For The First Time Walmart Annual Report Cites Changes To Food Stamps ‘And Other Public Assistance Plans’ As A Risk Factor

Nestled in the latest annual report from Wal-Mart Stores Inc. (NYSE:WMT) is a line that underscores just how much the world’s largest general merchandise retailer and its shareholders have depended on public assistance programs in recent years.

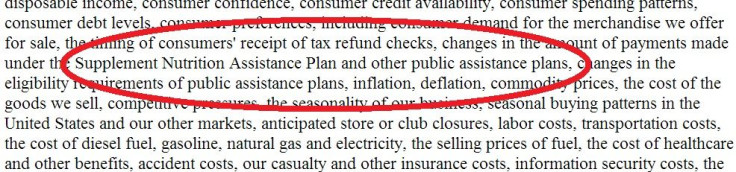

The Bentonville, Ark., company’s report for its fiscal year ended Jan. 31 includes the cautionary statement that’s required under securities regulations from all publicly listed companies. The purpose is to inform the public of factors that could harm future profitability. Such statements are routine and tend to list just about any potential risk factor. In Walmart’s case, the sentence disclosing risk factors is a staggering 668-words long and includes dozens of risks, including natural disaster, civil unrest, changes to income and corporate tax rates and ongoing investigations against the company.

A couple of items stand as newcomers to Walmart’s menu of risks. Here’s what the annual report released on Friday says:

“Our business operations are subject to numerous risks, factors and uncertainties, domestically and internationally, which are outside our control ... These factors include ... changes in the amount of payments made under the Supplement[al] Nutrition Assistance Plan and other public assistance plans, changes in the eligibility requirements of public assistance plans, ...”

In other words, Walmart for the first time in its annual reports acknowledges that taxpayer-funded social assistance programs are a significant factor in its revenue and profits. This makes sense, considering that Walmart caters to low-income consumers. But what’s news here is that the company now considers the level of social entitlements given to low-income working and unemployed Americans important enough to underscore it in its cautionary statement.

For the fourth quarter ended Jan. 31, Walmart said it earned $4.43 billion, a drop of 21 percent from a year earlier. The company cited the unusually harsh winter that struck many parts of the U.S. as a primary factor.

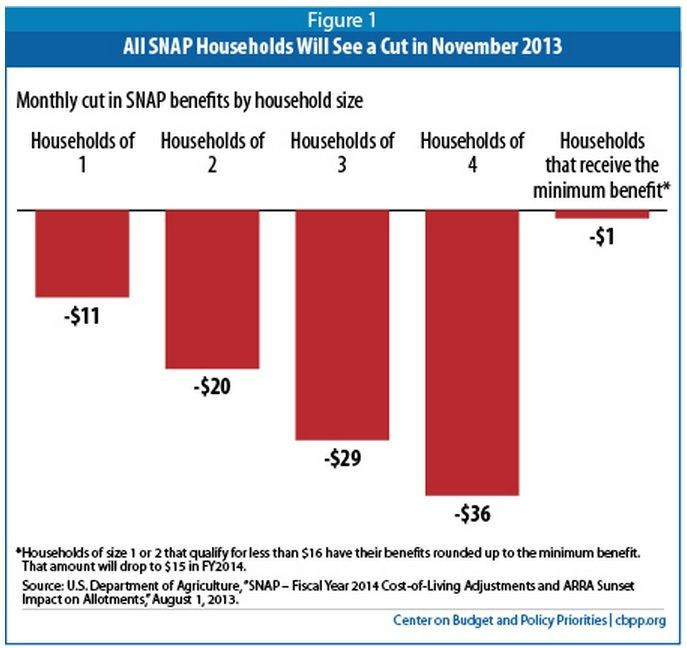

Prior to the earnings report, Walmart Chief Financial Officer Charles Holley said the company didn't anticipate how much the end to such programs as the unemployment benefits extension would affect it. Specifically, reductions to the Supplemental Nutrition Assistance Program that went into effect on Nov. 1, the first day of the company’s fourth quarter, pose a potential concern. The cuts led to a between $1 and $36 reduction in SNAP benefits per household, or up to $460 a year. Congress is debating reinstating the extension to the program and making the benefits retroactive to Nov. 1, something Walmart would clearly consider beneficial to its growth.

Enrollment in SNAP benefits increased by 70 percent between 2007, a year prior to the subprime lending crisis that sent the U.S. into its longest recessionary period since the Great Depression, and 2011, when enrollments began to level off.

Walmart has paid $7.23 per share in dividends over the past five years, according to Thomson Reuters. It’s expected to pay out $1.98 to shareholders this year and $2.19 in fiscal 2015, according to analysts’ estimates.

© Copyright IBTimes 2024. All rights reserved.