Duke Energy's $4.9 Billion Bid For Piedmont Natural Gas Shows Waning Demand For US Electricity

Duke Energy Corp.’s $4.9 billion bid to acquire a natural gas distributor reflects the rising pressure on utilities from softening U.S. electricity demand. Energy-saving tools and programs are driving down the use of megawatts in homes and offices, prompting power producers to turn to natural gas infrastructure and other investments to boost their businesses.

“As you see flattening demand across the country, utilities are going to be making a whole series of different choices, in terms of their fuel mix and infrastructure, so they can continue to earn money,” said Jim Kapsis, vice president of global policy and regulatory affairs at Opower, which provides cloud-based software to utilities.

Duke Energy, the largest U.S. power company, said Monday it would acquire Piedmont Natural Gas Co. for $4.9 billion. The deal would give Duke Energy an additional 1 million customers in North Carolina, South Carolina and Tennessee, expanding the utility’s total customer base to nearly 9 million energy users in the Eastern U.S.

In August, electricity giant Southern Co. said it agreed to buy natural gas utility AGL Resources Inc. for about $8 billion. The move is expected to give Southern Co. a large share of the fast-growing gas market from New Jersey to Florida.

Demand for natural gas is rising amid historically low prices for the fuel. The recent boom in hydraulic fracturing, or fracking, boosted natural gas production by 35 percent from 2005 to 2013, according to the latest federal energy data. The surge in production is raising the need for pipelines and other gas infrastructure. Since utilities make their money by earning returns on capital investments, the natural gas building boom is an attractive arena.

Power companies also are under increasing pressure from U.S. regulators and environmentally focused investors to ditch high-carbon coal and oil and instead increase supplies of lower-carbon natural gas and renewable energy sources, such as wind and solar power. At the same time, household and commercial customers are steadily lowering their energy payments by installing energy-efficient windows, appliances and thermostats or putting solar panels on their rooftops.

“Utilities are going to have to adapt their biz models to adjust to those new realities,” Kapsis said.

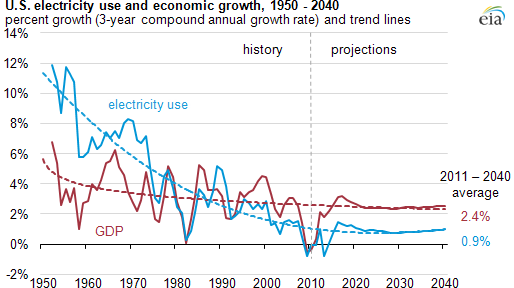

In the U.S., the average annual growth in electricity has slowed to around 0.5 percent per year in the last decade, down from heights of 9.8 percent average annual growth in the 1950s, the U.S. Energy Information Administration estimated. Population growth and economic expansion could accelerate growth slightly to 0.8 percent per year on average through 2040, although electricity demand won’t likely return to 20th-century levels, the federal statistics agency forecast.

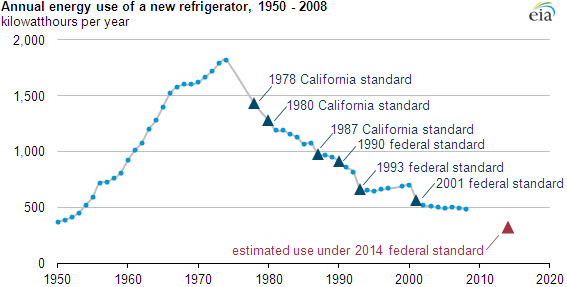

Falling electricity demand is due to a handful of factors, including the loss of energy-intensive manufacturing in the U.S. and the recent economic recession. But a leading driver of declining energy use is the widespread adoption of energy-saving appliances, smarter building control systems and other efficiency upgrades, according to an analysis by the American Council for an Energy-Efficient Economy (ACEEE), a nonprofit industry group.

Utilities themselves spent around $7.3 billion in 2014 on efficiency programs for electricity and natural gas, ACEEE estimated in an October report. Nationwide, states saved around 25.7 million megawatt-hours in energy savings last year, equal to saving about 0.7 percent of total U.S. retail electricity sales, the organization found.

The push for energy efficiency will likely soar in coming decades under the Obama administration’s Clean Power Plan, which was published in the Federal Register last week. Under the rule, states are required to reduce carbon emissions from power plants by 32 percent below 2005 levels within the next 15 years. The U.S. Environmental Protection Agency estimates that energy-efficiency programs could spur a 7 percent reduction in electricity demand over the same time frame.

“This year marks a tipping point for energy efficiency,” Steve Nadel, executive director of ACEEE, said in a statement last week. His organization recently published its annual State Energy Efficiency Scorecard, which found that 20 states improved their efficiency rankings compared with the 2014 scorecard.

“State policies are increasingly encouraging utilities to invest in cost-effective efficiency, prompting them to adopt new business models that align their interests with those of customers and policymakers,” Nadel said.

© Copyright IBTimes 2024. All rights reserved.