What's Driving Wall Street Sell-Offs?

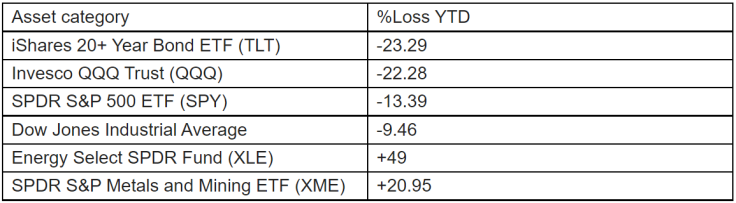

There have been the best and the worst times on Wall Street — to paraphrase Charles Dickens. Unfortunately, the time that has elapsed from the beginning of the year to this week has been the worst in the last couple of years. As a result, investors have been losing money across bonds and stocks. The U.S. Treasury bonds have lost 23.29% of their value year-to-date, the Nasdaq 100 stocks have lost 22.38% and the S&P 500 stocks have lost 13.99%.

There were a couple of exceptions: energy and materials, which were up 49% and 20.95%, respectively. But that trade may be at risk, too, judging from the action on Wall Street on Tuesday, where energy and materials headed south.

Still, the simultaneous decline in both stocks and bonds in such a short time could have a devastating impact on some investors. For instance, investors who held $1,000,000 in U.S. Treasuries at the beginning of the year in their retirement account now hold roughly $770,000, which could spoil their retirement plans. They may have to work longer to make up for the shortfall in their portfolio, which may not be harmful in today's labor shortage in the U.S. economy.

The trouble is that the U.S. economy won't stay in a labor shortage if markets continue to fall at this pace. It will eventually get into a recession, and jobs will be hard to find once again.

"What has been lost or made in the markets depends upon your entry point. It also depends upon the kinds of stocks that are being considered," Robert R Johnson, professor at Creighton University's Heider College of Business, told International Business Times. "In essence, the stock market is a market of diverse stocks. With all the liquidity infused into the markets, stocks with no earnings (and quite frankly, unsustainable business models) were driven to atmospheric valuations — witness the carnage in Cathie Wood's ARRK Innovation Fund and contrast that to Warren Buffett's Berkshire Hathaway. What we are seeing now is a focus on earnings and fundamentals."

What's behind the Wall Street sell-off?

Several things. Top on the list is inflation, which is running at a 30-year high. It has been driving bond prices lower and yields higher as investors demand a premium to compensate them for losing the purchasing power of the money they invest in bonds.

Then, the Fed's announcement that it will begin to liquidate its portfolio of Treasury Bonds and Mortgage-Backed Securities (MBS), beginning in early June, which has added selling pressure in the bond market.

Meanwhile, there is anxiety over the lingering war in Ukraine, adding to selling pressure on the shares of companies with significant global exposure.

And there's anxiety over the continued lockdowns in China, which have slowed down growth in the world's second-largest economy. It's beginning to catch up with the two sectors of Wall Street that have been doing well: energy and materials.

In addition, with the opening trade over, Wall Street seems to be running out of investment themes, as evidenced by the sell-off in leisure and traveling shares last week.

There's also the exit from "crowded trades" or areas of the market where investors have piled funds during the bull market and now are trying to get out at the same time, exacerbating the market sell-off. For instance, Thursday's and Friday's sell-off last week was concentrated in large-cap stocks, which are part of major indexes — like Amazon, Microsoft, Facebook and Netflix.

© Copyright IBTimes 2024. All rights reserved.