Capital Economics.

“The resilience of the wider economy and high levels of consumer confidence should ensure that this strength continues in the months ahead,” Hunter said in a research note Wednesday.

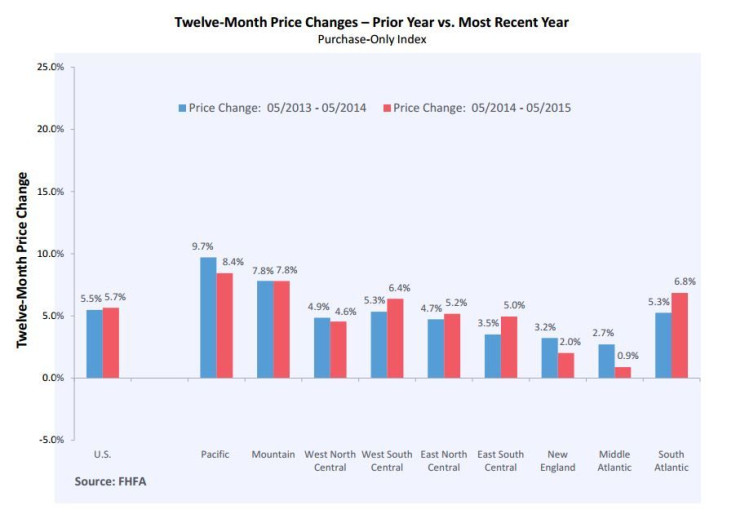

Separately, U.S. home prices rose in May as supply fell short of demand. The home price index climbed 0.4 percent on a seasonally adjusted basis from April, the Federal Housing Finance Agency said Wednesday.

© Copyright IBTimes 2024. All rights reserved.