5 Reasons China’s Banks Won't Have Another Liquidity Crisis In September

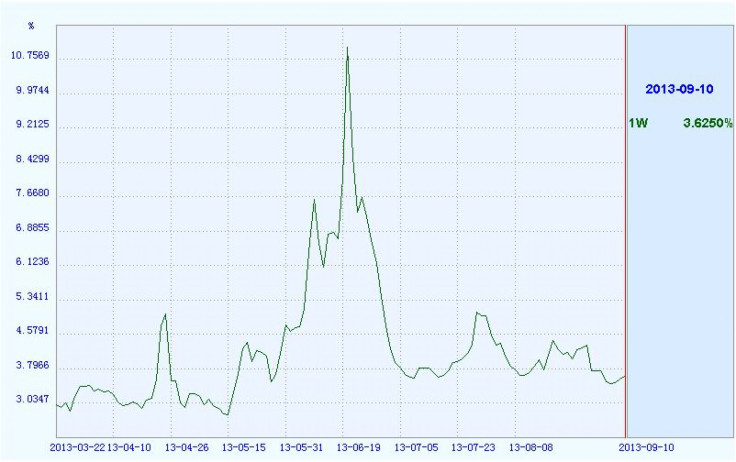

Remember China’s June interbank liquidity squeeze, when the 7-day repo rate shot up to a record-high of 12 percent? Worries that the June SHIBOR (Shanghai interbank offered rate) might be repeated at end-September are overblown, analysts say, even with rising demand for cash ahead of holidays this month and next.

Interbank liquidity has notably eased in early September, with seven-day repo rate, a gauge of funding availability in the banking system, declined to 3.63 percent Tuesday from 4.40 percent on Aug. 29.

However, investors are concerned about liquidity in September because like June, this month is the end of another quarter, when banks scramble for deposits to meet their loan-to-deposit ratio requirements. Consumers, on the other hand, are likely to withdraw deposits to celebrate two holidays: the Mid-Autumn Festival from September 19 to 21, and the week-long Golden Week Holiday in early October.

In addition, on the liquidity supply side, the amount of People’s Bank of China bill and repo coming to maturity is quite small, at 127 billion yuan ($20.75 billion) in September. That’s much lower than the 351 billion in June and will be the lowest amount since April, according to Bank Of America Merrill Lynch economists Xiaojia Zhi and Ting Lu.

Despite these unfavorable factors, Zhi and Lu believe the chance for another credit crunch is extremely small. “It’s extremely unlikely for China to have another interbank liquidity crunch in the near future,” Zhi and Lu wrote in a note to clients, adding that interbank rates might just rise a little to slightly above 4 percent by month-end.

Here’s why, according to Zhi and Lu:

Beijing wants stability. The PBoC, after the embarrassment in June, will closely monitor liquidity conditions and will inject liquidity whenever it's necessary. It’s very clear that the Chinese government led by Premier Li Keqiang put a big emphasis on growth and financial market stability. To achieve the 7.5 percent growth target in 2013, China simply can’t afford another interbank liquidity crunch. Moreover, amid the turmoil of some emerging markets and in the run-up to the very important third Plenary Session of the China Communist Party (CCP), the last thing China’s new leadership want is financial instability.

The PBoC has a deep pocket. It’s important to note that the PBoC has unlimited capability in providing liquidity if there is such a need. Simply put, the Chinese government has both the willingness and capability to deliver a stable interbank market.

FX inflows to pump up liquidity. China's better economic outlook, stable currency, large current account surplus and high savings could make China a safe-haven when some other emerging markets are hit by a possible U.S. QE tapering. Positive signs on FX inflows have emerged recently. The supportive government measures and improving economic data have already boosted market confidence on China. China’s foreign-direct investment growth rebounded strongly in June to 20.1 percent year-over-year and further to 24.1 percent in July, from merely 1.0 percent in the first five months of this year.

Rising fiscal spending. Fiscal spending may jump in September from previous months due both to seasonality and government’s vow to utilize idled fiscal money to stabilize growth. As a result, fiscal deposits at the central bank could drop by at least 400 billion yuan, compared to around 370 billion in both September 2011 and September 2012. This could be an important source of incremental liquidity supply in September.

Better prepared commercial banks. China’s commercial banks have improved their liquidity management significantly and are much better prepared to deal with a possible liquidity squeeze since the June interbank turmoil. They have become more conservative in allocating funds and have set aside more cash to weather a possible liquidity crunch.

© Copyright IBTimes 2024. All rights reserved.