What The Average American Spends Every Day In Walking Around Money Will Surprise You

Americans spent an average of almost $94 a day last month in stores, restaurants, gas stations and online. That's a lot of walking-around money, and it's higher than the $89 per day spent in July 2013, but lower than the six-year high of $98 per day recorded in May.

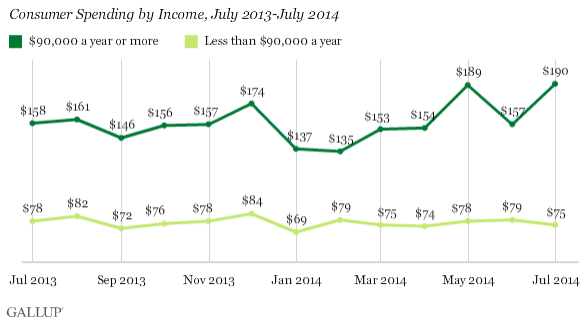

That kind of spending might bode well for the U.S. economy, but on the downside, only high-income earners accounted for the rise, suggesting a continuing gulf between the wealthiest and the rest, according to polling group Gallup. The estimates, based on interviews with more than 15,000 Americans throughout July, exclude home and vehicle purchases and routine bills to give a picture of discretionary spending, a major fuel for the U.S. economy, Gallup said.

Daily consumer spending has increased among Americans who make $90,000 or more a year, to $190 per day in July from $157 per day in June and $189 in May. But daily spending for the majority of Americans fell slightly to $75 per day from $79 in June, $78 in May and $78 in July 2013.

Spending among Americans earning less than $90,000 a year hasn’t changed much since last year aside from a dip in January when a cold snap chilled shoppers' demand. Overall daily spending has largely rebounded since the $60-$70 range Gallup tracked during and just after the recession from about 2009 to 2011. But that's still below the roughly $100 daily average recorded in early 2008 before the weight of layoffs and payroll cuts squeezed budgets.

“Although there have been some small changes in the month-to-month averages reported by Gallup, the broader trend since early 2012 has been one of increasing consumer spending, which could help fuel economic recovery,” Gallup said in the report.

In June, consumer spending rose for the fifth straight month and at the fastest pace in three months, by 0.4 percent month-over-month compared to a 0.3 percent rise in May, the Commerce Department said last week. Higher prices for non-durable goods accounted for much of the rise. Adjusted for inflation, spending rose 0.2 percent in June. From last year, consumer spending in June (adjusted for inflation) increased by 2.3 percent, in line with after-tax incomes, according to Gus Faucher, senior economist for PNC Financial Services Group.

Consumer spending has been the dominant source of economic growth for the U.S. in recent decades, accounting for nearly 70 percent of economic output, but trends of stagnant incomes, fragile confidence and tight credit could cause U.S. consumer spending to grow more slowly than in the past, according to the Fed.

Chris Christopher, director of consumer economics at IHS Global Insight, forecasts that back-to-school retail sales will be slightly weaker this season compared to last year. "This back-to-school retail season is looking relatively good — just not as strong as last year, growth-wise," he said.

© Copyright IBTimes 2024. All rights reserved.