This past weekend, Hollywood studios received bad news. The number of tickets sold during Hollywood's all-important summer season -- the first week in May through Labor Day weekend -- shrank to 532 million in 2012. That's off 4 percent from last year and on track to be the lowest summer attendance in almost 20 years, according to preliminary estimates from Hollywood.com.

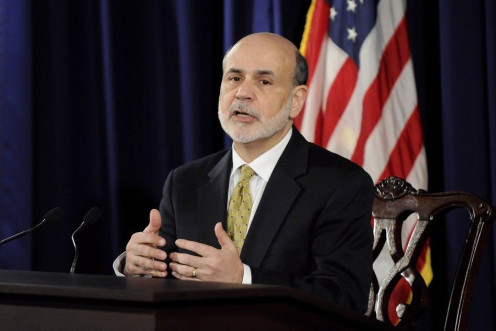

It seemed everyone was claiming their crystal ball has been right in anticipation of a much-hyped speech by the world's most powerful central banker, who managed to turn the attention of traders around the world to his podium in bucolic Jackson Hole, Wyo. Friday. They were all right and, as usually happens in such cases, they were also all wrong.

Two years after Federal Reserve Chairman Ben Bernanke announced plans for a massive second round of monetary stimulus -- so called QE2 -- at a yearly Fed summit in Jackson Hole, Wyo., the world's most powerful central banker returns, with markets primed for him to deliver on even more stimulus.

Workday, the human-resource software company started by PeopleSoft founder David Duffield, filed for a $400 million initial public offering sometime later this year.

Market-watchers continued to use words like "anticipation," "expectations," "disappointment" and "excitement" Thursday, less than 24 hours ahead of a speech by Federal Reserve chairman Ben Bernanke that is being hyped up as a make-or-break moment for economic affairs in 2012.

Can Richard Schulze, the 71-year-old founding CEO of Best Buy Co. (NYSE: BBY) put his money where his mouth is? Can he fork up billions from private eqiuity behemoths like KKR (NYSE: KKR)?

When Tiffany & Co. (NYSE: TIF) cut its fiscal year sales and earnings guidance for a second straight quarter on Monday, stock in the company rallied over 7 percent. The reason: investors think the worst is over for the New York-based jeweler.

The top after-market NYSE gainers Tuesday were Williams-Sonoma, La-Z-Boy Inc, Express, Inc, GenOn Energy and Pioneer Energy Services Corp. The top after-market NYSE losers were Qihoo 360 Technology, EnCana, Beazer Homes, Tim Hortons and Agrium Inc.

There's an almost-daft energy over Wall Street at the moment as stocks keep to four-year highs, a trend that hasn't kept analysts from warning that the party is about to be over.

It may be surprising to many who believe that Wall Street and global finance are inherently malevolent that a century ago, the public had a very similar perception of financial services, a notion that was channeled by editorial cartoonists in hard-hitting illustrations in magazines like Puck and newspapers like the New York Herald. These cartoons would be as fitting today as they were in 1912.

Shares of Facebook (Nasdaq: FB), the No. 1 social networking site, fell to a new record low of $19.01 in midday Friday trading, a day after insiders were allowed to sell as many as 241 million shares they had been required to hold since the May 17 initial public offering.

Trading in U.S. stocks has been going on at a snail's pace recently, a fact market-watchers are blaming on policy uncertainty, but could also be the result of investors fed up with the fragmented, unpredictable nature of the market.

Poor risk control, not fraud, was the reason for the disappearance of $1 billion during the collapse of MF Global.

Thursday frees holders of as many as 271 million shares of Facebook (Nasdaq: FB), the No. 1 social networking site, to sell them for the first time since the first-day trading fiasco on May 18, when shares that had been priced at $38 first traded at $42.05, then didn’t trade for 30 minutes and closed at $38.23.

Two years after Federal Reserve Chairman Ben Bernanke announced plans for a massive second round of monetary stimulus at a yearly Fed summit in Jackson Hole, Wyo., market watchers are beginning to take odds on the chances that his speech at this year's Jackson Hole summit could produce a similar announcement.

The Carlyle Group (Nasdaq: CG), a global asset manager, and Getty Images management said Wednesday they formed a partnership to acquire privately held Getty Images Inc. from Hellman & Friedman for $3.3 billion.

Leaders of a union that operates Colombia's main coal railway met Wednesday to decide how to respond to a unanimous court ruling declaring its three-week strike illegal.

Knight Capital Group Inc. (NYSE:KCG) saw shares in the company drop precipitously early Monday -- at one point losing over 7 percent of their value -- as the bruised-up broker-dealer continued to pick itself up less than two weeks after a trading algorithm gone berserk saddled the firm with $440 million in losses.

Each week, the International Business Times money team picks three winners and three losers. Our choices are made based upon the amount of money involved and how compelling, dramatic, or just generally interesting the story behind the money is.

U.S. regulators directed five of the country's biggest banks, including Bank of America Corp and Goldman Sachs Group Inc, to develop plans for staving off collapse if they faced serious problems, emphasizing that the banks could not count on government help.

The Justice Dept. said there was "not a viable basis to bring a criminal prosecution" against Goldman Sachs, quietly ending a yearlong investigation into allegations the firm bet against the same subprime mortgage-backed securities that it also sold to its clients.

The Justice Department will not prosecute Goldman Sachs or its employees in a financial fraud probe, officials announce Thursday.