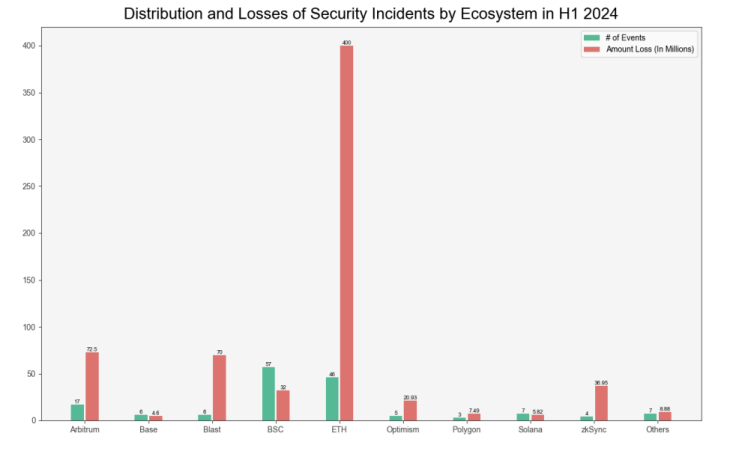

Ahead Of ETH ETFs Launch, Ethereum Led H1 2024 Security-Related Losses

KEY POINTS

- Arbitrum's losses of $72 million paled in comparison to Ethereum's $400 million in security losses

- Ethereum-based PlayDapp lost $293M in a span of two days to a private key exploit

- Ether users are waiting for the SEC to fully approve spot ETH ETFs

Security-related incidents such as frauds and scams continued to pester the cryptocurrency industry in the first half of the year, and among the different chains catering to various digital assets, Ethereum suffered the highest losses, a new blockchain security report revealed.

Blockchain security analytics firm SlowMist said in its 2024 Mid-year Blockchain Security and AML Report published Monday that the Ethereum blockchain suffered the highest losses in H1 with some $400 million lost to security incidents. It was the only chain that exceeded the hundred-million line in terms of security losses in the said period.

Arbitrum incurred losses of over $72 million, the Blast network lost approximately $70 million, and Binance Smart Chain (BSC) saw losses of $32.12 million. BSC suffered the highest number of security incidents (57), compared to Ethereum's 46 incidents.

So far in 2024, there have been a total of 223 incidents with total losses reaching as high as $1.43 billion, according to the report. SlowMist noted that its report has not yet included "personal losses in statistics."

One of the key incidents noted in the report was the attack into Ethereum-based gaming platform PlayDapp, wherein the exploiter took advantage of a leaked private key and implemented unauthorized minting of 200 million $PLA tokens worth over $36 million. The PlayDapp team tried to negotiate with the hacker by offering a $1 million white hat bounty but negotiations fell through. Two days after the attack, another 1.59 billion $PLA coins worth nearly $254 million were minted and dispersed across various wallets and crypto trading platforms.

News of the report's findings comes at a critical time in the Ethereum ecosystem's journey toward potential mainstream adoption. Users of Ether ($ETH), the blockchain network's native cryptocurrency, are waiting on the U.S. Securities and Exchange Commission (SEC) to fully approve spot ETH exchange-traded funds (ETFs) before the ETFs go live.

Industry experts and analysts are expecting the funds to be approved sometime after the holiday, considering some delay in the regulator's provision of comments to applying issuers. The SEC has also yet to clarify Ether's status as a commodity or a security.

Compared to the journey of Bitcoin, the world's top digital asset by market value, $ETH has had a slower and more rugged path up. $BTC hit a new all-time high of $73,000 in March, while Ether has been trading above $3,000.

On the other hand, hopes climbed for Ethereum to finally shine after the SEC partially approved spot ETH ETFs and dropped its investigation into the blockchain.

© Copyright IBTimes 2024. All rights reserved.