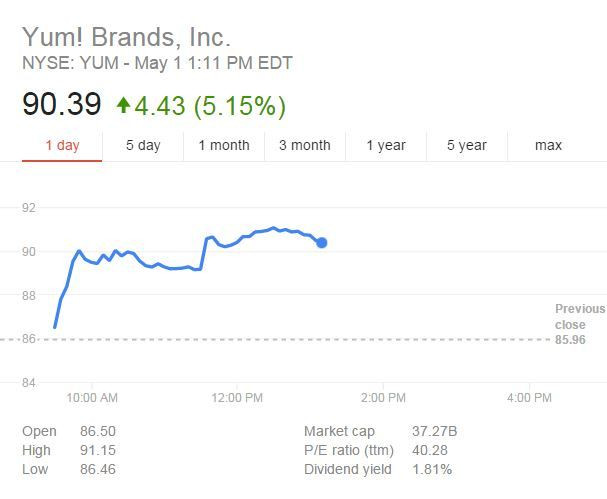

Yum Brands Inc (YUM) Shares Jump 5% After Daniel Loeb's Third Point Hedge Fund Takes 'Significant' Stake

Shares of Yum! Brands Inc. (NYSE:YUM) jumped more than 5 percent Friday to as high as $91.15 after billionaire investor Daniel Loeb's Third Point hedge fund took a “significant” stake in the world's second largest quick service restaurant company. Although Yum Brands, which owns KFC, Taco Bell and Pizza Hut, has struggled recently in China due to two supplier-related food safety incidents, Third Point said the company is “turning the page” and is likely to see dramatic profit recovery in the next few years.

“We initiated our position in the first quarter based on our view that the company was in the early stages of turning the page on recent troubles in its Chinese business,” Third Point said in a letter to investors. The New York-based hedge fund did not disclose its specific stake in the company.

Last week, the fast-food restaurant company’s quarterly earnings topped Wall Street forecasts, but saw its revenue dip as sales in its China division fell 12 percent last quarter. Meanwhile, same-store sales at the company's Kentucky Fried Chicken and Taco Bell divisions grew 5 percent and 6 percent, respectively.

Yum! Brands, which owns some 41,000 restaurants in more than 125 countries, saw overall flat sales at its Pizza Hut locations, with same-store sales declining 6 percent last quarter in China.

However, the company said it has initiated plans to get the business back on track and is on pace to open 2,100 new restaurants this year and plants to expand its already existing presence in emerging markets, such as Asia, Africa and Latin America. The company has opened 294 new restaurants this year, and 88 percent of those opening are in emerging markets.

“With China stabilizing and on the road to recovery, we see scope for significant earnings growth ahead as profits recover in the near to medium term and exceed prior peak in the long-term as the company opens more restaurants to meet the needs of the expanding Chinese middle class,” Third Point said.

For the January-March period, the Louisville, Kentucky, company posted net income of $362 million, or earnings per share of 81 cents, on revenue of $2.72 billion, compared with a profit of $399 million, or earnings per share of 87 cents, on revenue of $2.62 billion in the same period a year earlier.

Yum Brands, which has a market value of more than $37 billion, has seen its shares gain 25 percent this year.

© Copyright IBTimes 2024. All rights reserved.