Africa Outlook: Economists Say The Worst Isn't Over For Falling Sub-Saharan Currencies

Belt-tightening around the world, weaker commodity prices and careless domestic spending are all conspiring to weaken the currencies of sub-Saharan countries for an extended period, analysts said this week.

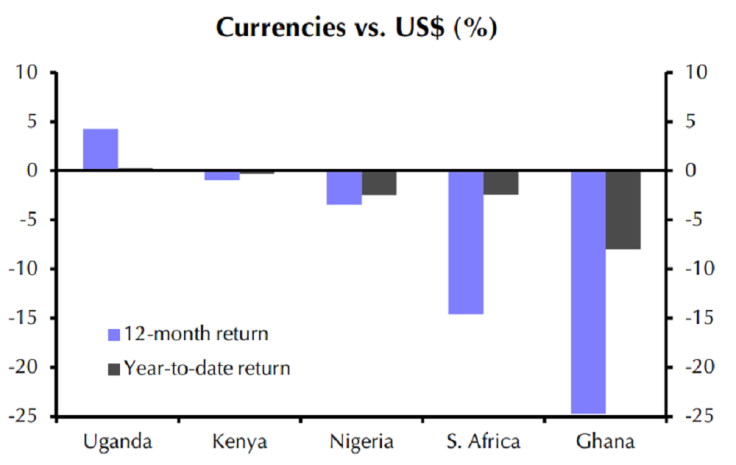

Zambia’s kwacha tumbled to an all-time low this month after currencies in Ghana and Nigeria also suffered. But the worst isn’t over yet as these countries get hit by falling commodity prices and widening deficits.

“The gradual tightening of global monetary conditions, combined with growing domestic vulnerabilities in some countries, mean that currencies across the region are likely to come under further pressure over the coming months,” wrote Shilan Shah, Africa economist at Capital Economics, in a note on Wednesday.

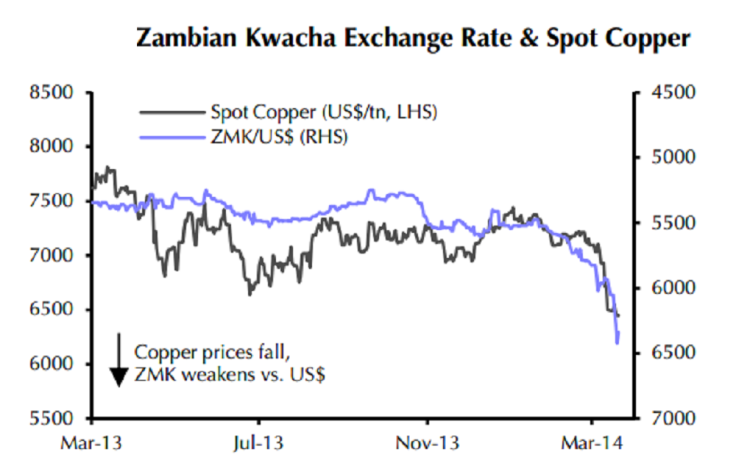

The Zambian currency has been steadily weakening along with global copper prices, which have fallen more than 10 percent in the past month, and 14 percent this year. Copper accounts for 60 percent of Zambian exports, and the country is one of the largest producers in Africa.

Shah wrote earlier that markets based on metal production and exports to China are likely to experience soft growth in the coming months thanks to decreased demand.

But another problem in the sub-Saharan region is widening budget deficits, which suggest that “a number of countries have been living beyond their means,” he said, which is another reason for currency troubles.

Deficits are less a problem when governments spend in public investment, which can boost long-term growth. The rising deficits in Cote d’Ivoire, Uganda and Kenya are mainly due to this type of spending, which makes it less of a concern. Mozambique and Tanzania are also running large deficits, but since they’re largely funded by foreign direct investment, their currencies will likely be more stable.

However, Shah warns, “the countries most likely to experience market pressure or a slowdown in growth are those that have seen a rapid increase in government current expenditure.”

The deficits of Nigeria, Ghana and Zambia are a prime example. Governments are spending more money on wages and subsidies than long-term investments.

“It is notable that public investment as a share of GDP has actually fallen in Ghana and Nigeria. And in Zambia, the rise in investment accounts for less than half of the widening in its budget deficit,” Shah wrote.

This is having an impact on currencies.

The Ghanaian cedi has fallen more than 25 percent against the U.S. dollar in 12 months, reaching a record low along with Nigeria’s naira.

© Copyright IBTimes 2024. All rights reserved.