Is Amazon.com’s Pull-Back a Buy Opportunity? - Stock Review

ANALYSIS

The shares of Amazon.com (AMZN) first discussed here on Oct. 3, 2011 at a price of $211.98, have pulled back, dropping below key, psychological support at $200, and already the nay-sayers are out.

And that investor response is typical amid today's uncertain economic conditions. Still, I just put the response in the category of fraidy cat money, and I view the pull-back as a buy opportunity, if you can tolerate moderate risk. Here's why:

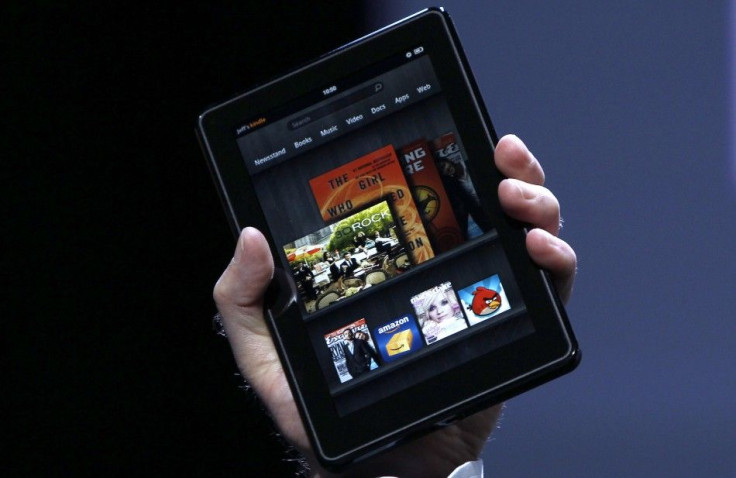

Amazon.com's Kindle Fire tablet has revitalized the tablet segment, primarily via pricing, but that's hardly a transgression in U.S. commerce.

A Renaissance In Tech

According to my analysis, we're looking at a renaissance in tech -- one in which a variety of devices in tech, from several suppliers, raises the profile of the value and utility of the gadgets -- including introducing a new segment of society to the products. Amazon is part of the mix and that bodes well for the stock, long-term, in my interpretation.

Amazon's (AMZN) new Kindle Fire tablet, like the launch of Apple's (AAPL) iPhone 4s, has created a buzz around Amazon's stock, and higher trading volume over the last four months reflect that increased interest.

Amazon's shares traded Tuesday afternoon down $2.88 to $193.36.

Look for Amazon's revenue to surge 40-45 percent in 2011 to $46.8 billion, after a similar 40 percent gargantuan gain in 2010, largely driven by market share gains, international expansion, and equally significant, new hardware products, including the Kindle Fire tablet.

Meanwhile, margins in 2011 will decrease, due to competitive pressures, offset partially by third-party sales.

To be sure, the new Kindle Fire tablet, listed at a bargain-basement price, will not displace the Apple's iPad, but it will lay the groundwork for a more-sophisticated tablet device. For now, Kindle Fire's major selling point will continue to be content, with the company continuing to derive a healthy revenue stream from the product's staple ebooks -- Amazon has millions of ebooks. The device will also likely be streaming video and music capable, able to receive apps, and contain a Web browser.

Amazon is calculating that its Kinder Fire will offer enough of a content experience to lure potential iPadbuyers who are not thrilled about plunking down $499 for a tablet device.

Amazon.com: An Online Retail Standout

Outside of Kindle Fire, Amazon's unique business model continues to impress investors. The online bookstore that's forced the closure of many brick-and-mortar bookstores, Amazon has wowed analysts with its successful expansion in to electronics, movies, music, games, toys, apparel, and shoes, among other categories.

What's more, Amazon has an enviable long-term plan, investing in Amazon Prime, Kindle/Kindle Fire and digital content.

A strong balance sheet, long-term customer relationships, and online business acumen practically say buy on a dip from an investment standpoint, regarding AMZN.

The Thomson Reuters First Call FY2011/FY2012 EPS estimates for AMZN are $1.26 and $2.11, and each EPS estimate looks about 10 percent low, according to my analysis.

Technical Statistics: Technically, as noted, the 2011 uptrend in Amazon's shares ran into turbulence in the autumn. Amazon's stock slid in volatile fashion from about $246 in October to about $180 in late November. Further, the recent move to the $195 range can be interpreted as a correction in the bear move, and the stock also has to overcome major psychological resistance at $200. Even so, the uptrend remains intact and I still see Amazon trading above $250 by early 2012 and vectoring toward $300 by the end of 2012. That's down from my earlier $325 high in 2012, but still a hefty increase from the $211.98 buy price.

Stock Category: AMZN is ideal for investors who want a growth company with plenty of upside potential. Don't expect a calm ride up to higher levels, however. There's only a 10 percent chance you'll lose your entire investment with AT&T over a 10-year period. There is no dividend.

2012 Outlook: I view AMZN as a long-term play, but if you're looking to sell AMZN within the year, it's probably best to take your profits after it rises to $240-249, if it fails to rise above $250.

Stock Analysis: Amazon.com is a moderate-risk stock. If an investor has already purchased the company's shares, I'd hold them. If not, I'd consider buying a 50% position in AMZN now. Under any circumstance, I wouldn't buy more than 75% of my AMZN position before March 2012 and I'd put a sell/stop loss at: $140.

- -

Disclosure: L.C. Jacobs of New York, N.Y. reviews stocks on a quarterly, semi-annual, and annual basis.

L.C. Jacobs has no positions in stocks reviewed, but does own federal, municipal, and corporate bonds.

To see additional stock reviews by L.C. Jacobs, click here.

To contact L.C. Jacobs about this stock review, write to: stockreview@mail.com.

- -

© Copyright IBTimes 2024. All rights reserved.