8 Cryptocurrency DeFi Projects to Watch For in May

DeFi is decidedly in right now.

But what is it and does it have mileage?

When it comes to the crypto scene there are only two teams, Decentralized and Centralized. Quite simply, the Centralized way of doing things is with intermediaries or third parties, smack bang in the middle of the equation. For instance in finance, I would go to a broker to take a loan, they would then find me a deal with a financial institution or bank. I would sign loads of paperwork and then get the money (hopefully) into my bank account.

With decentralized finance, there’s no broker, there’s no bank, there’s just me and the lender and I never have to even meet them, and I certainly don't have to sign any paperwork. All the deals done are verified and reconciled on the blockchain, which means no room for human intervention or error. There are many other types of use cases for Decentralized finance, or DeFi as it is known. These include online trading, prediction markets, mortgages, investments and plenty more besides.

According to DeFiPrime, there are currently 232 DeFi projects. This area has seen a massive explosion in the last year. That’s because it is often cheaper, faster and less open to manipulation then the centralized markets. And what’s more, if you trade or invest in DeFi, neither the Fed nor the IRS will be sniffing around your door expecting a cut of your winnings or profit.

The Advantages of DeFi

DeFi is infallible to manipulation, because the blockchain is unmanipulatable. If you do a deal on the blockchain, it stays on the blockchain. For gamers for instance this proves to be a massive advantage, where they can actually be on the same playing field as the casino, without worrying about number manipulation. Another excellent reason for using DeFi is the anonymity and privacy it affords its users. When opening an account with most DeFi projects, you don’t need to provide your bank account or your personal details at all. If you have a crypto wallet, then that is all you need.

DeFi projects open up a huge world of investing opportunities that are just not available to centralized investors. Heard of staking? It is the newest way to use your crypto holdings and to passively get an income from them by locking them inside various projects for the purposes of development or expansion. You can get a generous yield in return (known as APY) that is just not available outside of DeFi.

Let’s go deeper and take a look at some projects that are currently under the radar but are most definitely worth knowing about.

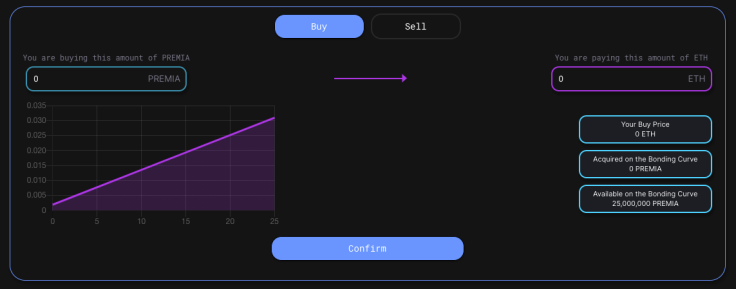

1. Premia

Premia Finance is the foremost platform of its kind, offering traders the ability to manage their risk during trading on the blockchain. Users can hedge their risk in this protocol’s native token positions, and in other tokens, and in the future earn yield for holding their native token. The platform offers options trading with covered call and put options for a variety of different Ethereum and Binance Smart Chain (BSC) tokens.

This innovative decentralized platform is a base for users to trade from and for developers to build on top of.

2. BondAppetit:

BondAppétit, based on the Ethereum blockchain, is a protocol that connects DeFi together with traditional debt instruments (bonds) with the involvement of regulated securities and crypto brokers. It is the first DeFi protocol that has its own stablecoin that is entirely backed by real world assets, with fixed periodic income. It offers a new tool for diversifying risks and for users to get passive income from their bonds. The stablecoin (USDap) is collateralized and always has the value of $1.The protocol is standalone and not tied to any legal entity.

BondAppétit offers a range of features which include:

Utilizing debt obligations (and matching interest payments) to supply cash-flow to governance token liquidity pools.

Incentivization for the community, including dispensation of the profits from the project.

Staking Rewards for holders of BAG token for locking up their holdings for a set time.

The stablecoin is a governance token which bestows full voting rights on the community. Its value grows alongside the profit generated from the project.

The stablecoin is bound to the protocol’s assets.

The protocol currently has $7.78M of total locked value.

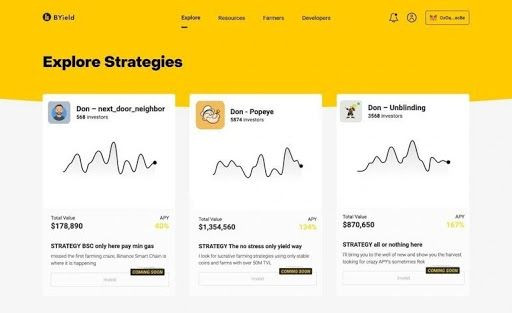

3. Don-key Finance

Don-key finance is a discovery platform that helps users discover the best yield farmers to mimic or follow their strategies instantly.

Yield farming is a full time job, requiring farmers to constantly tweak their strategies, worry about liquidity fees, overall pool performance, network congestion as well as constantly comparing different options in terms of alternative cost.

Don-key was established to simplify yield farming. The platform enables users to discover top performing yield farmers (with proof of historical APY) and to one-click follow their strategies to boost your own yield.

Farmers on the other hand, can get verified and build their own strategy and then create a liquidity pool to allow users to join it. Once the pool is open, users can follow farmer’s yield strategy in exchange to a small fee which the farmer sets.

4. Cook Finance:

Cook Finance is a cross-chain asset management platform that enables investors and asset managers to connect to the DeFi ecosystem in a very innovative way. Users can choose from a selection of strategies offered by fund managers. The interface is user-friendly for investors and it equips fund managers with a variety of robust trading tools.

On the buy side, investors can browse through a selection of secure fund manager allocations and on the sell side, the fund managers have access to a huge selection of investors looking to invest in their strategies without having to open up their strategy details.

Funds on offer can be managed actively by the DeFi optimization protocols or passively. Investors will receive an LP token, which is unique to the fund they are investing in. Investors are able to exchange their token for the corresponding underlying asset.

Other features include, insurance to protect users funds, interoperability across all major blockchains, pricing information from oracle integration with names like Chainlink and Uniswap Oracle, and complete transparency for investors to know what their funds are doing at all times.

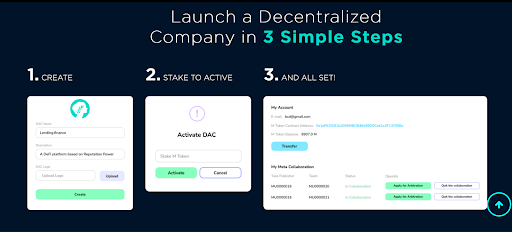

5. MetisDAO:

MetisDao is a Layer2 DAO protocol, which builds up technical and organizational infrastructures to be able to run Web 3.0. In effect it allows anyone to enable users to govern the internet through decentralized smart protocol. Metis allows everyone to benefit from scalability, low gas fees and many other features for easily building their own decentralized projects on the blockchain. It offers a comprehensive solution so that users with absolutely no experience or technical know-how can launch their own decentralized company and manage community operations without having to fret over the complexities of development and deployment. Teams with coding capabilities may use the protocol, APIs, and templates to develop their own decentralized Apps.

6. LiquidiFy:

LiquidiFy offers a decentralized protocol based on smart contracts that enhance the available liquidity and depth of the long tail crypto asset market. Long tail crypto assets are those with low liquidity, low trading volume and generally low market cap. The protocol does this by allowing users to collateralize their crypto holdings through their asset pool. It synthesizes their assets into LAT tokens and LFY tokens. LAT tokens track the value of the long-tail assets locked inside. LFY tokens are reward tokens that give the users passive income from the staking of these tokens.

7. Prophecy:

Prophecy is built from a group of participants that govern the internal economic policy of the Prophecy network, a complete suite of decentralized financial products. It is both a protocol and at its heart sits the native token (PRY). The protocol focuses on creating the most comprehensive monetary policy and unit for the storage and transfer of value which are fair and community governed.

8. Xinfin:

Xinfin is a hybrid Blockchain technology protocol that is focused on international trade and finance. The public/private blockchain offers users the ability to digitize, tokenize and instantly settle trade transactions. This set of features reduces reliance on external FX products, bringing simplicity, and flexibility to users. Xinfin combines the use of a public network, while also meeting needs of both data visibility and auditability for larger institutions, serving the needs for both public and private institutions.

The XDC coin sits at the core of the protocol.The XDC protocol is designed to support smart contracts, and can facilitate 2,000 transactions per second (tps), 2 seconds transaction time, KYC to Masternodes (Validator Nodes), to offer a powerful platform that is suitable for both enterprise and retail use.