Russia's 2014 Economic Outlook Bleak Amid Toughening Western Sanctions

The Russian economy was barely growing even before it was hit with Western sanctions following the annexation of Crimea. Many economists believe further escalation of the crisis in Ukraine would push Russia’s economy into recession for the first time since the global financial crisis.

Last year, the economy grew by just 1.3 percent -- its lowest growth in the past 13 years barring the downturn-hit 2009. But there had been hopes that growth would rebound this year. Instead, Russia's economic performance is deteriorating further.

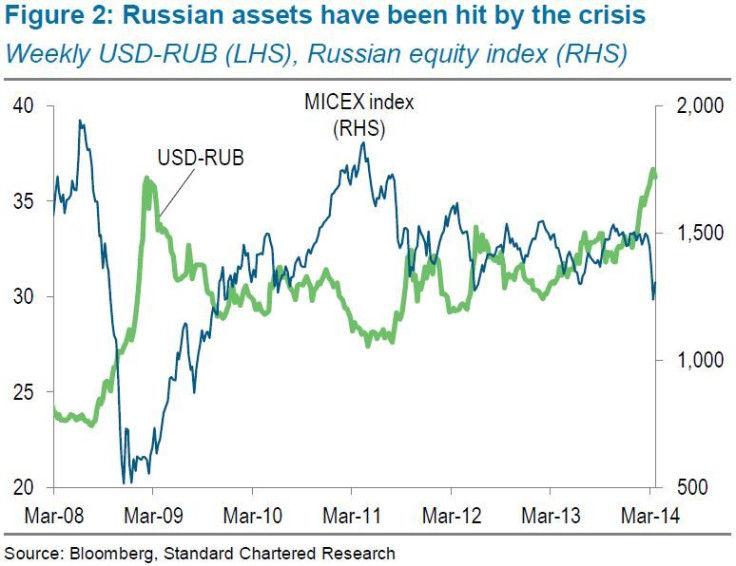

“The intervention in Crimea and subsequent fall in Russian assets has resulted in tightening financial conditions and is likely to have reversed the improvement in business confidence experienced in the first two months of the year,” Jinny Yan, a London-based economist with Standard Chartered, said in a note Wednesday.

Assuming Russian expansion remains limited to Crimea, the Institute of International Finance estimates that the cumulative loss in output from trade disruption and higher financing costs could be around 1.2 percent of gross domestic product over two years.

A further escalation in the crisis would bring more sanctions, sovereign downgrades -- rating agencies have placed Russia’s BBB/Baa1 ratings on a negative outlook -- and more damage to the economy. Intensified sanctions would further restrict access to financing for the private and public sectors, reduce export market access, and trigger more capital flight.

The World Bank estimates that if the crisis escalates further, Russia's economy will contract 1.8 percent this year.

Russia has already seen approximately $65 billion leave the country in the first quarter – higher than the $63 billion in capital flight for all of 2013 -- and may post a net capital outflow of $100 billion in 2014, Deputy Economic Development Minister Andrei Klepach said earlier this week.

“The drying up of foreign capital to Russian banks and corporates would have an adverse effect on investment, [which is] already weak, since they rely heavily on foreign funding,” Yan said.

Business sentiment fell to its lowest level in three months in March, according to data released Wednesday. MNI Russia Business Sentiment, a monthly poll of executives at companies listed on the Moscow Exchange, fell to 52.5 in March from 60.0 in February, a decline of 12.5 percent on the month and well below the 59.3 seen in March 2013.

While Russia's economic growth slows, inflation is shooting up, as a significantly weaker ruble raised the price of imports. The Economy Ministry expects inflation to reach between 6.9 percent and 7.0 percent (annually) in March, up from 6.2 percent in February.

Russia's annexation of Crimea has set off the worst East-West crisis since the end of the Cold War and triggered U.S. and European sanctions on senior officials and business leaders. And Russian financial markets have been hit hard by the escalating geopolitical tensions: The key MICEX equity index has weakened more than 12 percent during the month of March.

“We expect the ruble to level out at around its current value, supported by another rate hike, though an escalation in tensions would likely result in a further selloff,” Yan said. “So far, the impact on commodity prices has been muted.”

So far, the sanctions haven't touched on Russia's vital economic interests. But on Wednesday, the U.S. and the European Union agreed to work together to prepare possible tougher economic sanctions, including on the energy sector, and to make Europe less dependent on Russian gas.

The EU is Russia's largest trading partner. Almost half of Russia's exports -- $292 billion worth -- end up in EU countries. Russia, in turn, is the third-biggest trading partner for the EU, with $169 billion in imports.

Meanwhile, the U.S. and Russia trade very little. Russia is merely the 20th-ranking trading partner for the U.S., with $27 billion worth of commerce. On the flip-side, the U.S. is Russia's fifth-largest partner, with just $11 billion worth of trade.

Russia’s energy supplies remain vitally important for the EU, to which it supplies a third of its natural gas. Germany, the euro zone's biggest economy, imports around 40 percent of its gas from Russia. The U.S., on the other hand, is less depended on Russia’s energy due to the shale gas boom.

© Copyright IBTimes 2024. All rights reserved.