Amazon Is Catching Up To Google In Search-Based Ads

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) subsidiary Google and Facebook dominate the U.S. digital advertising market. Google could claim 36.2% of that market this year, according to eMarketer, as Facebook grabs 19.2%.

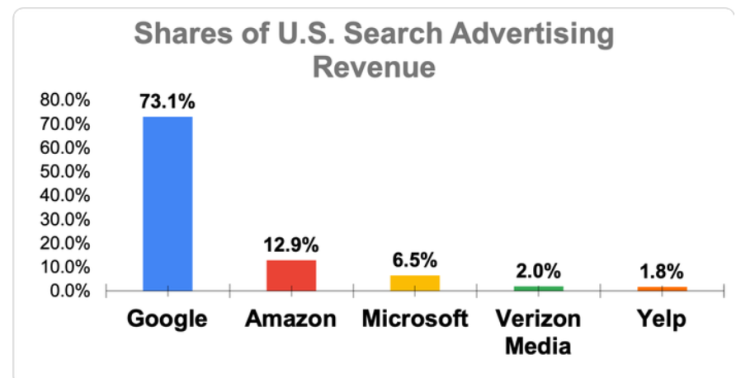

In search-based ads, Google rules the market with a 73.1% share, according to a recent eMarketer report, but Amazon (NASDAQ:AMZN) ranks second with 12.9%. The firm believes Amazon's share will rise to 15.9% by 2021 as Google's slips to 70.5%.

eMarketer also expects Amazon's search business to grow nearly 30% this year and boost its search revenue to $7.09 billion, or 2.5% of its total estimated revenue. Amazon already surpassed Microsoft as the third-largest digital ad platform in the U.S. last year.

Amazon's advertising business is growing because most U.S. internet users start their product searches on Amazon instead of Google. The Seattle-based tech giant leverages that lead, along with its e-commerce muscle, to sell more ads.

Advertisers are drawn to Amazon because they can craft better-targeted ads with its shopper data while dealing with fewer privacy concerns than Google and Facebook. In short, Amazon's advertising segment could soon become a core growth engine alongside its e-commerce and cloud businesses.

This article originally appeared in the Motley Fool.

Leo Sun owns shares of Amazon and Facebook. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Facebook, and Microsoft and recommends the following options: long January 2021 $85 calls on Microsoft. The Motley Fool has a disclosure policy.