Is Inflation Going Up? New York Fed Expects Price Growth To Flatten

Consumers’ expectations for the inflation rate, often a self-fulfilling prophecy, has leveled off at just below 3 percent, according to monthly survey data released by the Federal Reserve Bank of New York Monday. The announcement followed a significant uptick between November and January.

Projections for the rate of price growth over the next three years rose to 2.98 percent from 2.9 percent in January, while expectations for inflation over the next year barely budged to 2.96 percent from 2.98 percent over the same period. In November, both rate projections rose from a long-term range of between 2.4 and 2.8 percent, where they’d lingered since the fall of 2015. The last time either had reached 3 percent was June of that year. The actual inflation rate has consistently stood at 1 to 1.5 percentage points below the expected level, but tends to follow its dips and increases, and has remained relatively low over the past couple of years, most economists agree, as a result of a sharp decline in oil prices over the same period.

Read: Is Trump Good For The Economy? Consumer Confidence Hits Highest Level Since July 2001

Inflation plays a major role in the Fed’s decision to raise its federal funds rate—a bank-to-bank lending rate that influences mortgage, credit card debt and other loan interest rates. As part of its dual mandate to keep inflation stable and economic growth steady, the central bank tends to raise the rate, reeling in economic growth, when inflation rises at or over 2 percent. If inflation drops too low, a phenomenon known as disinflation, the Fed will seek to stimulate economic activity, pushing inflation up, by lowering its interest rate. (Contrary to popular belief, the Fed does not print loads of dollars to boost inflation.)

On Wednesday, Fed Chairman Janet Yellen is widely expected to announce a hike in the rate to a range of 0.75 and 1 percent, a move that would both rein in inflation and give the central bank more room to act in the event of a sudden economic catastrophe. Such a decision would also mark the third time the Fed has done so since the financial crisis of 2008, after which the rate was drawn down to approximately zero.

Along with inflation expectations, the New York Fed’s survey questioned respondents on their predictions for other major economic indicators.

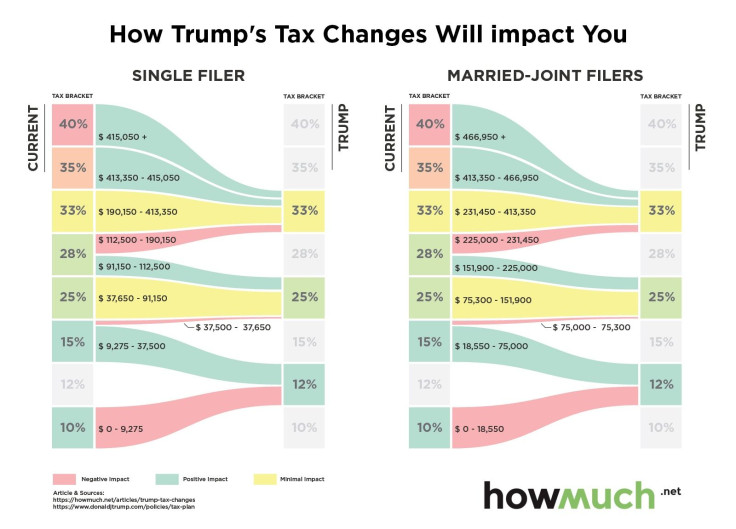

Consumers’ projections for the change in the amount they’d have to pay in taxes a year ahead dropped to its lowest level since the New York branch of the central bank began collecting the monthly data in June 2013, to 2.11 percent from 2.49 percent in January. Those views may reflect the proposals of President Donald Trump, who has pledged to narrow the income tax code to three brackets from seven. The cost information site HowMuch created an infographic showing the impact on earners in different salary ranges.

Read: Is The US In A Bubble? Warren Buffett Expects American Economy To Keep Growing

People also, however, expected their wage growth to drop, according to the survey, to just 2 percent from 2.42 percent in January. Consumers’ average expectations of losing their jobs dropped to 14.97 percent from 15.34 percent, while average expectations of finding a new job fell to 55.98 percent from 56.39 percent.

© Copyright IBTimes 2024. All rights reserved.