Amazon Is Not FedEx's Biggest Problem

The news that FedEx (NYSE:FDX) Express isn't renewing a contract with Amazon.com (NASDAQ:AMZN) has given new wind to the thesis that the online shopping giant presents a real threat to package delivery companies UPS (NYSE:UPS) and FedEx. After all, there's strong evidence to suggest that when Amazon enters an industry, it creates margin pressures on industry incumbents. But the reality is that FedEx has more pressing problems to worry about than Amazon. Let's take a closer look.

Why FedEx Express ditched Amazon

Starting with the Amazon decision, it's worth noting that it only relates to Express and not any other contracts FedEx has with Amazon. Moreover, FedEx's management has long pointed out that the e-commerce giant isn't actually its biggest single client -- in fact, it was only responsible for less than 1.3% of total FedEx revenue in 2018.

Furthermore, there's a wide e-commerce world out there beyond Amazon. As the FedEx statement regarding the Amazon contract said, "There is significant demand and opportunity for growth in e-commerce which is expected to grow from 50 million to 100 million packages a day in the U.S. by 2026."

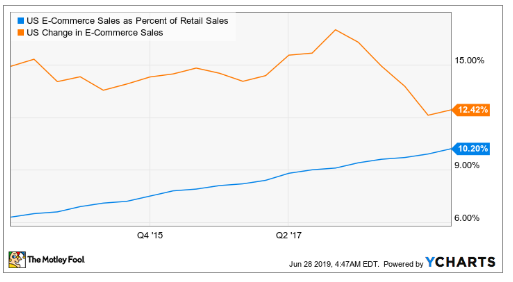

It's not hard to see that FedEx is probably right. E-commerce sales in the U.S. continue to grow at a mid-teens clip, and if they continue at the same rate then they will double in six years.

As a reflection of the opportunities available to FedEx, the company recently made a strategic alliance with Dollar General (NYSE:DG) to offer FedEx drop-off and pickup services in thousands of Dollar General stores. FedEx has similar arrangements with retailers like Walgreens and Walmart. All told, Amazon is important, but FedEx has plenty of other e-commerce growth opportunities available to it.

As to the question of whether Amazon offers some sort of existential threat to UPS or FedEx, the reality is that replicating the kind of networks the package delivery giants already have simply isn't in the cards for Amazon. In a sign of just how onerous it would be to do so, FedEx and UPS are both having to invest billions in their networks in order to support e-commerce growth.

When FedEx President Raj Subramaniam discussed the media's focus on so-called last-mile deliveries on the third-quarter earnings call, he said, "[V]ery few people think about the first few thousand miles. When you see a FedEx truck on the road, it not only is carrying those local last mile shipments but also the other shipments that have originated from all parts of the globe creating density for last mile delivery and higher revenue per stock."

Amazon is highly unlikely to be willing or able to replicate such a dense global network.

FedEx's real challenges

There are two of them. Specifically, ensuring the profitability of e-commerce deliveries, and the ongoing integration of TNT Express.

In reality, the problem isn't one of end demand for e-commerce deliveries, so losing Amazon's FedEx Express business won't have a significant impact beyond the near-term. The problem is actually ensuring e-commerce deliveries are profitable. In addition, UPS and FedEx have both taken hits to profitability due to the difficulty of meeting peak demand periods during the holiday season.

In this context, the decision not to renew the Amazon contract probably comes down to being selective about e-commerce deliveries rather than taking a shot across the bow at a potential rival. UPS continues to work with Amazon in a mutually beneficial relationship.

As discussed above, FedEx and UPS are both investing heavily in their networks, and this means earnings and cash flow will be constrained in the near term. The key question is what they will look like for FedEx after what management describes as a transitional 2020.

Unfortunately, the TNT Express integration continues to pose problems. The acquisition looked problematic from the start, not least because TNT was already in the middle of a major transformation intended to win back customers and improve margin when FedEx bought the business in 2016.

Throw in the NotPetya cyber attack in 2017 and its impact on TNT Express -- FedEx CEO Fred Smith believed it would have bankrupted TNT had it been a stand-alone company -- and it's clear that the acquisition integration hasn't progressed as originally intended. The issue is that TNT Express lost clients as a consequence of the cyber attack, which caused a shift in TNT's product mix toward lower-margin freight deliveries. Consequently, FedEx was forced to back off its forecast for FedEx Express operating income to increase by $1.2 billion-$1.5 billion from 2017 to 2020.

Stop worrying about Amazon

All told, the Amazon threat is not really the big issue that FedEx investors should be following. Instead, the TNT Express integration and the company's transformational efforts are arguably much more important. It's going to take time for these matters to become clear.

Analysts have FedEx's EPS rising mid-single digits in its fiscal 2020, and picking up to high-single-digit growth in fiscal 2021. FedEx is definitely a stock for more patient minded investors.

This article originally appeared in the Motley Fool.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon and FedEx. The Motley Fool has a disclosure policy.