Saudi Arabia Says Its Flood Of Low-Cost Oil Is Hobbling US Shale Rivals

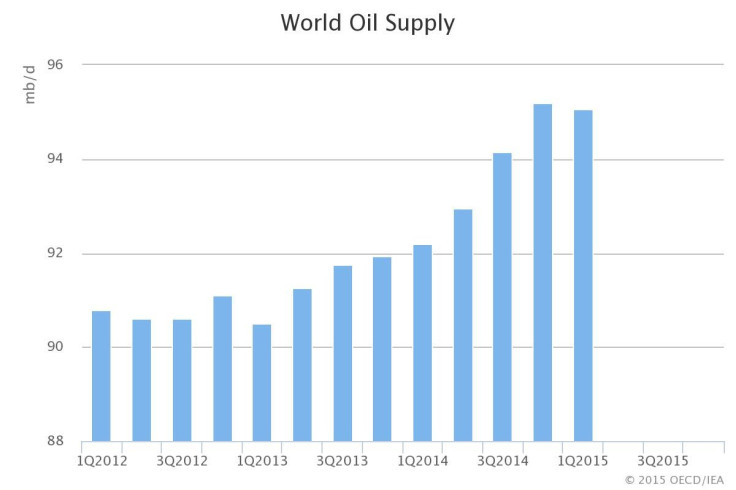

Saudi Arabia’s plan is working. As oil prices drop to near six-year lows, the oil-producing nation has kept its taps flowing at record high volumes in an attempt to force rivals like U.S. shale drilling operations out of business.

“There is no doubt about it. The price fall of the last several months has deterred investors away from expensive oil, including U.S. shale, deep offshore and heavy oils,” an unnamed Saudi official in Riyadh told The Financial Times on Thursday. The comment offers a clear indication of Saudi Arabia’s oil policy objectives.

In an attempt to maintain its global market share, the world’s largest petroleum liquids exporter has been selling its crude in Asia at below benchmark prices, relying on its massive stockpile of currency reserves to address its deficit.

Seeing the threat posed by the U.S. shale oil boom, late last year Saudi Arabia rallied fellow OPEC members to steer away from OPEC’s traditional policy of restricting production when prices fall. OPEC member states, including Nigeria, Venezuela and Iraq, have oil-dependent economies whose budgets dip into deficits when prices fall below certain thresholds.

Meanwhile, the U.S. shale oil boom has ended, at least for now, thanks to the oil glut.

“In the supposed standoff between OPEC and U.S. light tight oil, LTO appears to have blinked,” the International Energy Agency, a key prognosticator, said Wednesday in its monthly oil market report. “LTO production growth buckled last month, sending US crude output growth into reverse and bringing a multi-year winning streak to an apparent close.”

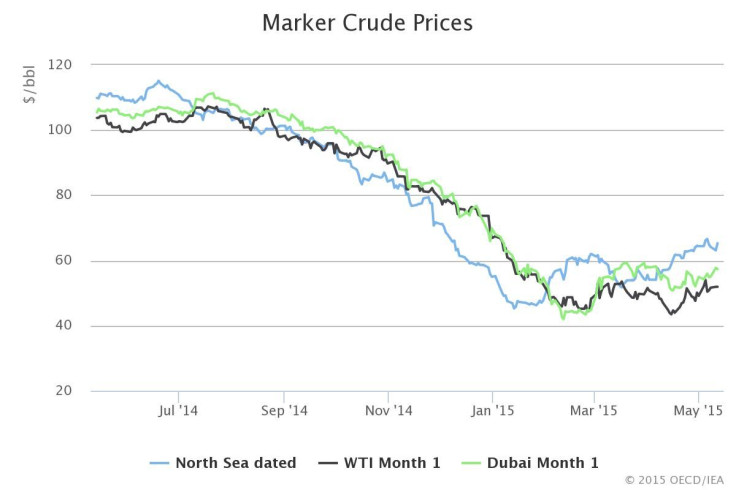

OPEC Secretary-General Abdullah al-Badri said in January that oil prices may have hit the floor and that a rebound is in the works. And indeed global oil prices have rebounded about 40 percent in recent weeks from a six-year low earlier this year. But that rally could be short-lived, fueled by futures traders buying on low prices.

The U.S. Energy Information Administration expects a slowdown in global demand, with major consuming nations buying oil at a slower rate over the next year than seen in the year after 2010 as the global economy was slowly recovering from the last major turndown. China’s recent slowdown will likely lead to the U.S. reclaiming its top position as the world’s largest oil buyer this year, according to a recent Bloomberg report.

© Copyright IBTimes 2024. All rights reserved.