90% of Companies Use 'Peer Benchmarking' to Set CEO Pay

Chief executive officers at the nation's largest companies now earn 343 times more than the typical worker, AFL-CIO reported in April -- a pay gap that has widened steadily since the 1970s, when the average CEO earned about 28 times more than a run-of-the-mill employee.

However, pay raises haven't necessarily come as a result of company growth or a boost in profits -- rather, much of the increase has resulted from a now common practice among big-name companies to ensure their CEOs' pay is above the median for their industry.

This increase has occurred despite the fact that worker pay has actually declined and the nation's widespread unemployment, which continues to hover at about 9 percent, according to an investigation by The Washington Post. The concept, known as peer benchmarking, is intended to keep talented bosses from leaving -- even though some of these highly paid bosses may not actually be as talented as their salaries reflect.

For instance, Kevin W. Sharer, the CEO of the biotech company Amgen, earned $21 million in 2010, a 37 percent increase from the year before that made him one of the highest earning chief executives in the industry. Sharer received a pay boost even though Amgen was forced to lay off thousands of workers and shareholders at the company lost 3 percent of their investment that year.

A 2011 regulatory filing from Amgen states that Sharer's pay was increased to meet a compensation value closer to the 75th percentile of the peer group. However, Amgen actually had the second-lowest revenue among the 11 companies it considers to be among its peer group.

The members of the Amgen board are basically just rubber-stampers, Steve Silverman, who owns one of the largest portions of Amgen stock held by a single investor, told The Post. [Sharer] put most of them on the board himself. If he's getting paid too much -- and he certainly is -- they're not going to say so.

Peer Penchmarking: Controversial Policy

Peer benchmarking has been controversial for years, reported the Post, which also wrote about the practice in 2002. Because almost no corporate board will admit that they consider their executive teams to be below average, compensation continues to grow, with no feasible end in sight.

Companies were secretive about how they set their executive pay scale for years, the Post reported. It was only in 2006 that the Securities and Exchange Commission began requiring companies to disclose exactly how they use peer groups to determine executive pay.

Now, researchers believe that about 90 percent of major U.S. corporations use peer benchmarking to make sure their CEO is paid above the median for their industry, regardless of performance.

While corporate executives continue to rake in multimillion-dollar salaries, the U.S. Bureau of Labor Statistics reports that pay for the average non-supervisory worker has fallen by more than 10 percent.

Other fledgling companies have continued to pay their CEOs more even as shareholders continue to lose money. The software company Adobe Systems (ADBE) paid CEO Shantanu Narayen $12.2 million -- after the company's compensation committee insisted she be paid at the 90th percentile of her peers -- in 2010, even though shareholder returns have been negative over the past five years.

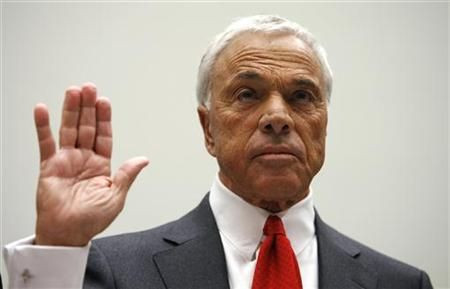

Similarly, Countrywide Financial CEO Angelo Mozilo made more than $180 million over the five-year period preceding the U.S. housing bust, pushing the company toward financial ruin. However, during some of this period, Mozilo's pay was reportedly set at the 90th percentile.

During the five-year period from January 2002 through December 2006, the stock of Countrywide, Merrill Lynch, and Citigroup appreciated, and the three CEOs collectively received more than $460 million in compensation, stated a 2008 memo by Rep. Henry Waxman, D-Calif.

Despite their enormous pay -- which, by the science of peer benchmarking, was justified due to executives' talent -- the three companies managed to lose more than $20 billion during the last two quarters of 2007 alone.

© Copyright IBTimes 2024. All rights reserved.