Twitter (TWTR) Q1 2014 Earnings Preview: Slumping User Growth Offsets Strong Increase In Revenue

Twitter Inc. (NYSE:TWTR) likely failed to accelerate user growth in the first quarter despite major investments aimed at making the social network more attractive to new users in the U.S. and abroad, according to analysts looking ahead to Tuesday’s first-quarter earnings report.

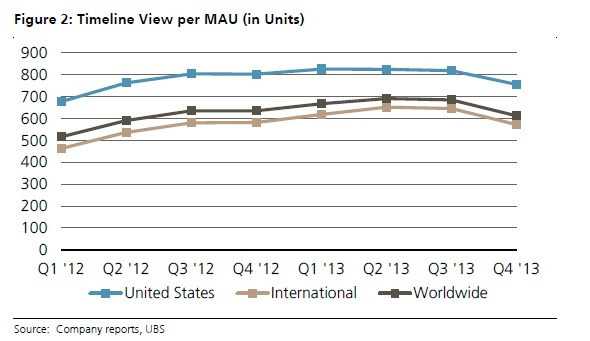

“Twitter’s unstructured, rapid evolution has resulted in a headwind to user growth, as many new users struggle to acclimate to the platform,” Eric Sheridan, an analyst at UBS, said in a report. UBS predicts that Twitter’s user base only grew 23.4 percent year-over-year, down from 30.3 percent in the previous quarter.

The bank also predicts that user growth in the U.S. fell 5 percent, while international growth fell 7.6 percent. In total, Twitter UBS predicts that Twitter only added 11 million users in the first first three months of 2014.

When Twitter announced in February that it only added 9 million users, many investors jumped ship and the San Francisco company pledged changes to make Twitter more accessible to new users.

Unfortunately, these changes, including a major redesign of Twitter user profiles and a slew of smaller tweaks and features, failed to accelerate user growth much in the January-through-March period and Twitter’s quarterly income will suffer.

Wall Street analysts polled by Thomson Reuters expect, on average, Twitter to report a net loss of $17.72 million, or 30 cents per share (EPS), when it reports first-quarter earnings on Tuesday after markets close. Excluding one-time items, the Street expects an EPS loss of 3 cents. In the first quarter of 2013 the company lost $27 million, or 6 cents per share, but excluding one-time items it lost $11 million, or 2 cents per share.

The good news for Twitter is that it has figured out how to squeeze more money out of each user, and revenues increased dramatically. Twitter is expected to report nearly $242 million of revenue, a 112 percent year-over-year increase. That’s slightly above what the company forecast when it issued its fourth-quarter 2013 earnings report; Twitter said it expects revenue for the first quarter of 2014 in a range of $230 million to $240 million.

About 90 percent of that revenue comes from advertising, and Twitter’s ad revenue shows an increase of 117 percent from the first quarter of 2013.

Twitter also generated about $25 million from data licensing, boosted by the purchase of MoPub, a mobile ad network that delivers advertisements to mobile apps that are not owned by Twitter. While that’s a small portion of Twitter's overall revenue, it still represents a year-over-year increase of 80 percent, showing great potential for growth in this area.

Still, analysts feel that this strong growth in revenue is offset by slowing user growth engagement.

“We need to see significantly better numbers this quarter, or the Twitter momentum story may be over for good,” Charles Lewis Sizemore, an analyst with Sizemore Capital Management, told International Business Times.

Another issue is when the first major lockup of Twitter stock expires May 5, making 500 million shares of Twitter stock available for sale for the first time. Early investors and Twitter employees will likely take the opportunity to cash in, but long-term investors are nervous about the damage it will have on Twitter’s stock.

Twitter CEO Dick Costolo will likely address these concerns in a conference call to discuss the earnings, which Twitter will broadcast on its website at 5 p.m. EDT.

© Copyright IBTimes 2024. All rights reserved.