AMD’s Operating Earnings Beat Estimates Despite Overall Loss

Advanced Micro Devices (NYSE: AMD), the No. 2 microprocessor developer, reported first-quarter operating income that beat estimates, despite posting a net loss on one-time charges, as revenue rose more than expected.

The results could be the first signs the Sunnyvale, Calif., company is seeing the fruits of new management and shedding its capital-intensive semiconductor fabrication plants,

AMD said first-quarter operating earnings were $138 million, or 12 cents a share, about 4 cents above the estimates. Revenue, essentially flat with last year, was $1.61 billion, compared with expectations of $1.56 billion.

AMD delivered solid results in the first quarter, said new CEO Rory Read, who assumed his job only last August.

Nevertheless, the company reported a net loss of $590 million, or 80 cents a share, for one-time events including divesting its chip lines to GlobalFoundries of Abu Dhabi and acquiring private SeaMicro, a manufacturer of low-power chips for advanced servers.

The optimism about AMD has helped send its shares up nearly 50 percent this year. They closed Thursday at $7.97 but rose another 2 percent, to $8.12, after hours.

With a market capitalization of only $5.57 billion, compared with Intel's $138.7 billion, AMD is in a constant battle with the company that controls roughly 90 percent of the global market for microprocessors, the chips inside PCs and computer servers that process all the electronic instructions.

Both companies essentially developed the microprocessor that pioneered the initial PC revolution and battled over patent rights for years before agreeing to settle and cross-license each other.

Manufacturers headed by Hewlett-Packard Co. (NYSE: HPQ), the biggest PC maker and Dell (Nasdaq: DELL), No. 3, need AMD chips as second sources in case a problem crops up with Intel, as well as a lower-cost producer.

Under new CEO Read, a former executive with China's Lenovo Group, AMD has taken steps to rebuild itself as a slimmer design house. Under prior management, it spun off its flash-memory business as Spansion (NYSE: CODE) and sold most of its manufacturing to Abu Dhabi's GlobalFoundries.

As a result, AMD now is fabless, although it has agreed to pay GlobalFoundries shares valued at $278 million and a sales commitment valued at $425 million. One-time charges of $703 million helped create the first-quarter loss.

Analysts expect further improvement this year because of new product introductions, higher growth and AMD's new freedom to order its designs executed by others, including Taiwan Semiconductor Manufacturing Corp. (NYSE: TSM).

In the past week, analyst Vijay Rakesh at Sterne Agee boosted his price target on AMD to $10 from $8, and Ambrish Srivastava boosted the price target to $7.50 from $5.

Indeed, 12 analysts polled by Zacks now rate the chip designer a strong buy, with one more as a buy and 11 as a hold. Two rate AMD underperform and one a sell.

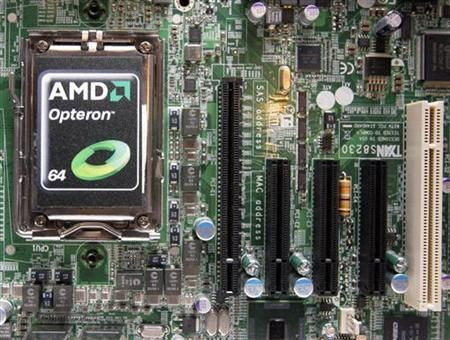

Under Read, AMD has also taken steps to compete better against Intel. Last month, it closed the $334 million acquisition of SeaMicro, a private developer of low-power microprocessors whose technology will be integrated into its Opteron chips. The acquisition is now AMD's Data Center Server Solutions unit.

AMD reported cash and investments of nearly $1.73 billion, down from about $2 billion last quarter. billion. Some analysts have speculated that AMD might want to acquire MIPS Technologies (Nasdaq: MIPS), a designer which has hired Goldman Sachs (NYSE: GS) to advise on strategy.

AMD itself hired in January a new chief strategist, Rajan Naik from McKinsey & Co., an engineer who worked at Intel. Read has also hired new chiefs for marketing and technology and said the company wants to focus more on high-end computing and mobile platforms.

© Copyright IBTimes 2024. All rights reserved.