After Playing Wage Catch-up, U.S. Firms May Have Found Their Footing

At the worst of the pandemic labor crunch, convenience store chain Sprint Mart struggled to staff its shops across the southern U.S. as available workers drifted to the higher wages Amazon.com Inc offered at its fulfillment centers or opted for flexible gig economy jobs.

It took two years, sequential wage hikes totaling 20%-30%, and new pick-your-own-schedule software, but Sprint Mart human resources chief Chris McKinney said the Mississippi-based firm has rounded the corner, with headcount stable at around 1,400 and enough applications in the pipeline to account for turnover.

"We started gaining traction six to nine months back, returning to where we felt we need to be," after staffing dipped as low as 1,100, he said. "We are getting the applications, and we are in a mode right now that we aren't chasing a never-ending increase in hourly wages."

In the Federal Reserve's quest to tame inflation and find a stopping point for interest rate increases, few dynamics will be as important as what played out in Sprint Mart's drive to coax workers back to the sort of front-line service jobs hit hardest by the pandemic.

Graphic: Wages gains slow

Fed officials, chief among them Chair Jerome Powell, have singled out hiring and wage trends in the broad service sector as central to their outlook for inflation and, therefore, monetary policy. While there is disagreement about the degree to which wage increases directly influence price hikes, Powell in particular has said the recent pace of wage growth - anywhere from 4.4% to over 6% annually according to two common measures - is inconsistent with the Fed's inflation mandate.

That target is defined as a 2% annual increase in the Personal Consumption Expenditures price index, which as of January was rising at a 5.4% annual rate.

Powell this week will deliver his semiannual report to Congress on monetary policy and the economy, testifying before the Senate Banking Committee on Tuesday and House Financial Services Committee on Wednesday.

If Sprint Mart's experience is any indication, the situation may be slowly improving in the Fed's favor as companies bit-by-bit finish the wage, benefit and working-condition adjustments needed to stay competitive in the post-pandemic economy and, as McKinney put it, "ease off the gas."

Businesses "are looking to have more workers than fewer. That is a general proposition," Atlanta Fed President Raphael Bostic told reporters last week. Yet they also "expect to ratchet down the pace of wage increases and eventually expect it to normalize...We are hearing a great consensus that this is still in catch-up mode and that it will attenuate."

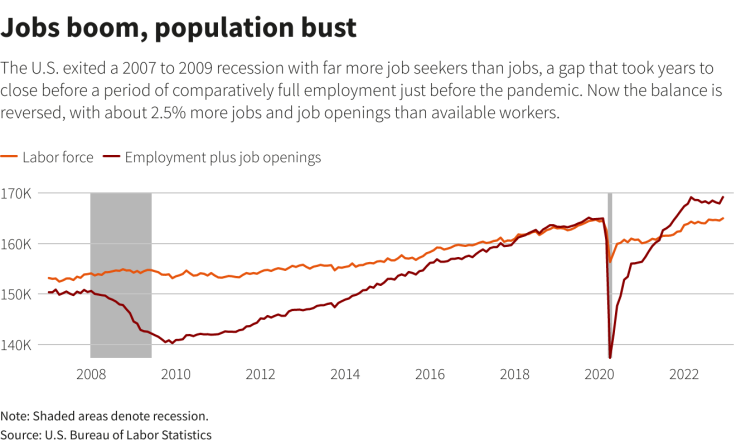

Graphic: Jobs boom, population bust

'TENTATIVE SIGNS'

While the job market overall remains tight, with millions more workers needed than are available, Atlanta Fed Vice President and Senior Economist Jon Willis said recent data and surveys show good reasons to think wage growth will keep slowing.

After pandemic-era adjustments, companies "are very much aware that they do not want to get wages too much out of alignment with long-term plans," he said. Data like a recent jump in those choosing part-time work suggests firms are using flexibility on hours and other incentives short of higher wages to attract employees.

Upcoming data will tell the tale more fully, including the latest federal survey on job openings and layoffs released Wednesday, followed Friday by an employment report for February that will include an update on wage growth.

Like Willis, private economists and analysts at payroll firms and staffing companies also see a labor market that is stressed but adjusting.

A recent Goldman Sachs study concluded wage growth should continue slowing even with the current low unemployment rate of 3.4%. Once pandemic-related changes are completed, companies won't have to perpetually ratchet worker incentives beyond the new baseline, Goldman Sachs economist Manuel Abecasis wrote. Between lower inflation, a slow but steady drop in job openings, and a wrapping up of pandemic adjustments, wage growth should fall by the end of next year to the 3.5% annual rate considered more consistent with the Fed's inflation goals.

Fed officials at their Jan. 31-Feb. 1 meeting appeared to generally agree there were "tentative signs" hiring was getting easier and growth in employment costs was slowing, meeting minutes showed.

A blowout 517,000 new jobs added in January raised some concerns that the economy remained too hot. But even that came with slowing wage growth, and the gain was amplified by seasonal adjustments used to factor out expected swings in hiring during holidays and summer. Firms apparently retained more holiday staff than usual, which may mute future seasonal hiring and bring the labor market closer to balance.

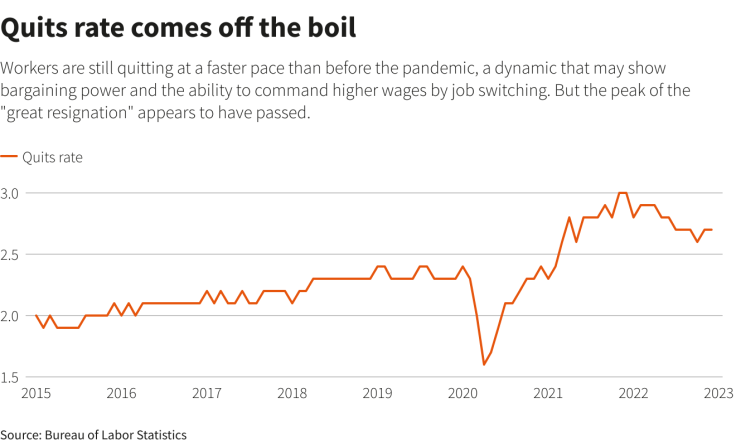

Graphic: Quits rate comes off the boil

PICKING UP THE SLACK

An index of job openings from hiring firm Indeed remains above pre-pandemic levels, but has been trending down. The closely watched "quits" rate, considered a proxy for the overall strength of the labor market, has been falling for about a year even as it remains above pre-pandemic levels.

There also have been high-profile layoffs. But while rounds of firing at companies like Alphabet Inc's Google and Facebook-parent Meta Platforms have roiled the tech industry, other firms are picking up the slack.

"It's not a big surprise that larger companies are the ones doing layoffs. They overachieved" during the pandemic, said Dave Gilbertson, vice president of payroll provider UKG. The company's analysis showed time clock punches at firms of more than 5,000 dropped 3% in January.

By contrast firms in the 50 to 250 employee range, often strong contributors to U.S. job growth, accounted for more than half of average net hiring over the three months ending in December, the largest share since the start of the pandemic, according to federal job openings and hiring data.

Nela Richardson, chief economist at payroll processor ADP, said even as economy-wide hiring remains strong, the tech layoffs may be helping mute overall wage growth.

ADP information shows the median tech sector salary is in decline, with layoffs adding to the available worker pool. A drop she has seen in overall job turnover rates likely also means less worker bargaining power than earlier in the pandemic.

"If that is a trend...we would expect there would be less drive for wage growth," she said.

© Copyright Thomson Reuters 2024. All rights reserved.