Wall Street 2016: Firms Managing Pension Money Spend Millions To Support Governors, Despite Pay-To-Play Rule

“If political contributions or improper payments to government officials play a role in the selection of investment professionals, the fairness of the process by which public contracts are awarded is undermined,” Ceresney told a gathering of current and former regulators in mid-October. “These practices, known as ‘pay-to-play,’ also distort the process by which professionals are selected and may result in pension funds receiving inferior services and paying higher fees, thereby harming retirees and the taxpaying residents of the states.”

Ceresney, who is head of the SEC’s division of enforcement, said his team is now working with other federal law enforcement agencies to do “all we can to shine light in this opaque area.” His warning spotlighted the fact that — six years after the SEC enacted its pay-to-play rule — financial executives have found ways around the strictures as they seek lucrative deals to manage portions of the nation’s $3 trillion public pension system.

A new International Business Times/MapLight review found that in the 2016 cycle, executives at firms managing state pension money have donated nearly $1.3 million to the Republican Governors Association, on top of the more than $6.8 million such firms gave to the RGA in 2013 and 2014. Those donors gave to the RGA while the group was helping the campaigns of governors with influence over state pension funds — funds that have invested with the donors' firms.

Democrats weren’t forgotten: the Democratic Governors Association received $151,000 from firms managing public pension money in states where the DGA was involved in gubernatorial races in the 2014 election cycle.

This IBT/MapLight report is the latest in a series looking at how anti-corruption rules are being systematically circumvented, ignored and unenforced. Many of those rules were established amid high-profile corruption scandals over the past decade. They were advertised as a way to reassure the public that state contracting decisions are influenced by merit, and not by political favoritism.

Much of the money flowing around the SEC’s rule has come from executives at hedge funds, private equity firms and others in the “alternative investment” industry. The flood of cash comes as state pension funds are facing intensifying pressure to sell off their alternative investment holdings because, critics argue, the returns do not justify their high fees. Decisions by gubernatorial appointees to resist such pressure can be the difference between alternative investment firms continuing to make millions off pension fees — or losing out on those profits.

‘It Is Not Possible For Us To Anticipate’

Of all the opportunities for government business, state pension funds offer some of the most lucrative. Many states have shifted growing portions of their pension assets into alternative investments in the past decade. The investments, which are often shrouded in secrecy, have been presented as necessary to diversify portfolios and boost returns. But while the investments have generated massive fees for the financial firms, many have delivered below-market returns.

Under the 2011 pay-to-play rule, firms whose executives donate to public officials that control pension funds are barred from earning fees off of those pension systems. The sanctions apply even if a management firm denies any intent to buy influence through campaign contributions. Pension overseers can hire and fire external financial managers at any time, and so the rule covers donations not only before a firm was hired but also as long as a pension management contract remains in force.

An SEC official told IBT/MapLight that while direct donations to public officials are covered by the pay-to-play restrictions, contributions to outside political groups “are independent expenditures that do not trigger” the rule.

Even as they put the rule in place, though, regulators suspected politicians and financial firms might look for routes around it.

“It is not possible for us to anticipate all of the ways advisers and government officials may structure pay-to-play arrangements to attempt to evade the prohibitions of our rule,” they wrote. Therefore, they said, “the rule includes a provision that makes it unlawful for an adviser or any of its covered associates to do anything indirectly which, if done directly, would result in a violation.”

For their part, the RGA and DGA both assert that they do not allow donors to earmark contributions for particular races, and that their organizations therefore cannot be used as an indirect conduit around the pay-to-play rule.

“The DGA does not accept contributions designated for particular candidates,” said DGA spokesman Jared Leopold. “This ensures that contributions to the DGA — such as these — comply with the SEC rule.” The RGA did not respond to IBT/MapLight questions, but spokesman Jon Thompson previously said the organization’s “anti-earmarking policy and other compliance policies ensure that candidates to whom the RGA contributes do not receive prohibited funds.”

Some financial firms say they send their donations to the organizations’ operating accounts or to separate funds that pay for conference activities and aren’t used for elections. A hacked email exchange between Democratic National Committee staffers, obtained by Wikileaks, suggests that some donors give the organization explicit “pay to play letters,” and says that “donations that come in from those donors, in any form, get put into the operating account.”

Those explanations do not satisfy ethics watchdog groups who say the spirit of the pay-to-play law is being violated.

“The intent of pay-to-play rules is to make sure that contractors don’t find ways to throw money at the feet of those responsible for issuing the contracts,” said Craig Holman, a governmental ethics lobbyist at Public Citizen. “It doesn’t matter where it goes — it should not go to any officeholder or candidate who’s running for a position responsible for issuing those contracts.”

‘We Do Not Know Nor Are We Aware Of The Facts’

In recent months, high fees and weak returns have prompted some major public pension funds to move to end their investments with external money managers. At the same time, IBT/MapLight’s review — which used Center for Responsive Politics data and focused on donors who gave more than $50,000 — found many instances of the RGA accepting funds from Wall Street pension managers, and spending big to help governors. Those governors in turn appoint pension overseers.

- In Missouri, for example, state records show hedge funds Elliott Management and AQR Capital manage more than $1 billion worth of state pension money, earning the two firms more than $11 million in fees last year.

Paul Singer, the founder of Elliott Management, has given $3.1 million to the RGA since 2013, including $500,000 this election cycle. AQR’s co-founder, Cliff Asness, has given $150,000 to the RGA since 2014. The RGA has moved $5.8 million this year to its Missouri account, which has delivered $5 million to Republican candidate Eric Greitens’ gubernatorial campaign.

“Elliott complies with the laws that restrict political contributions by hedge fund employees to certain state and local candidates and officeholders,” said Martin O’Looney, a spokesperson for Elliott Management. “Contributions made to the Republican Governors Association during the 2014 and 2016 election cycles were specifically designated for a segregated RGA account that is not used to make contributions to any candidates or officeholders.”

- In Indiana, Lieutenant Governor Eric Holcomb is running to succeed Republican vice presidential nominee Mike Pence as governor. AQR and Bridgewater Associates are listed on government documents as financial firms managing money for the Indiana pension system, whose board is comprised of gubernatorial appointees.

Donors from the two firms have given a combined $75,000 to the RGA in the 2016 election cycle. Meanwhile, a super PAC funded by the RGA has donated $5.1 million to Holcomb’s campaign, and the RGA is airing ads against his Democratic opponent. Bridgewater declined to comment for this story.

The flow of money to third party groups and around the SEC’s pay-to-play rule during the 2016 campaign mimics similar examples from prior election cycles.

- The RGA spent big to help Florida Gov. Rick Scott win re-election in 2014, sending nearly $16 million to a political committee backing him, according to state records. An executive from Mason Capital Management, Michael Martino, and the former co-founder of Berkshire Partners, Carl Ferenbach, who remains a senior advisor with the firm, each donated $50,000 to the RGA in the 2014 election cycle.

As governor, Scott is one of three trustees for the State Board of Administration that oversees the Florida pension system. The SBA contracted Berkshire and Mason Capital to manage more than a quarter billion dollars in 2011, the year Scott first took office. Scott has served on the RGA’s executive committee since 2012 .

“The SBA’s elected Trustees do not now, nor have they ever participated in the selection of individual investments or investment managers,” said Dennis MacKee, the Florida agency’s spokesman. MacKee noted that the SBA closed its investment with Mason Capital in April. The firm’s main fund has struggled over the past two years, and some of its clients have pulled their money, according to Bloomberg.

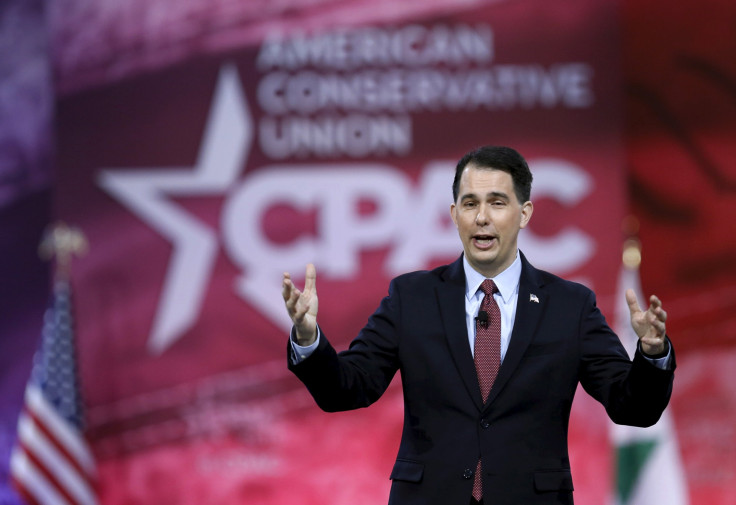

- In Wisconsin, the RGA spent over $8 million to help Gov. Scott Walker win reelection in 2014. That year, the group raised $100,000 from Berkshire Partners, Prudential and JPMorgan Chase. At the time, the Walker-controlled State of Wisconsin Investment Board (SWIB) maintained $674 million worth of investments in funds managed by those firms, according to pension disclosure documents.

“SWIB’s Board of Trustees does not select or approve investment managers or specific investments,” SWIB spokesperson Vicki Hearing told IBT/MapLight in an emailed statement. “We do not know nor are we aware of the facts and circumstances of how the Republican and Democratic Governors Associations may have been involved in the Wisconsin gubernatorial races or how any contributions made by anyone to those groups may have been solicited or donated.”

It’s difficult to know the extent of any pay-to-play in Wisconsin because in 2011, only a few months after the SEC rule went into effect, Walker signed legislation blocking the disclosure of information about what particular investments are in the pension fund’s $677 million venture capital portfolio. Walker has raised more than $161,000 from the venture capital industry, according to data compiled by the National Institute on Money in State Politics.

- Then there is New Jersey, where governors are constrained not only by the SEC’s federal pay-to-play rule but by the state’s own stringent rules restricting donations from financial firms contracted to manage state pension assets. Donors from firms managing those assets nonetheless gave money to groups backing Christie’s campaigns, like the RGA, Republican National Committee and New Jersey Republican State Committee.

Just as financial industry money was flowing to the groups backing Christie’s 2013 reelection, the Republican governor’s aides tucked a proposal into the state administrative code to say the pay-to-play rules would no longer apply to donations to "a federal or national campaign committee."

That change went into effect in 2014, the year Christie chaired the RGA. When Democratic lawmakers passed a bill to roll it back, Christie vetoed the legislation, arguing that “because the federal campaign contribution laws preempt state law in this area, I cannot approve of such a provision.”

Loopholes, Fund-Of-Funds and Super PACs

Governors are not the only officials getting Wall Street cash while they have power over investment decisions — nor are they the only officials who have benefited from weaknesses in the SEC’s pay-to-play rule.

- In North Carolina, the state’s $90 billion pension system is controlled solely by Treasurer Janet Cowell, a Democrat. Just after the SEC rule went into effect in 2011, she was the beneficiary of a political fundraiser at the home of former White House chief of staff Erskine Bowles, a senior adviser to a financial firm. Only a few weeks later, Bowles’ firm was given a lucrative pension management deal.

- In Chicago, Mayor Rahm Emanuel appoints members of his city’s pension funds. Despite the SEC pay-to-play rule — and his own executive order prohibiting contractor donations — Emanuel’s campaign accepted $600,000 in contributions from executives at financial firms that manage city pension money through pooled investments known as a “fund of funds.” The SEC’s rule explicitly covers contributions from sub-advisers in pooled investments. The firms said they were in compliance with the rule.

Another potential way around the pay-to-play rule is through super PACs that are supposed to be independent of candidates.

In March, during the Republican presidential primary, AQR’s Asness gave $1 million to a super PAC called Our Principles PAC. The group bought at least $1 million worth of television and digital ads in Ohio slamming Donald Trump — by extension helping Republican Gov. John Kasich win the state’s primary. AQR is listed in state documents as a hedge fund manager for the Ohio Public Employees Retirement System, and Kasich appoints two members of that pension fund’s board. (The same month that Asness’s donation effectively boosted Kasich’s campaign, he gave a presentation to the pension board called, “Why Hedge Funds are Good for the Portfolio.”)

Some ethics experts say it’s likely the SEC’s anti-circumvention language would apply to cash given to super PACs that back only a single candidate, because there would be no ambiguity about who benefits from the money.

So far, none of these maneuvers and legal interpretations has been challenged by law enforcement agencies.

Meanwhile, some state officials have suggested that returns could be reduced — and retirees harmed — if pension systems divest from firms that legally circumvent the pay-to-play rule.

“We believe from a fiduciary perspective, the exclusion of potential highly qualified managers who were/are in compliance with the law from consideration would be irresponsible,” said MacKee, the spokesman for the Florida pension system.

This story is a collaboration between International Business Times and MapLight, a nonpartisan nonprofit that reports on money in politics. The article is the second in a series on how companies are circumventing pay-to-play laws designed to restrict their political spending and influence.

© Copyright IBTimes 2024. All rights reserved.