Activist Hedge Funds Outperform: Goldman Sachs

Activist hedge funds pushing for corporate change have outperformed their more passive brethren, according to a Goldman Sachs Group Inc (NYSE:GS) research note sent out Friday.

“Activist funds have returned 40 percent during the past two years vs. 23 percent for the typical equity hedge fund,” wrote Goldman analysts in a note. They analyzed 778 hedge funds with a combined $1.8 trillion in gross equity positions.

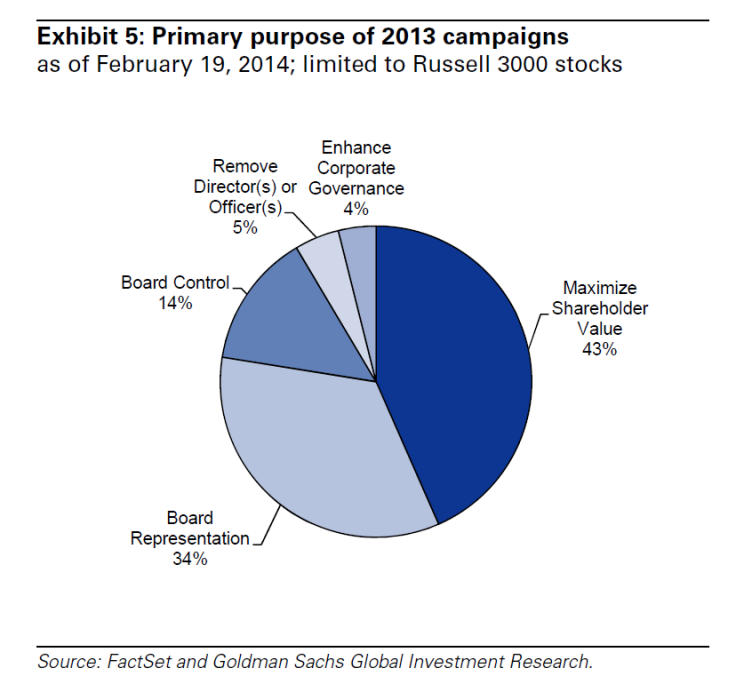

Activist campaigns, where big investors often demand board shuffles or corporate restructuring, have reached their highest level in five years, according to the note.

Twenty-five activist campaigns have been launched thus far in 2014. Hedge funds participated in three quarters of activist campaigns in 2013, the most engagement shown by hedge funds in at least a decade.

The detailed report comes after a broadly unhappy 2013 for hedge funds, which mostly underperformed the market. In 2013, the typical hedge fund posted returns of 9.8 percent relative to the S&P 500’s return of 32 percent, though hedge funds have done slightly better so far this year, said Goldman.

Elite hedge funds returned 41 percent in 2013, though, on Goldman’s measure, even though less than 5 percent of funds beat the market in that year.

Prominent examples of activist investors include billionaire Carl Icahn, Third Point LLC’s Daniel Loeb, and Trian Fund Management’s Nelson Peltz. Companies targeted by these influential investors and others include Apple Inc. (NASDAQ:AAPL) Sony Corporation (TYO:6758), PepsiCo Inc. (NYSE:PEP) and eBay Inc. (NASDAQ:EBAY).

© Copyright IBTimes 2024. All rights reserved.