Fatca Tax Evasion Crackdown: DeVere CEO Backs Repeal (Q&A)

This story was updated at 3:24pm on January 30, 2014, with a comment from the U.S. Treasury and information from Deutsche Bank's website.

As U.S. regulators stepped up a crackdown on global tax evasion, some finance executives and politicians warned of harmful unintended impacts.

The U.S. Foreign Account Tax Compliance Act (FATCA) requires non-U.S. financial institutions to share information on their U.S. customers with governments, or face steep tax penalties.

Advocates have said it reveals sheltered offshore accounts and could claw back $100 billion in tax revenue. Critics have said the U.S. law violates the sovereignty of foreign countries, raises privacy concerns, and costs banks millions in compliance costs. Some U.S. citizens have also had problems banking overseas.

Nigel Green, CEO of the major financial advisor deVere Group, spoke to IBTimes about the regulatory scheme, which will be implemented later this year.

Green has been an outspoken opponent of the tax-reporting regime, echoing remarks from Sen. Rand Paul (R-Ky.) and the Republican National Committee (RNC).

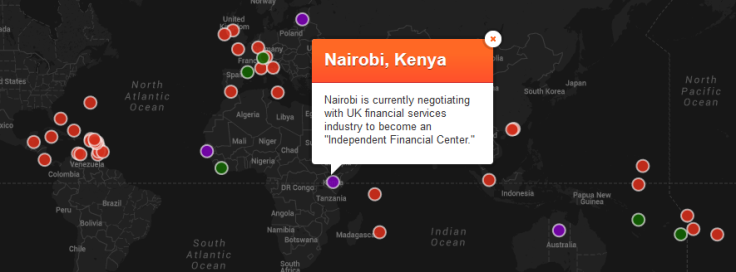

DeVere has more than 70,000 clients globally and $9 billion under management, with a presence in more than 100 countries. It calls itself one of the world’s largest independent financial advisors and caters to wealthy clients, often millionaires.

DeVere has also developed “specialized products for US clients,” offering Americans “alternative ways to invest their money that could potentially give them attractive tax advantages, whilst remaining in-line with US laws and regulations.” The company didn’t elaborate on those specialized products.

Edited Q&A excerpts follow.

Q: Are wealthy Americans disproportionately affected by FATCA? Why should ordinary Americans care about the law?

A: Fatca relies on a ‘dragnet approach,’ requiring the private financial information of millions of ordinary Americans, of whom the vast majority are not suspected of wrongdoing. Most don’t owe any tax, but information must be reported on the off chance some hidden offshore assets are found along the way. It’s a highly ineffective and extremely costly approach. (The IRS has said, however, that U.S. taxpayers with less than $50,000 in assets may be exempt from Fatca.)

Q: What's wrong with the intergovernmental agreements (IGAs) now being negotiated, if anything? (Regulators negotiated treaties to avoid information being passed on directly to the U.S. Internal Revenue Service.)

A: The IGAs [agreements] are not authorised or even mentioned in FATCA and they haven’t been presented to the Senate for counsel and consent.

The Treasury Department is at pains to stress that more and more countries are ‘partnering up’. But many experts – even some who back FATCA – struggle to see how IGAs will be able to force FATCA upon hundreds of thousands of financial firms worldwide.

The IGAs are the contracts imposing a form of U.S. global fiscal imperialism, taking away other countries’ privacy protections and other local laws. It is a violation of sovereignty.

The IGAs could also potentially damage important international trade relations with other countries because they are discriminatory by their very nature. Fatca only applies to non-U.S. financial institutions. It is a violation of international norms.

Former U.S. diplomat Jim Jatras says FATCA is deeply resented in Canada, the U.S.’s biggest trading partner and foreign energy source.

The tragic irony is that if foreign governments didn’t knuckle under by signing IGAs, FATCA would collapse.

Q: FATCA has already passed as legislation, and it seems fairly unrealistic that it'd be repealed at this point. Given that, what can banks (and foreign financial institutions), citizens, or regulators do to blunt FATCA's impact, aside from advocating for repeal?

A: As a piece of legislation FATCA is fundamentally flawed, because it does not actively tackle tax evasion. Its far-reaching and misguided impact cannot be realistically “blunted”.

The prospect of FATCA's repeal is quite realistic. If institutions help educate and inform the American public and Congress, there’s a good chance Fatca can be delayed and perhaps – I hope – eventually repealed.

Q: What non-anecdotal evidence do you have that banking problems for U.S. citizens – reportedly caused by FATCA – are widespread? Can you name some banks that are denying services or closing accounts?

A: An increasing number of our U.S. expatriate clients are telling us that the potential onset of FATCA is making their lives difficult.

Why? It’s expensive and highly complex for foreign financial institutions, such as non-U.S. banks, to become FATCA-compliant. As a result, many are simply rejecting business from American expats and firms operating globally – even if they have been clients for many years.

Major wealth management firms including HSBC Holdings Plc, Deutsche Bank AG, Bank of Singapore Ltd. and DBS Group Holdings Ltd. have all rejected business from U.S. citizens ahead of the implementation of FATCA.

(Most of these banks didn’t immediately respond to requests for comment. HSBC told IBTimes: “HSBC is committed to full compliance with FATCA regulations. We do not comment on individual customer matters.” Some banks, however, including HSBC and the Netherlands’ ING Group Bank, have merely said they’ll require extra paperwork from U.S. citizens. On its website, Deutsche Bank says: "Deutsche Bank is proactively implementing changes to its current business practices in order to comply with FATCA while best serving its clients and counterparties." Many global banks are expected to comply with FATCA to avoid IRS penalties and lost access to U.S. capital markets. U.S. citizens who don’t provide extra paperwork as required by FATCA, however, may face problems.)

U.S. citizens who live outside America need foreign bank accounts…U.S. expats are becoming financial pariahs as a direct result of Fatca.

Q: Is higher renunciation of U.S. citizenship is directly linked to FATCA? Have no other factors played into it?

A: In a global poll last November, deVere Group asked more than 400 of its American expatriate clients: "Would you consider voluntarily relinquishing your U.S. citizenship due to the impact of FATCA?"

68 per cent answered that they had ‘actively considered it’, ‘are thinking about it,’ or ‘have explored the options of it.’

This is a staggeringly high figure if you think about it. It is our experience that Americans – at home and abroad – are becoming increasingly aware of the serious unintended adverse effects of FATCA.

I believe interest in this strategy likely soared since it was revealed that Facebook, Inc. (NASDAQ:FB) co-founder Eduardo Saverin renounced his U.S. citizenship to become a resident of tax-efficient Singapore, and that American icon Tina Turner became a Swiss citizen.

Our findings and observations are supported by official statistics. The number of American expatriates relinquishing their U.S. citizenship surged in the second quarter of 2013, to 1,131 cases, compared with just 189 in the same period in 2012.

What advice would you give someone thinking of renouncing U.S. citizenship for FATCA reasons?

A: In our experience, most Americans find the prospect of giving up their U.S. citizenship an emotional one. It is considered by the vast majority as a last resort.

I’d urge those in this situation to consult a cross-border financial specialist. Professional advice is important for many reasons: you might be subject to gift or exit taxes designed to deter U.S. citizens from giving up citizenship.

--

See the U.S. Treasury Department’s September 2013 statement on Fatca, entitled "Myth vs. FATCA."

A Treasury spokesperson added in an email to IBTimes: "FATCA has been widely recognized as a global model for combating offshore tax evasion and promoting transparency, as evidenced by the G20 and OECD’s work on developing the common reporting standard, which draws extensively on our intergovernmental approach. We are proud of the significant progress made with FATCA and the growing international support for its implementation."

© Copyright IBTimes 2024. All rights reserved.