Tesla Motors Inc (TSLA) Earnings Preview Q2 2015: What To Look For Ahead Of The Model X Rollout

UPDATE: In its second quarter earnings release, Tesla Motors reduced the number of cars it expects to sell this year.

Original story begins here:

Tesla Motors Inc. (Nasdaq:TSLA) is entering an important new phase in its push to overtake Nissan Motors as the automotive history’s biggest electric-car manufacturer. If all goes according to CEO Elon Musk's plan, the first Tesla Model X sport utility vehicles will hit the streets by late September. And by next summer, the auto world will get its first peek at a prototype for the modestly priced Tesla for Everyman: the Model 3, due out in early 2018.

Musk's blueprint also includes an expansion of Tesla’s automotive and energy storage production, and hitting milestones in the construction of the company’s multibillion-dollar “Gigafactory” battery facility in Nevada.

Of course, as all these gears spin in unison, a lot could go wrong.

The company is banking on the notion that it can quickly transition from a boutique manufacturer to a mass-producer of electric cars, as it attempts to grow from the roughly 32,000 cars it sold last year to at least 500,000 by 2020. And Tesla's energy unit, too is dependent on an assumption that businesses and homeowners will rapidly adopt its power storage units.

But any number of missteps could scuttle Tesla's growth. The company, for instance, is just one automotive safety recall away from the entire operation crashing down on the heads of its exuberant shareholders.

For now, Tesla's growth engine is running smoothly.

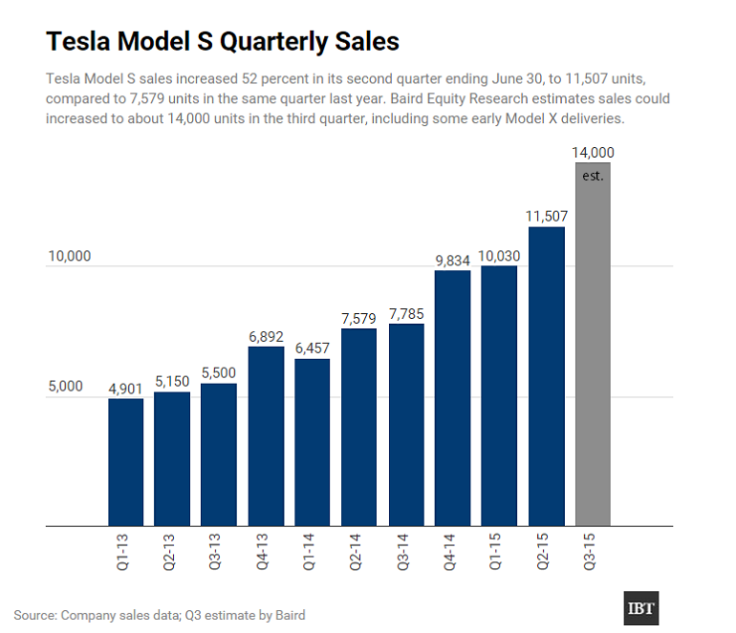

“We think demand for the Model S will remain strong throughout 2015 in the U.S. and Europe. Additionally, [Tesla] has several significant milestones coming up over the next 18 months,” Benjamin Kallo, a new-energy research analyst at Baird, said in a research note Tuesday.

What matters most for Tesla is maintaining its sales momentum. The company has said it will deliver 55,000 cars in 2015. It delivered 21,537 in the first six months of the year. Even if it hits its goal, the company isn’t expected to turn a profit anytime soon, and it will likely see costs increase during this next phase of development.

“Certain costs should rise as the company expands internationally as it invests in technology and infrastructure for the upcoming Model X SUV,” Standard & Poor’s equity analyst Efraim Level said in a research note last week.

Tesla’s Q2 2015 Estimates

Despite some volatility in Tesla’s stock price in recent weeks, investor confidence remains high. The stock is up 19 percent since the start of the year. The share price came close to an all-time high in July. The company's lack of profits hasn't deterred its growth-stock investors from bidding up the share price nearly 800 percent since the summer of 2012.

Tesla’s share price was up 1.73 percent in midday trading Tuesday, to $264.49, down from a 52-week high of $291.42. The company’s highest closing price, $286.04, was reached Sept. 4, 2014, after the location of the Gigafactory was announced. Tesla struck its second-highest closing price July 2 after its second-quarter sales results were released.

Tesla will announce second-quarter financial results after markets close Wednesday. Company watchers can listen to Musk talk about important developments and issues facing his company by clicking here at 5:30 p.m. EDT Wednesday.

Tesla is expected to book a wider loss of $126.1 million, or $1.02 a share, for the April-June quarter. That compared with a loss of $61.9 million, or 50 cents per share, in the same period last year, analysts polled by Thomson Reuters said.

But revenue -- the most critical number for Tesla right now -- is expected to be the highest on record, at $1.17 billion, up from $857.5 million in the year-ago quarter. The company’s revenue first broke through the billion-dollar mark in the fourth quarter of last year. Efraim Levy, an equities analyst for Standard & Poor's, expects revenue to grow 62 percent this year as Tesla sells significantly more cars this year than last.

Recent Tesla Motors Developments

So far this year the Palo Alto, California, company has expanded its power storage business by unveiling its Powerpack and Powerwall storage units aimed at lowering power costs. Last month, three Southern California schools were among the first major customers to sign up for Tesla stationary battery storage since April’s announcement.

Last month, Tesla introduced pricing and hardware options for the Model S. The company lowered the price of the entry-level Model S to $70,000 for a single-motor powertrain carrying with a 70 kWh battery pack that gives up about 230 miles of range. The company also added a “Ludicrous Speed” upgrade that starts at $118,000 for a 0-60 mph time of 2.8 seconds, giving the Model S the performance typically ascribed to million-dollar supercars.

In the past week, Tesla introduced an incentive program to entice loyal Model S owners to lure like-minded new customers into the Tesla fold. On Friday, Musk announced progress in a soon-to-be-released over-the-air firmware upgrade that will add automatic steering for highway driving and automatic-parking capabilities to existing Model S cars.

Almost ready to release highway autosteer and parallel autopark software update

— Elon Musk (@elonmusk) July 31, 2015The China Factor

Luxury carmakers have been watching China with wary eyes. On Tuesday, German automaker BMW warned that China's recent economic slowdown could affect its global sales. BMW's sales have been sliding in the world’s biggest car market, where foreign luxury automakers are having trouble luring customers to cars that cost less than the Model S.

This doesn’t bode well for Tesla’s China ambitions and could make 2015 as disappointing as last year. Tesla has reorganized in China and stepped up its marketing efforts this year, but macroeconomic pressure could negate the efforts. Wealthy Chinese buyers need to be convinced that they won’t run out of power in a six-figure electric car while stranded in the country’s legendary traffic jams. And now there are fewer of those wealthy Chinese customers.

But so far, Tesla’s Chinese challenges aren’t expected to have a measurable impact on short-term sales. The focus is on the U.S. and European markets, and with a new vehicle poised to hit showrooms, Tesla should get a sales boost that will carry it into next year.

© Copyright IBTimes 2024. All rights reserved.