After Dominating The Holidays, iRobot Looks Forward To Non-Roomba Growth

iRobot (NASDAQ:IRBT) released fourth-quarter 2018 results on Wednesday after the market closed, highlighting better-than-expected growth during the lucrative holiday season, an encouraging legal victory, and plans for diversifying its product base, manufacturing, and supply chain.

With shares up 12% in after-hours trading as of this writing, let's have a closer look at how iRobot ended 2018, and what investors can expect in the coming quarters.

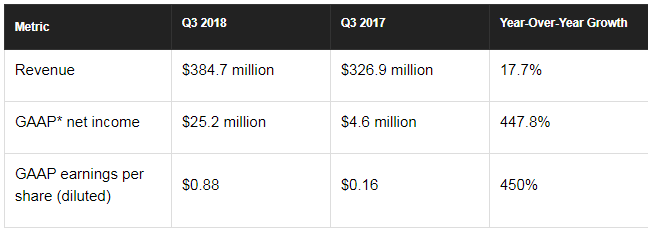

iRobot results: The raw numbers

What happened with iRobot this quarter?

- For comparison purposes, keep in mind last year's fourth quarter included a negative-$0.41-per-share impact from tax reform law, as well as a $0.03-per-share discrete tax benefit related to stock-based compensation. This quarter included a $0.04-per-share tax benefit related to stock-based compensation.

- This quarter's performance brought full-year 2018 revenue to $1.093 billion, operating income to $105.8 million, and net income to $88 million, or $3.18 per share. By comparison, iRobot's latest guidance, provided in October, called for lower 2018 revenue of $1.09 billion, operating income of $92 million to $96 million, and net income per share of $2.55 to $2.75.

- Quarterly adjusted EBITDA grew 8.9% year over year, to $46.5 million, and gross margin expanded 150 basis points to 48.5%.

- Domestic revenue climbed 18% year over year to $215.4 million, driven by "substantial demand" for iRobot's new Roomba i7 and i7+ models.

- International sales climbed 17.3% to $169.3 million, including 25% growth in Braava robot sales in Japan thanks to a new national television marketing campaign in the country.

- Last week, iRobot unveiled Terra, its first Robotic lawn mower.

- In December, iRobot received a final positive ruling from the U.S. International Trade Commission in its ongoing patent-infringement case against several competitors in the robotic-vacuum market.

What management had to say

iRobot Chairman and CEO Colin Angle called it a "phenomenal finish to 2018," noting that the company grew revenue 24% for the full year despite increasing competition, and generated operating margin of almost 10% even after absorbing the impact of tariffs on products imported to the U.S. from China in the fourth quarter.

Angle added:

This year we will continue on a growth diversification journey, focusing on driving growth of non-Roomba products, as well as supply chain and manufacturing diversification for longer-term production stability. We will introduce a new category of robot, the iRobot Terra, our revolutionary autonomous lawn mower, and engage a contract manufacturer outside of China to produce several Roomba robots, beginning in 2019. We will do so while continuing our investment in innovation to extend our technology and product leadership, drive further adoption of both Roomba and Braava robots, and introduce several additional new products mid-year. [...] While we are navigating uncharted waters with the current tariff uncertainty, we expect our global business to deliver strong financial performance in 2019 that will in turn fund critical investments in future technologies and marketing, to further solidify our position as the unambiguous leader in robotic floor care.

Looking forward

For the full year of 2019, iRobot expects revenue in the range of $1.28 billion to $1.31 billion, up 17% to 20% from 2018, with operating income of $108 million to $118 million, and earnings per share of $3.00 to $3.25. For perspective, and though we don't usually pay close attention to Wall Street's demands, most analysts were modeling 2019 earnings of just $2.88 per share on revenue near the low end of iRobot's guidance range.

What's more, looking out to 2020 -- and including the impact of tariffs, as they're currently proposed -- iRobot is targeting a three-year compound annual growth rate of roughly 19%, with gross margin of 48% and operating margin expanding to 10%.

In the end, from iRobot's relative outperformance in the fourth quarter to its new robotic lawn mower, its plans to diversify manufacturing and supply chain partners to reduce the impact of tariffs, and its strong outlook in the meantime, there was nothing not to love about this report from a shareholder's perspective. And iRobot stock is responding in kind.

This article originally appeared in the Motley Fool.

Steve Symington owns shares of iRobot. The Motley Fool owns shares of and recommends iRobot. The Motley Fool has a disclosure policy.