Election 2016 Donald Trump Tax Plan: Cuts Across The Board Proposed As Billionaire Gets More Serious

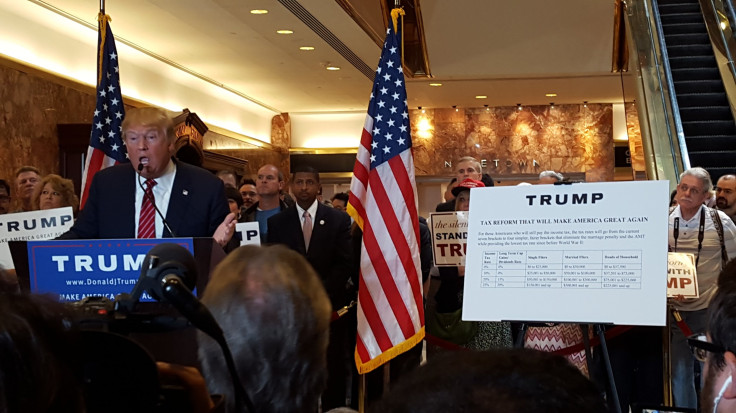

With glistening golden marble as a backdrop in a building that in many ways defines opulence, Republican front-runner Donald Trump, flanked by a pair of American flags, offered up his tax plan Monday at Trump Tower, proposing to cut all individual American tax brackets, impose a discounted tax on money held offshore by U.S. companies and cut capital gains.

“In other words, it’s going to cost me a fortune," he said Monday after promising he plans on closing loopholes for special interests and the rich. His speech was notably void of attacks on other candidates. “This is actually a tax reduction, including for the very wealthy.”

The current tax system tops out taxes for the wealthiest Americans at 39.6 percent. Trump's plan would impose the highest tax rate on married couples who make more than $300,000 a year, 25 percent. The top capital gains tax rate also would be reduced, the Wall Street Journal said, dropping to 20 percent from 23.8 percent. Capital gains are profits gained from selling off property or investments, and generally are taxed at a lower rate than regular income to encourage investment in higher-risk ventures like small businesses or property purchases. The alternative minimum tax also would be eliminated.

To pay for the tax cuts, Trump proposed an incentive that could bring back as much as $2.1 trillion currently sitting offshore. The plan would impose a 10 percent flat tax on all of that money, even if it stays overseas. The idea behind this portion of the plan is that it would increase the amount of money in the U.S. and encourage investment and job growth stateside.

The plan also would limit the amount of personal deductions allowed, a proposal that would affect the nation's wealthiest individuals the most.

I know you will enjoy reading my tax plan- http://t.co/FxtUQNXEFH #MakeAmericaGreatAgain

— Donald J. Trump (@realDonaldTrump) September 28, 2015

Trump has been looking to bolster his campaign and show his candidacy is about more than just his ability to hold a room and be a popular celebrity. His lack of policy papers became particularly noticeable during the second Republican debate, during which former Hewlett-Packard CEO Carly Fiorina put up a disciplined and policy-strong front. She and retired neurosurgeon Dr. Ben Carson have been surging in polls.

“I think he’s been tried in a lot of ways,” said Kathy Johnson, 65, a Florida resident who attended the press conference Monday. Johnson was wearing a red Trump campaign hat and said while the billionaire was her first choice, she needed to see how his policy proposals would impact her and her law firm. “I need to hear more of what he has to say.”

That recent surge, and the potential weakness it uncovered, was apparent Monday before the press conference. Just 25 days earlier, the same venue was packed for hours with reporters and supporters ahead of a Trump press conference to announce he had agreed to sign a pledge to support whoever the eventual Republican nominee would be. People came early to make sure they could get a seat.

That urgency wasn’t there Monday. Reporters filed in slowly, missing the 8:30 a.m. check-in time by up to two hours, and crowd of supporters finally lined up behind the podium at 10:45 a.m., about 15 minutes before he was scheduled to speak.

His strategy of simple popular appeal seemed to be waning.

“The idea of stalling out the field is not going to work. It’s worked well for him thus far, but eventually we’re going to move from the personality phase to the substance phase and basically Trump’s going to have to be aware of that,” said Ford O’Connell, a Republican strategist who is unaffiliated with a 2016 campaign. “He’s looking for that second act. He had the first one: ‘I’m Trump and everyone else is a Bozo,’ and now it’s like, ‘Hold on. I’m going to need a little bit more meat behind this,’ ” added O’Connell, who worked on John McCain's presidential campaign in 2008.

Up until recently, Trump’s campaign website was limited in terms of policy positions with just a section designated for immigration reform. Recently a position on 2nd Amendment rights was added, and now he is hitting taxes.

The real estate mogul first previewed the tax plan Sunday night on CBS's "60 Minutes," noting it would eliminate income tax for individuals making $25,000 or less, or for married couples making $50,000 or less. There would be tax cuts up and down the income spectrum with his plan, and the bracket system would be simplified from seven different levels to just four. Those four brackets would be taxed at 0 percent, 10 percent, 20 percent and 25 percent.

"I will say this, there will be a large segment of our country that will have a zero rate, a zero rate," Trump declared Sunday. "Some very wealthy are going to be raised. Some people that are getting unfair deductions are going to be raised."

His corporate tax rate is one of the lowest in the GOP field. His proposed 15 percent is just higher than that of Kentucky Sen. Rand Paul’s, who has proposed a flat-tax rate of 14.5 percent on all kinds of income. Florida Sen. Marco Rubio would cap business income taxes at 25 percent and former Florida Gov. Jeb Bush proposed a 20 percent corporate tax rate.

Trump continues to front the GOP field. He’s first in nationwide polls, according to an average of polls compiled by Real Clear Politics, by 6.4 percent with 23.4 percent of the vote. He also leads in early nominating states Iowa, up 6 points at 27.3 percent, and New Hampshire, where he's up 11 points at 25.3 percent.

© Copyright IBTimes 2024. All rights reserved.