US Solar Projects Hit Record High In 2015, Outpacing New Natural Gas Capacity: Report

U.S. solar installations hit a record high in 2015 as developers scrambled to tap a key tax incentive, and the costs of photovoltaic panels continued to plunge.

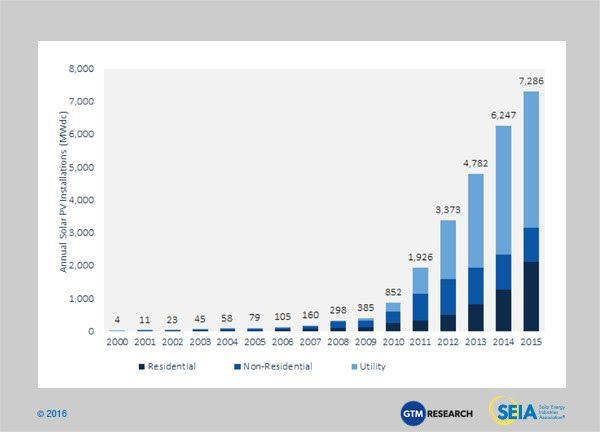

The U.S. solar industry added nearly 7,300 megawatts of new PV projects last year, up 17 percent from 2014 installations, GTM Research and the Solar Energy Industries Association reported Monday. Last year’s solar surge outpaced additions of natural gas capacity for the first time, the groups said.

Five states — California, Massachusetts, North Carolina, Nevada and New York — led most of the nation’s growth in solar projects, although the market is starting to diversify. Twenty-four of the 35 states surveyed saw solar market growth in 2015, said Shayle Kann, senior vice president of GTM Research in Boston.

“The U.S. solar market remains concentrated in key states, with the top ten states accounting for 87 percent of installed capacity in 2015,” he said in a statement. “But growth has been widespread.”

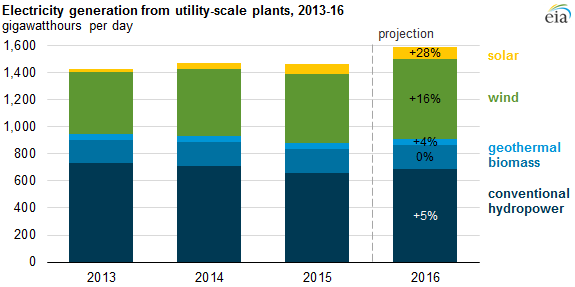

U.S. solar projects supplied 29.5 percent of the nation’s new electric generating capacity last year, according to the research outfit.

Residential rooftop projects saw the greatest growth, jumping 66 percent year over year with more than 2,000 megawatts in installations. Giant utility-scale projects grew 6 percent year over year but still represented more than half of all solar PV installed last year. The nonresidential market, including commercial rooftop projects, added more than 1,000 megawatts in projects, but remained roughly flat compared with 2014.

Solar developers raced to build new projects last year under the federal Investment Tax Credit, which was expected to ramp down next year. The incentive allows solar companies to claim tax credits at 30 percent the price of a solar array, but the credits were initially scheduled to fall to 10 percent in 2017, driving a building boom. Congress in December extended the credit, which will stay at 30 percent through 2019, then steadily decline to 10 percent in 2022, where it will remain.

Plunging solar prices are also driving installations as household rooftop projects and large-scale utility projects become more affordable. Installed project costs are down more than 50 percent since 2009 thanks to cheaper panel prices, more efficient construction and falling financing costs. The median cost of installing solar panels fell from $6.3 per watt in 2009 to $3.1 per watt for projects completed in 2014, and prices keep dropping, the Lawrence Berkeley National Laboratory reported in September.

Still, individual solar companies have seen their stock prices plummet in recent months amid slower growth plans and investors’ fears that plunging crude oil prices might diminish demand for renewable energy.

Shares of SolarCity Corp. (NASDAQ:SCTY) plunged by over 30 percent earlier this month after the company —- whose largest investor is Tesla Motors Inc. founder Elon Musk — forecast a bigger-than-expected loss for the first quarter and said installations fell short of its target. Its competitors Vivint Solar Inc., Sunrun Inc. and SunEdison Inc. have also seen their shares lose value, although solar companies Monday were gaining in New York markets.

“Without a doubt, 2015 was a monumental year for the U.S. solar industry,” Rhone Resch, president and CEO of the Solar Energy Industries Association, the main trade group, said in a statement Monday. “Over the next few years, we’re going to see solar continue to reach unprecedented heights as our nation makes a shift toward a carbon-free source of energy.”

© Copyright IBTimes 2024. All rights reserved.