Perils Of Microfinance: Why The Miracle Economic Strategy, Winner Of A Nobel Prize, Failed To Turn The Poor Into Entrepreneurs

LABOR COLONY, India -- For Zareen, a 47-year-old housewife from this slum about 50 miles northwest of Bangalore in southern India, the word “microfinance” invokes terrible memories of the time when she had to sell her blood and everything she had to repay loans she took from a local microlending company.

“I went to the local clinic and sold my blood. I had no other option as the lenders’ agents said they would not leave my house if I did not repay them right away. I had sold every other valuable in my house, including utensils and dresses," Zareen told International Business Times.

Another woman from the same neighborhood, Dilshad, had a similar experience and sold her blood for 1,000 rupees ($16.03).

“They (microlenders) have trapped us,” said Varalakshmi, a Labor Colony housewife. “Several people committed suicide by hanging themselves, while many others ended their lives on railway tracks.”

The most traumatic episodes occurred in 2010, at the height of the Indian microfinancing (MFI) crisis, when as many as 70 people in Andhra Pradesh, India’s fifth-most populous state, committed suicide to escape payments between Mar. 1 and Nov. 19. Microlending was also blamed for riots, breaking up communities through its so-called group borrowing model, and increasing – rather than alleviating -- the financial burden of the poor.

The crisis came only a few years after the concept – which essentially involves giving a poor person (nearly always a female) a small loan so that she could start a business and climb out of poverty – was being celebrated internationally as a powerful solution to an intractable problem. The United Nations Economic and Social Council proclaimed the year 2005 as the International Year of Microcredit. The following year, Muhammad Yunus and the Grameen Bank he founded in Bangladesh were awarded the Nobel Peace Prize for their pioneering work to provide small loans to the poor. Dozens of academic studies seemed to back up the value of this Third-World strategy: A premier analysis funded by the World Bank claimed that microcredit had reduced poverty in Bangladesh, and one of the researchers later estimated that 5 percent of Grameen Bank borrowers escaped poverty each year.

Since then, however, some harsh realities about microlending have come to light. Much of the research purporting to show a correlation between higher earning and higher borrowing has been widely discredited. Moreover, in-depth controlled studies depict communities that remain largely unchanged by this approach. In 2005 the nonprofit National Bureau of Economic Research began to examine quality-of-life indicators for 52 randomly selected poor neighborhoods in India in which a new microlending agency had set up shop and 52 similarly chosen indigent neighborhoods where microlending was not available. After three years, the availability of MFI did not affect bottom-line poverty data such as household spending, nor did it have any effect on developmental improvements often attributed to microfinance, such as health, education or women’s empowerment.

“There has been enough time and evidence now to explore the full impact of microcredit in depth, and, set against its vaunted reputation, my verdict is dour,” wrote David Roodman, a leading expert on microfinance, in the Washington Post. Though it has devastated individuals and families, Roodman wrote that in financial-improvement terms, “Microcredit rarely transforms lives.”

In the wake of the microlending crisis, and in part as a result of the resulting studies, new approaches to financial improvement for the poor are being explored. Some contain aspects of microlending but focus much more on financial inclusion, the current buzzword. This includes savings accounts and insurance policies – health and disaster – targeted at the very lowest economic strata. And it encompasses greater educational efforts to teach the poor how to manage finances – micro or otherwise – and to avoid the come-ons from malicious microlenders as well as customizing loans to an individual's business or personal needs.

Among the microlending ideas that have lost credibility is the group model, which provides a lump sum for a cluster of people, usually a neighborhood, leaving it to the borrowers to decide how the loan will be distributed among the members. While the model avoids some moral hazards of the industry, its reliance on group pressure can be damaging for tight-knit communities like Labor Colony.

“It ruined our relations, as other group members who are also neighbors will come and sit at our home until we pay,” Zareen told IBTimes as she sat in her hut, which, despite its bright blue walls, is in dire need of repair, and slum children without shoes, or sometimes, pants, crowded in the tiny quarters to watch. “They used to scold and shout at us for not paying,” she recalled.

“Dealing with private moneylenders is better for us,” Zareen added. “If we don’t have money, we can escape these lenders by locking our door and sitting in a neighbor’s home, but with the group model that strategy won’t work.”

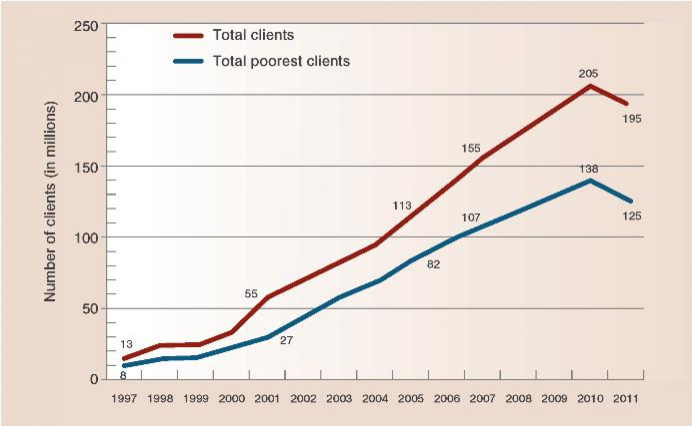

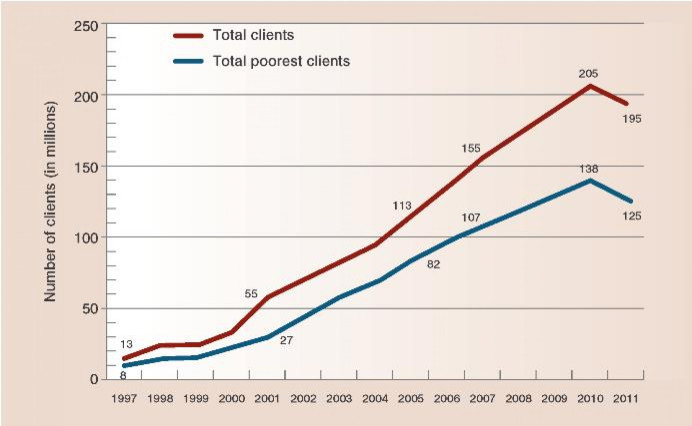

As the horror stories about microlending spread, activity in the sector slipped markedly. In 2011, the last year for which data is available, the total number of clients with outstanding loans fell for the first time from 205 million to 195 million, according to the Microcredit Summit Campaign, which tallies microloans worldwide. A large part of the decline can be attributed to strict regulations in Andhra Pradesh that took effect after the slew of suicides. These new rules limit the circumstances under which microlenders can sign up clients as well as their collection activities and have all but shut down microcredits in the state.

Too Much Credit

While India’s microlending crisis has received the most media attention, Bosnia, Morocco, Bolivia and Pakistan also experienced MFI bubbles that led to social instability and subsequent reform. In Bosnia, outstanding microloans more than tripled to $1 billion in 2008 from $275 million in 2005, but slumped to $830 million in 2009 on defaults and write-offs. And in Bolivia, after a relatively profitable period in the late 1990s, poor fruit vendors, cobblers and farmers, armed with dynamite, took the superintendent of banks hostage in 2001, demanding forgiveness or reduction of the debt they incurred through microlenders and consumer lenders. Although the hostage situation was resolved through negotiations, few actual loan concessions were granted.

Speaking of microlending globally, Maclyn Clouse, a professor who teaches a microfinance class at the University of Denver’s Reiman School of Finance, said that the effectiveness of the initial loans, which were generally made to people who legitimately needed the money to startup or expand businesses, led to a more lenient atmosphere and questionable loans. “The issue began when microfinance became more successful and more well-known, and other financial institutions discovered that this may be a profitable institution,” said Clouse.

With an oversupply of credit as lenders rushed to fill a perceived demand gap, microfinance agencies became less selective about their borrowers, freely giving loans to people who used the money for unproductive purchases, such as TVs, or to repay a debt with another microlender. These loans were made at usurious interest rates, higher than traditional moneylenders in the region.

“I took out four loans,” said Asmita, a woman from Zareen’s village. “I had to marry off my daughter and repair my house, so I had to raise funds for that. When I could not pay the loans back, the lenders asked me to mortgage the house to raise money. They used to come and sit at my home asking for dues.”

Best Practices

Compared with India, which is still smarting from the 2010 incidents, South America, Indonesia and other more mature markets have set positive precedents for establishing functional microfinance industries. In particular, Peru is frequently cited for its successes in that arena. The principal regulator of microfinance in Peru, the Superintendencia de Banca, Seguros y AFP, has created a competitive marketplace which, due to the lack of an interest-rate cap and capital requirements fair competition is encouraged; in turn, borrowers benefit from lower interest rates. But this market-based system only works because regulators closely supervise the microlenders by requiring these companies to publicly post their interest rates and financial statements and by establishing procedures for borrower disputes. Peru also has a system for educating clients about their rights and about basic financial concepts.

“Peru is a best practice example in microfinancing, in terms of transparency and supportive regulations,” said Martin Holtmann, the head of Microfinance at the International Finance Corporation, a member of the World Bank Group. “As such, even though Peru allows multiple borrowing and has a fairly saturated market, its microfinancing market has not exhibited the overindebtedness other countries have seen.”

The World Bank is in the process of implementing a pilot project in Peru known as “factoring,” in which a manufacturing supplier that serves micro- and small-enterprises (MSE) can sell its creditworthy accounts receivables to a third party, the factor, at a discount and receive immediate cash. The suppliers can then use this money to provide additional credit to their MSE customers without negatively affecting working capital, while the participating MSEs receive more financing from suppliers and build their credit histories for the future.

Financial Inclusion

Whatever types of solutions are adopted for the problems brought on by microlending, most experts believe that they will have to embrace the basic concepts of financial inclusion. This approach calls for more borrower-centric lending strategies, which begins with first finding out specifically what an individuals financial needs are. Not everyone needs a business loan. Some customers need funding for one-time expenses such as weddings and funerals, and would best be served by a savings account or by pooling resources in a community to share these costs, as occurs in parts of Africa.

Savings accounts could be particularly beneficial for women in the Philippines who have difficulty putting money aside because of demands on their incomes from relatives, neighbors or husbands, according to a 2010 World Bank report. Currently, half of the world’s adult population -- more than 2.5 billion people -- do not have a savings account at a formal financial institution, the Bank said.

Another example of financial inclusion is microinsurance that protects the poor – few of them have access to formal insurance – against risks such as serious illnesses or crop failure that could decimate their already unstable and vulnerable livelihoods. A new survey from the United Nations found that 78 percent of Cambodians would be willing to pay for insurance to transfer their financial risks, and typical coverage ranges from $2 to $6 per year in Cambodia.

Sometimes, simply being flexible to clients’ unique needs can make a difference. For example, if a client is a farmer, then it could make sense for the first payment to be due after the harvest, when the borrower has money to repay the loan. “The trend of the industry is to develop an array of products and services that can meet the needs of the native client,” said Neal Estey, associate director for the Center for Finance at Boston University. “Microcredit, insurance products, savings products, and remittances. No single product or service will be appropriate for everybody.”

Here, too, more mature markets provide useful precedents. Savings deposits in microfinance institutions in Indonesia, Bangladesh and Bolivia are now higher than loan balances, and in Mexico, the Compartamos Banco offers life insurance along with its loans.

Meanwhile, the MFI industry is considering new approaches to make the sector less risky. One idea is to create credit bureaus that could alert MFIs about a potential borrower’s existing financial obligations. The information maintained in credit files can be based on word of mouth in a community if real data is not available.

And governments are also trying to create better-regulated microfinance environments. For example, India is addressing customer abuses by mandating that loan collectors be accompanied by state officials. One of the downsides is that regulations that protect customers also make it difficult for MFI agencies to collect loans and have driven up default rates.

Not surprisingly, given the dismal track record of microlending to date, microlenders and policymakers are skeptical about this strategy for alleviating poverty. The excitement that once pervaded discussions about microlending has been replaced by cynicism. Yet the underlying problems that led to the need for microlending remain and countries with large impoverished populations have a vested interest in at least testing the effectiveness of new microlending proposals.

“Perhaps the new models still won’t reach the bottom of the pyramid,” Estey said. “But if you’re helping someone who’s living on $4 a day, not $2, then that’s still a worthy cause.”

© Copyright IBTimes 2024. All rights reserved.