Remember The Eurozone Crisis? IMF Chief Lagarde, Joseph Stiglitz Aren’t Ready To Declare “Mission Accomplished;" Warn Of Lingering Threats

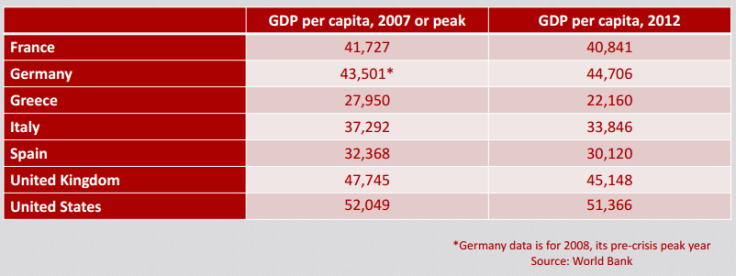

While a potential collapse of the euro no longer threatens the global economy as it did following 2007-08's financial crisis, economists are still nowhere near declaring the world’s third-largest economic zone's troubles over.

"The recovery is under way, that is correct," International Monetary Fund chief Christine Lagarde told Germany’s Handelsblatt on Monday. She cited alarmingly low inflation and weak bank lending as immediate challenges and added that, “Some countries have completed the auxiliary [bailout] programs successfully. But that does not mean that the crisis is over and our mission accomplished.”

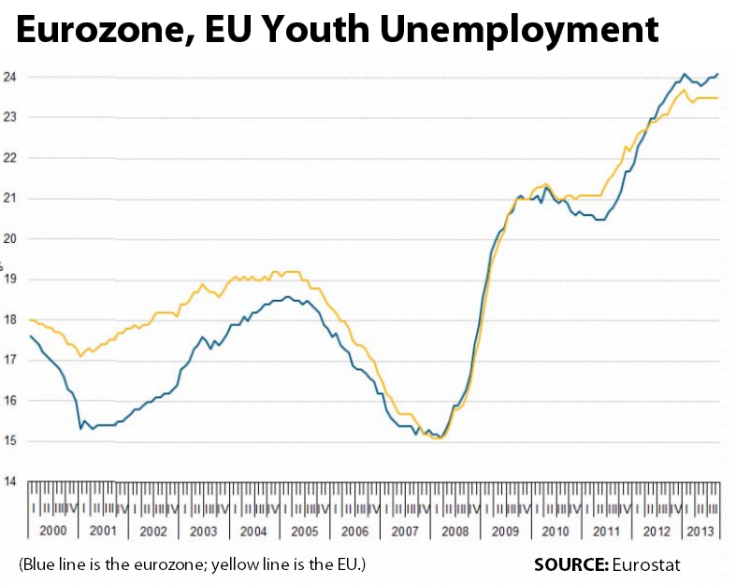

Eurozone’s jobless figures remain alarmingly high in southern Europe, and even in the north unemployment rates top those in most U.S. states. After years of austerity programs pushed by the IMF and Germany, six eurozone countries sport unemployment rates above 13 percent. Unemployment among working-age Europeans under 25 is hovering at 50 percent or higher in Spain, Greece and Croatia.

On Monday the euro fell to a seven-week low against the dollar after European Central Bank President Mario Draghi said it would cut lending rates in June. The ECB hopes lower rates would stimulate bank lending to businesses and promote hiring and spur economic growth. The U.S. has used such monetary easing to combat a sluggish economy, but critics cite the dangers of such fast-growing debt.

Europe's biggest problem is jobs. There aren’t enough of them and that's causing consumer prices to fall on slow demand, the essence of deflation. Lagarde on Monday echoed an oft-cited call for “structural reforms in the labor markets.”

Joseph E. Stiglitz, a Nobel laureate in economics, recently released a more ominous warning to Europe, calling for much broader measures than simply tackling the high cost of labor.

“What will not work, at least for most eurozone countries, is internal devaluation – that is, forcing down wages and prices – as this would increase the debt burden for households, firms, and governments,” Stiglitz wrote last week, reflecting on the outcome of the Italian elections that brought leftist Premier Matteo Renzi to power.

On a visit to Rome last week, Stiglitz pointed out that economic depression persists in some Eurozone countries and that unless fundamental changes are made the region is facing a lost generation of working-age Europeans.

© Copyright IBTimes 2024. All rights reserved.