Silver Saw Net ETF Inflows, Compared To Gold’s Insane Decline

Silver exchange-traded funds saw modest net inflows this year, beating out their trading partner and more popular companion metal gold, which saw record outflows from ETFs.

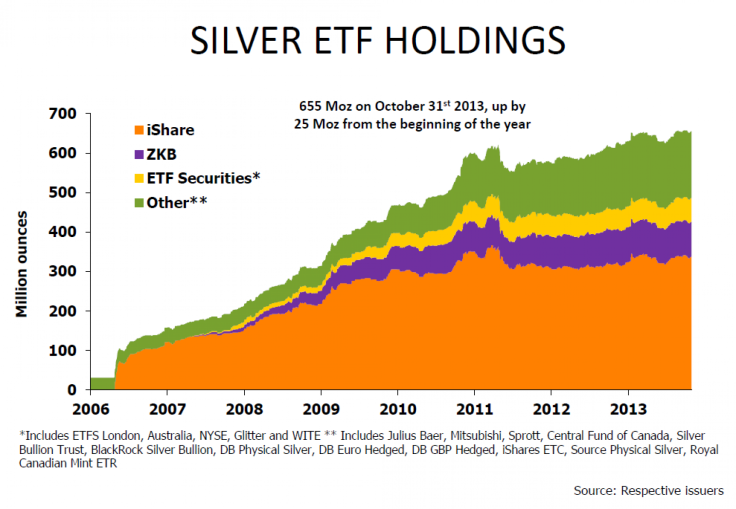

Holdings in silver specialist investment vehicles, which allow ordinary investors to track silver prices without owning physical metal, were at 655 million ounces as of Oct. 31, up 25 million ounces from the start of the year.

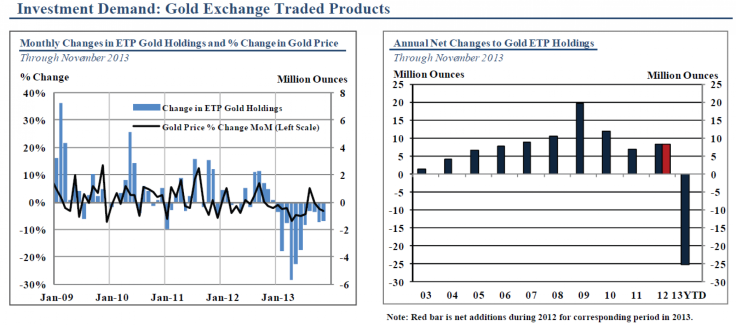

Compare that with holdings in the equivalent gold products, which saw outflows of 806 metric tons in 2013, according to Barclays PLC (LON:BARC) data from Monday.

“This contrasts sharply with the liquidation we’ve seen on the gold side, through 2013,” said Michael DiRienzo, executive director of silver trade body the Silver Institute, which promotes the precious metal worldwide, at a recent industry conference.

“On the investment side, at least for ETFs … there’s a strong appreciation for silver, even at these prices,” he continued.

Industrial demand for silver, which is used in consumer electronics, medical equipment and industrial catalysts, should reach 838 million ounces, up about 3 percent from last year, according to a Dec. 4 precious metals report by the CPM Group.

Investment demand for silver accounts for 24 percent of total demand, up from about 4 percent in 2003, according to DiRienzo. After exchange-traded products were introduced in the mid-2000s, investors used these liquid trading instruments to easily gain exposure to silver.

Silver investors tend to be small individual investors, instead of large institutional investors like hedge funds, whose positions strongly affect global holdings in gold-backed funds. That may explain why gold ETFs have fared badly this year, while silver ETFs are holding up better, said DiRienzo.

“Overwhelmingly, the evidence suggests that investors are holding or adding to their silver positions, even though in gold they’re liquidating,” David Franklin, a market strategist with Sprott Asset Management, told International Business Times.

He cited silver’s relative affordability and its industrial uses, which should pick up if the global economy recovers, as attracting investors.

The U.S. Mint has also seen record sales of silver coins this year, with 41.4 million coins sold by Dec. 1. That’s already 29 percent above sales for the full year of 2012, and a new record.

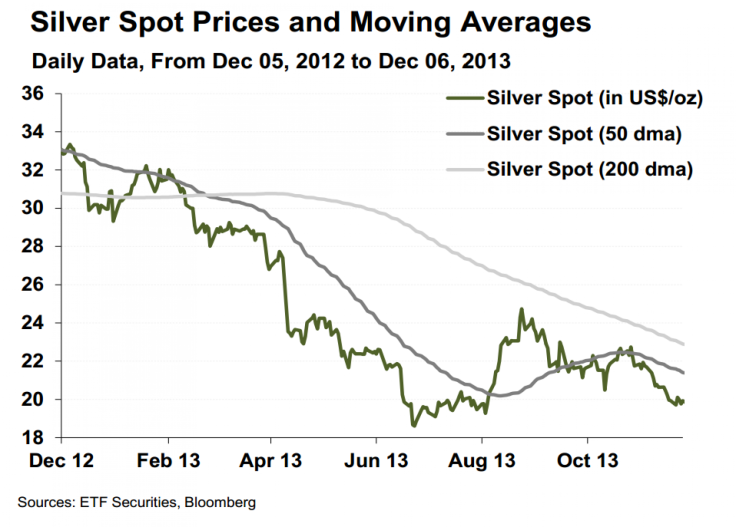

DiRienzo and others supportive of silver may be speaking too quickly, however. CPM Group data showed that silver ETF holdings fell 8 million ounces in November, the largest monthly loss since May, which saw 17.7 million ounces in outflows. Those betting on higher silver prices, as shown in CFTC data, also fell to the lowest since August 2013.

“Market participants in November have been mostly bearish in their outlook for the silver market,” wrote CPM Group in their latest report. “Demand for physical silver from investors and fabricators has been weak over what is typically a strong season. … Investors in physical silver bullion coins and ETPs have become noticeably more bearish in November.”

Silver opened at $19.5 per ounce in New York on Monday. Silver prices have fallen 35 percent for the year to date, dragged down in part by gold declines. Weak industrial demand has also weighed on silver, according to an Oct. 30 note from London’s Capital Economics.

But globally, silver imports into India have more than doubled in the first three quarters of this year. That’s partly because government gold import restrictions have led to gold shortages, leading some Indian consumers to switch to silver. Franklin says India consumed a quarter of silver mine output this year, a tremendously bullish factor that could extend for the near future, if gold remains difficult to buy there.

The global silver investment market was worth $8 billion in 2013, much larger than the annual average of $1.2 billion from 2001 to 2010, according to a Silver Institute survey from April.

© Copyright IBTimes 2024. All rights reserved.