Alibaba IPO Winners: SoftBank, Jack Ma And The Bankers

The Alibaba IPO has been the gift that keeps on giving.

The Chinese e-commerce behemoth raised a record $25 billion when it started trading on Friday. Under the ticker “BABA” its stock soared 38 percent, inspiring underwriters to sell another 48 million shares -- netting themselves an extra $300 million, according to Reuters.

One of the reasons it did so well was a small group of big investors. As Bloomberg reports, nearly half of all the shares were placed with just 25 funds that include Fidelity Investments, BlackRock Inc., and T.Rowe Price Group Inc.

After an initial spike to $98.99 per share on Friday, BABA was trading at $91.96 on Monday morning.

Alibaba head Jack Ma, a 50-year-old former schoolteacher, saw his net worth increase to $26.5 billion along with shares. He’s the richest man in China, and the 23rd richest person in the world, according to the Bloomberg Billionaires Index.

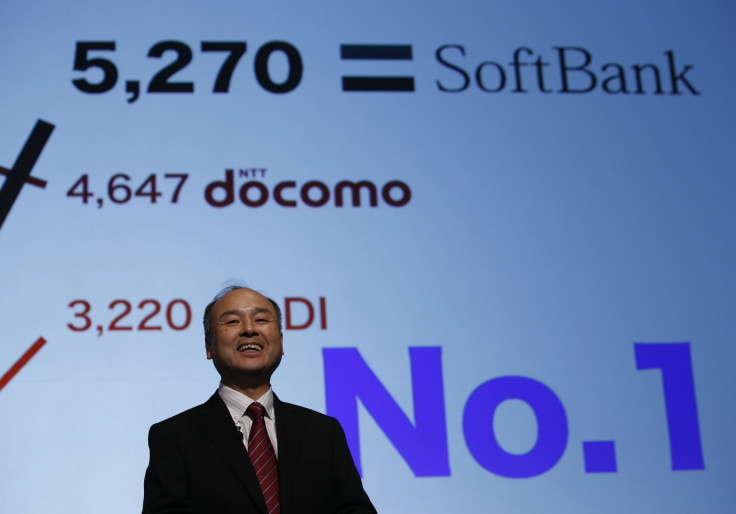

Japanese firm SoftBank Corp., which has a 32 percent stake in Alibaba, said it expected a $4.6 billion boost after the IPO.

“This is not the end. This is the beginning. This is the beginning of Alibaba,” SoftBank head Masayoshi Son, the richest man in Japan, told CNBC.

Like other investors in Alibaba, Son expressed hopes that the company will grow along with China’s massive economy.

“China is still going to grow. Penetration is low. The e-commerce is going to grow.”

The second-biggest IPO globally was Agricultural Bank of China Ltd, which raised $22.1 billion in 2010. In 2008, Visa Inc. was the largest in the United States, at $19.7 billion. Alibaba’s one-day move is the largest for any IPO over $10 billion.

On the other hand, Yahoo! Inc. saw its stock plunge 6.8 percent on Friday after months of growth thanks to investors betting on its 22 percent stake in Alibaba.

“There’s a consensus in the market that core Yahoo business isn’t valued very highly,” Wedbush Securities analyst Gil Luria told International Business Times in advance of the IPO. "Once investors can buy Alibaba directly, and assuming there won't be any arbitrage, that could limit demand for Yahoo."

© Copyright IBTimes 2024. All rights reserved.