Oil Price Decline Prompts S&P To Downgrade Eight US Oil And Gas Companies

The steep drop in oil prices is battering the credit ratings of U.S. oil and gas companies. Standard & Poor’s this week downgraded eight exploration and production firms after reviewing the energy sector in light of cheapening crude, Reuters reported.

The oil and gas companies downgraded were WPX Energy, Energy XXI, Warren Resources, Swift Energy, Midstates Petroleum, Magnum Hunter Resources, Black Elk Energy Offshore Operations and Rooster Energy. The ratings agency also lowered the outlook of a dozen additional companies. Two more firms, Apache Corporation and BreitBurn Energy Partners, were placed on “negative watch,” which means the companies have a 50 percent chance of their ratings being lowered in the next three months.

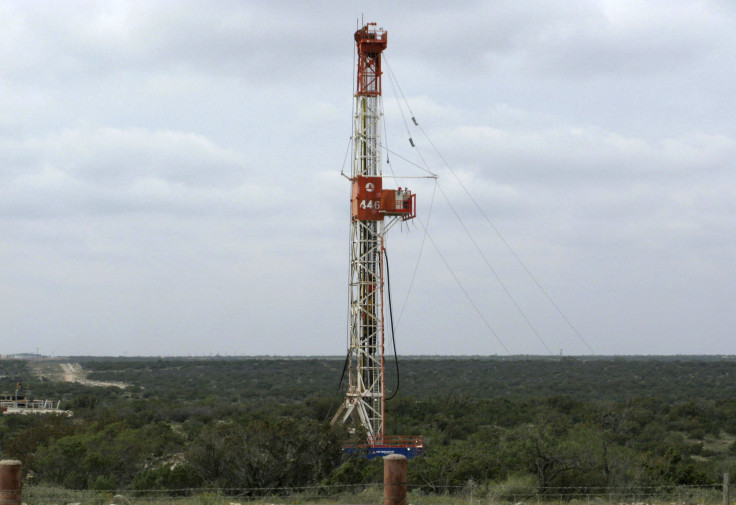

Falling oil prices have put tremendous pressure on capital-intensive U.S. oil and gas projects such as offshore drilling and shale exploration. Brent crude, the global benchmark, was trading below $49 a barrel Tuesday, down more than 30 percent from late November. West Texas Intermediate crude, the U.S. benchmark, traded around $47 a barrel, about 40 percent less than its price two months ago.

Houston-based Apache, one of the nation’s largest independent firms, says it will slash its North American budget by 26 percent this year and lay off several hundred employees in response to cheaper crude oil. Baker Hughes and Schlumberger, two other major industry firms, say they are letting go of thousands of workers in Texas and Oklahoma, the Associated Press recently reported. ConocoPhillips and Rosetta Resources each say they’ll trim 2015 budgets by 20 percent, while Linn Energy has halved this year’s budget. Chevron Corporation has delayed announcing its plans for 2015.

The S&P report said analysts found most energy companies have adequate liquidity for the next 12 months. But the agency warned that some of the firms could face “material liquidity pressure” if oil prices don’t recover in 2016, Reuters reported.

© Copyright IBTimes 2024. All rights reserved.