Peru’s Mining Sector: A Bright Spot Amid Emerging Market Turmoil?

Peruvian officials and business executives touted the country’s fast growing mining sector to New York investors in a tour soliciting foreign investment, saying the sector has proved a bright spot despite regional turmoil.

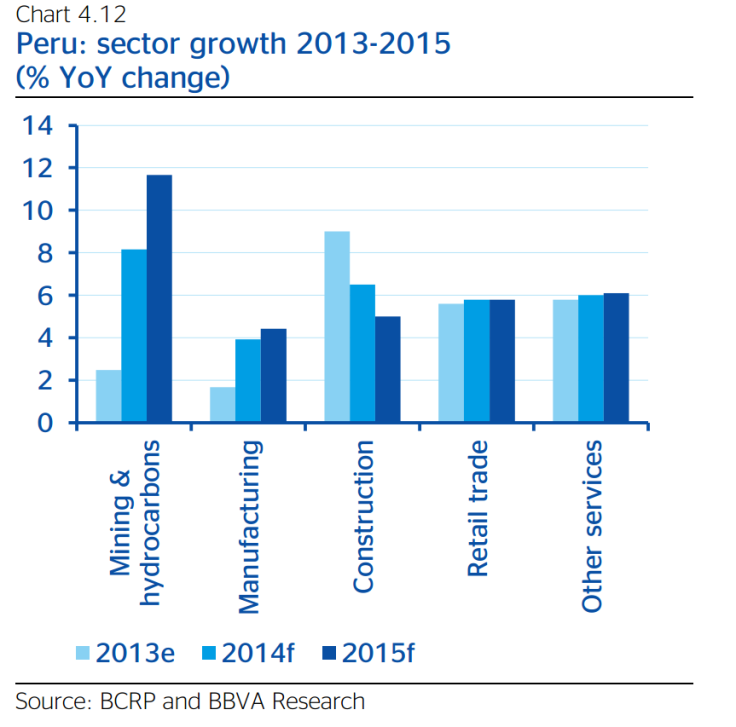

Copper production in Peru, the world’s third-largest producer of the red metal, could double by 2015 to almost 2,000 metric tons, Peru central bank governor Julio Velarde in a Thursday presentation outlining the Peruvian economy.

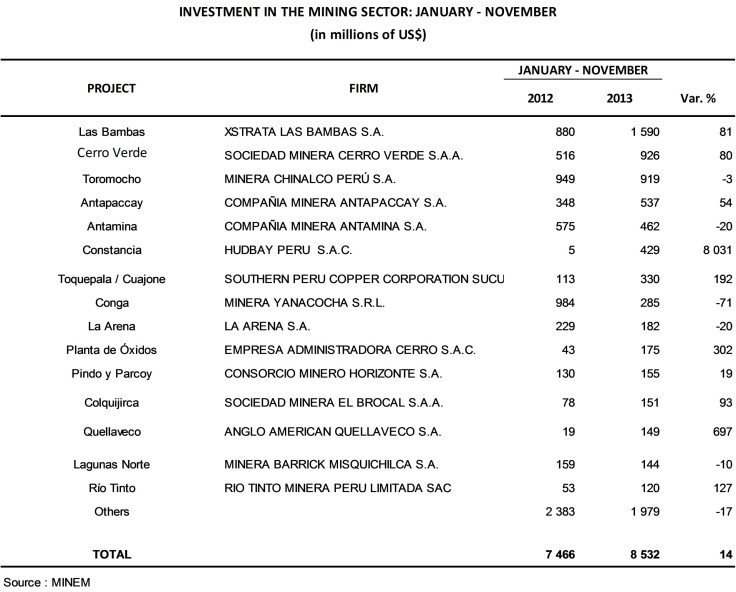

Major multinational miners like Rio Tinto PLC (LON:RIO) and Anglo American PLC (LON:AAL) are players in Peru, alongside national giants like Buenaventura SAA (NYSE:BVN), which mines both copper and gold. Mining investment in Peru could reach a record $14 billion in 2014, Peruvian President Ollanta Humala said in late December.

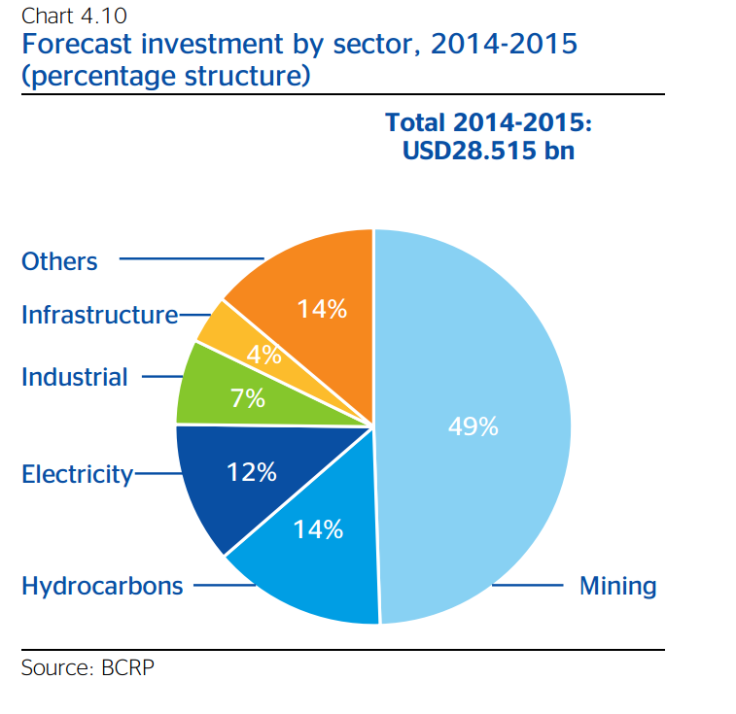

Mining exports are expected to boom in the export-led economy, as several mining projects near completion in the next two years, according to research from international bank Banco Bilbao Vizcaya Argentaria SA (BBVA) (NYSE:BBVA). The mining sector could consume half of all investments in Peru over the next two years.

Optimism about Peru’s mining sector comes despite increasing Chinese ownership of projects and a vast informal gold mining sector, which dumps toxic mercury into the environment and speeds deforestation.

Officials and executives visiting New York failed to mention the $3 billion illegal gold mining industry, described by some as more profitable than local drug trafficking, but acknowledged that a swath of Peru’s economy remains informal.

Participants at the inPeru investment forum estimated that almost two-thirds of the national economy is “informal." That refers broadly to business conducted in cash, where people lack bank accounts and don’t pay taxes.

A $90 billion infrastructure gap and deficient education and healthcare remain key national challenges, added Citigroup Peru CEO Jose Antonio Blanco.

“The No. 1 challenge in Peru is poverty,” he added. “There are 7.5 million people in Peru who live in absolute poverty.”

Executives also dismissed challenges to Peruvian exports presented by a potential economic slowdown in China. Even though China consumes much of Peru’s mineral exports, less Chinese consumption wouldn’t hurt Peru materially, they said, partly because Peru has diversified destinations for its exports.

Public and private cooperation in mining may leave some activists and mining critics uncomfortable, however. Buenaventura Chairman Roque Benavides said he’d taken over a presentation on behalf of Peru’s economic vice minister at the world’s largest mining conference, the Prospectors and Developers Association's Toronto gathering earlier this week. Peru became the first country ever to sponsor the conference this year.

“The public and the private sector today in Peru have the same speech,” said Benavides, who added that he’d already toured major New York funds seeking investments for Buenaventura during his trip.

Buenaventura is one of Peru’s largest mining companies with 2013 revenues of $2.36 billion. It faced a 17-day strike at its Chipmo mine in October 2013. The company has also faced trenchant local opposition to its stalled Minas Conga project, where it partners with Newmont Mining Corp (NYSE:NEM).

Greater regional volatility, as in Venezuela and Argentina specifically, hasn’t impacted Peru materially, despite emerging market capital outflows, central bank chief Velardes told reporters at New York stock exchange on Thursday. Velardes said interest rates would likely remain steady and stable in 2014, and cited Peru’s strong economic growth over the past decade, which has averaged at 6 percent gross domestic product growth.

But there are only five Peruvian companies listed on the New York Stock Exchange, compared to 85 from Latin America, according to NYSE regional director for Latin America Alex Ibrahim. Budding international interest in Peruvian markets is hampered by an underdeveloped local equity market.

© Copyright IBTimes 2024. All rights reserved.