Alibaba Files For IPO: Chinese E-Commerce Giant Made $5.5 Billion In Revenue In 2013

Alibaba Group Holding Ltd., China’s largest e-commerce website, officially filed for its U.S. initial public offering on Tuesday and confirmed what many have suspected: that the giant company has the potential to become the most valuable U.S. IPO of all time.

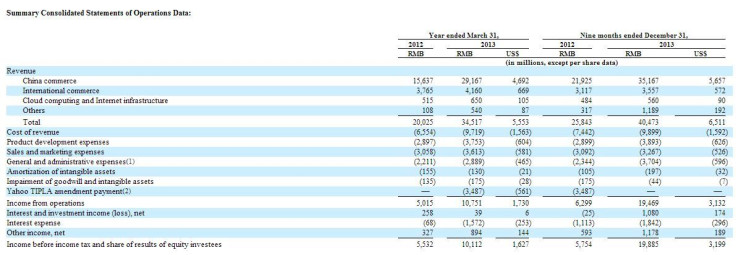

According to an F-1 document filed with SEC, which gave the first official look into the company’s finances, Alibaba made $5.55 billion in revenue in 2013, and total revenue was $1.6 billion. The company makes its money primarily by charging commission on a number of online marketplaces. It's biggest three are Taobao, a consumer-to-consumer platform; Tmall, which allows brands to sell directly to Chinese consumers; and Juhuasuan, a group-buying platform that Alibaba claims is the most popular in China.

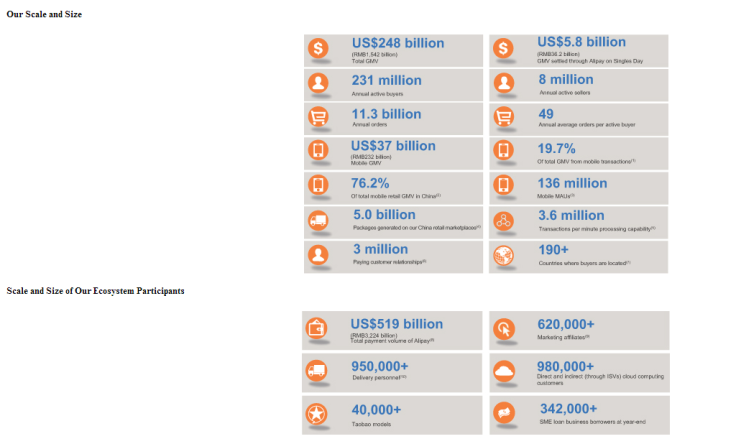

Below is a graphic from Alibaba revealing more information about the company's size and growth, as well as a screenshot from the SEC document showing the company's revenue.

In the nine months that ended Dec. 21, 2013, Alibaba's revenue was more than $6.5 billion, a 57 percent year-over-year increase. Net income in that same period inreased 305 percent to $2.9 billion.

The company did not specify how many shares it would offer, but Bloomberg said that Alibaba is looking to sell about 12 percent of the company. Alibaba stated that it's looking to raise $1 billion with its IPO, but most believe that number to be a temporary place holder. Many analysts expect the company could raise as much as $20 billion with the IPO, which would beat Visa’s $19.65 billion IPO in 2008 as the largest of all time.

The document also revealed that Jack Ma, the former English teacher who created Alibaba, owns 8.9 percent of the company. Alibaba reported that it has 231 million active buyers that place an average of 49 orders every year for a total of 11.3 annual orders.

Alibaba has not yet decided on a stock ticker, nor did it state whether it would list on the New York Stock Exchange or Nasdaq.

You can read the full F-1 form here.

© Copyright IBTimes 2024. All rights reserved.