Xiaomi's Patent Deal With Qualcomm Could Pave Way For US Rollout -- But Hurdles Remain

Qualcomm signed a key licensing deal with Chinese electronics manufacturer Xiaomi under which Xiaomi can use the chipmaker's 3G and 4G technology in its smartphones. With Xiaomi eager to stem slowing smartphone sales, it may now be equipped to expand more aggressively into foreign markets, including the U.S. But while the licensing agreement is a step in the right direction, it is just one hurdle of many the company will have to overcome if it is to become a truly global brand.

Qualcomm confirmed to International Business Times that Xiaomi is a "global Qualcomm licensee," meaning if the Chinese startup was to launch smartphones outside its core markets in Asia and South America, it would be able to use Qualcomm wireless technology without fear of litigation from the vendor.

“A license from Qualcomm will play an important role in helping us bring the newest and most innovative products to our growing customer base," Xiaomi CEO Lei Jun said in a statement. The company declined to comment specifically on whether it might use the licensing deal to gird international expansion.

Xiaomi Vice President Hugo Bara in April told Bloomberg the company plans to roll out more aggressively in the U.S. in 2016, and that building up its licenses around intellectual property would be an important part of the campaign.

World's Most Valuable Startup

Less than a year ago, Xiaomi was touted as the world's most valuable startup. With a $45 billion valuation, rapidly rising smartphone sales and investors queuing up to fund its continuing growth, the future looked bright for the company. A year later it is still among the world's biggest smartphone manufacturers but the gloss has worn off Xiaomi's glowing reputation somewhat in recent months as it has struggled to maintain high growth in its core markets of China and India.

Xiaomi is the world's fifth biggest smartphone manufacturer despite selling its devices in just a handful of countries, with China and India being by far its most important markets. In China however it has lost the No. 1 spot to Huawei, while in India in the third quarter of 2015, it saw a drop in shipments of 46 percent year-on-year, according to figures from CounterPoint Research, at a time when the overall Indian market grew by 20 percent.

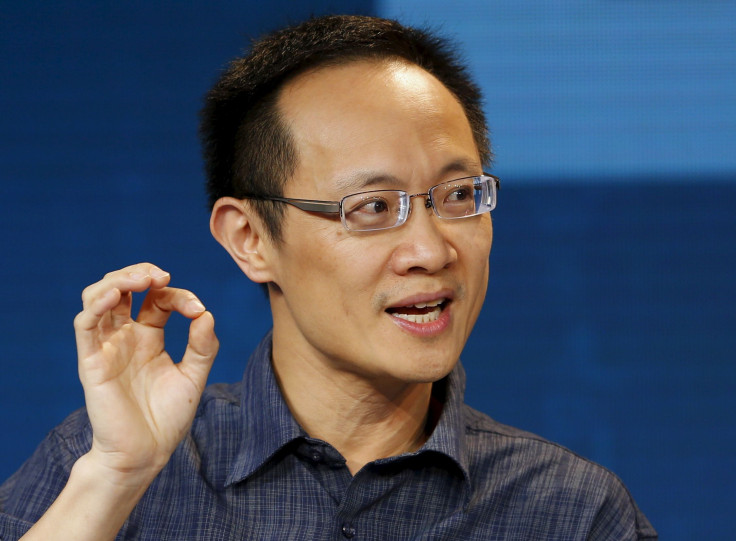

Market watchers now say they believe for Xiaomi to continue to grow, it needs to expand into Western markets like the U.S. and Europe. Company co-founder Bin Lin indicated in October Xiaomi was considering the move -- but simply penning a licensing deal with Qualcomm will not be enough.

"I am not sure if this would actually mean [Xiaomi] could enter the U.S. and the U.K. [markets] as they might face litigation on other infringements, like they are facing in India," Imran Choudhary, an analyst with Worldpanel ComTech told International Business Times. In India Xiaomi was banned from selling some of its smartphones last December after Ericsson claimed the company has infringing its patents.

More Challenges

While that issue related to MediaTek chips it indicates just how challenging it could be for Xiaomi to grow its businesses in markets not as welcoming as its home territory. "Even if Qualcomm and Xiaomi had a full international agreement, Xiaomi could still be challenged on core technology -- particularly on 4G where many others are strong," Ben Wood, an analyst with CCS Insights told IBT.

At the beginning of the year, Xiaomi predicted it would ship 100 million smartphones, a 66 percent increase on the 61 million it sold in 2014. That estimate was trimmed to 80 million later in the year and insiders speaking to Bloomberg recently suggested the company is likely to miss that goal. In a smartphone market that is slowing -- even in China -- Xiaomi needs to go global in 2016 if it wants to remain among the world's biggest smartphone makers. Patent litigation is just one of the challenges Xiaomi is going to face.

"Distribution remains the biggest challenge for Xiaomi in the U.S., where phone sales are dominated by the carriers," said Jan Dawson, an analyst with Jackdaw Research. "Yes, Xiaomi has some intellectual property issues to take care of too, but I think distribution is the bigger barrier to launching in the U.S."

The U.S. smartphone market is dominated by carriers, an industry where Xiaomi has few relationships.

Another Chinese company which has had success in breaking into the U.S. market is ZTE, but it had built up years of relationships with carriers such as Verizon, AT&T and Sprint by supplying them with white-label devices. ZTE used these relationships to successfully launch its own branded devices in the U.S. and it is now the fourth biggest smartphone brand in the country.

Another problem facing Xiaomi's expansion is going to be its iffy relationship with Google. While some of the company's phones do offer Google services (Maps, Search, Gmail and access to the Play Store), those sold in China -- which accounts for the majority of Xiaomi's sales -- don't and as a result it has been able to augment its hardware revenue with sales of content from its own suite of apps.

In countries where smartphone users expect to have access to the millions of apps and games available through the Play Store, Xiaomi will have to strike a deal with Google.

© Copyright IBTimes 2024. All rights reserved.