Why Salesforce Would Want To Buy ClickSoftware For $1.5 Billion

2018 was the biggest year in Salesforce's (NYSE:CRM) history in more ways than one. Revenue continued to rise at a double-digit clip, hitting new highs; co-founder and longtime CEO Marc Benioff appointed a co-CEO, Keith Block, to share the management burden; and the enterprise software company spent over $7 billion on smaller rivals, its biggest calendar year ever for acquisitions.

Salesforce isn't shy about its aspirations in the cloud-based software world. Buying smaller but complementary competitors is an increasingly important part of that strategy. To that end, the company may be about to make another big purchase -- acquiring privately-held Israeli company ClickSoftware for $1.5 billion -- according to a recent Reuters report that Salesforce neither confirmed nor denied.

Salesforce to the field

If the $1.5 billion valuation figure Reuters cited can be believed, ClickSoftware is a fast-growing business. The software provider was taken private in 2015 for just $438 million by technology private equity firm Francisco Partners.

ClickSoftware provides field service management tools. Salesforce already participates in this market through its Field Service Lightning product -- part of the service cloud segment. Nevertheless, ClickSoftware could be a formidable addition to its arsenal. On its website, ClickSoftware boasts that it is able to save its customers 30% in fuel costs, increase jobs per employee by 29%, and increase same-day repair calls by 65%. Plus, if it does go for more than three times the amount it last sold for in 2015, that would indicate the service provider has been on a tear in the last few years.

Where the puzzle piece fits

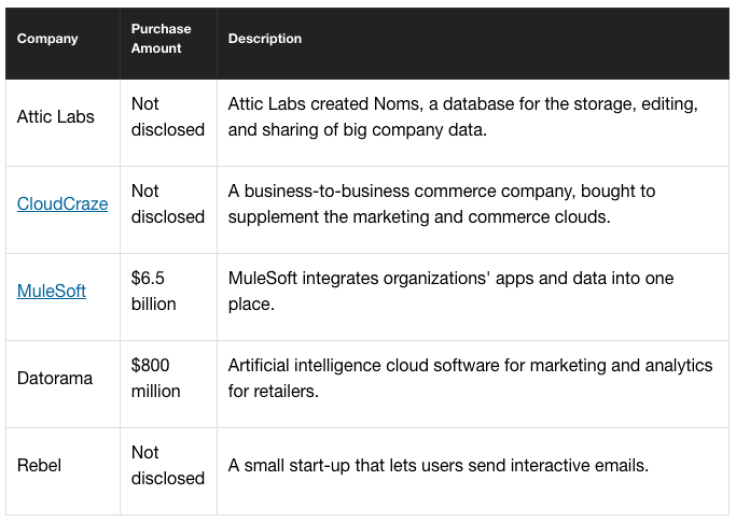

Assuming Salesforce does move forward with the purchase of ClickSoftware, it would be the company's sixth acquisition since the beginning of 2018. If $1.5 billion is the price tag, it would be well under the hefty $6.5 billion paid for MuleSoft, but would still rank as one of the largest acquisitions in Salesforce's history.

That $1.5 billion is a big number, but it will be easy for Salesforce to digest. The company is on track to top $13 billion in revenue for its fiscal year that ends on Jan. 31, 2019. Through the first three quarters of the year, Salesforce achieved an enviable 74.1% gross margin, earning $7.17 billion of gross profit on $9.68 billion of revenue.

But why ClickSoftware? It's a different type of company than Salesforce's other recent acquisitions. It would supplement Salesforce's service cloud, which contributed $917 million in revenue during the third quarter: 29% of the grand total. That was a 24% year-over-year increase -- a fantastic growth rate, but still slightly slower than the company's total revenue increase of 26%.

Perhaps management thinks the service cloud needs a boost, especially considering that the enterprise software market is becoming increasingly crowded. Adding more services also creates cross-sell opportunities for the numerous other services Salesforce offers. Signing new customers is still important, especially overseas, but Salesforce is also relying on getting more revenue from existing customers to drive its growth.

In short, it's no surprise that Salesforce could be about to make another big buy after a busy 2018, nor should it be surprising if it continues to make waves on the acquisition trail in the years to come. If these acquisitions help Salesforce maintain its nearly 30%-a-year growth trajectory, it will more than likely be money well spent.

This article originally appeared in the Motley Fool.

Nicholas Rossolillo and his clients own shares of Salesforce.com. The Motley Fool owns shares of and recommends Salesforce.com. The Motley Fool has a disclosure policy.